The investment team at Mission Wealth offers their thoughts as it pertains to market implications and investment portfolios for the upcoming election:

- We continue to be focused on long-term fundamentals and disciplined in our investment decision-making. We believe any near-term volatility may offer us enhanced rebalancing opportunities.

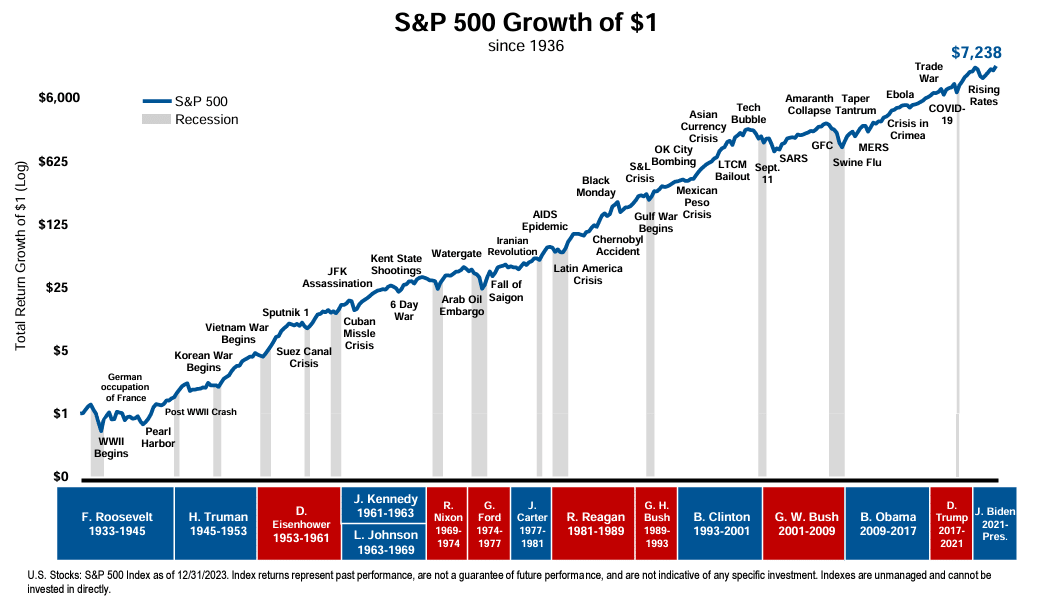

- The stock market has historically performed well over the long term regardless of who wins the United States presidential election.

- If history is a guide, we should expect any uptick in volatility to subside following the election once the results are known.

- Ignoring short-term noise, avoiding emotional decisions, and staying fully invested have historically been rewarded time and again.

No Evidence Elections Impact Market Returns

With the election fast approaching, we’re often asked if the outcome of an election has any bearing on stock market returns. In short, the answer is no. While an election can cause some short-term volatility and headline noise, there is no statistical evidence that elections impact the market’s long-term trend. Indeed, the stock market has performed well over extended periods of time regardless of who wins the White House and under both divided and unified governments.

This makes sense because the President is just one factor amongst many that influence the profitability and productivity of businesses, economic growth, and the market. Interest rates, technological advances, innovations, and efficiency enhancements that drive productivity increases tend to have a much greater bearing on the long-term trajectory of company profitability and broad financial markets.

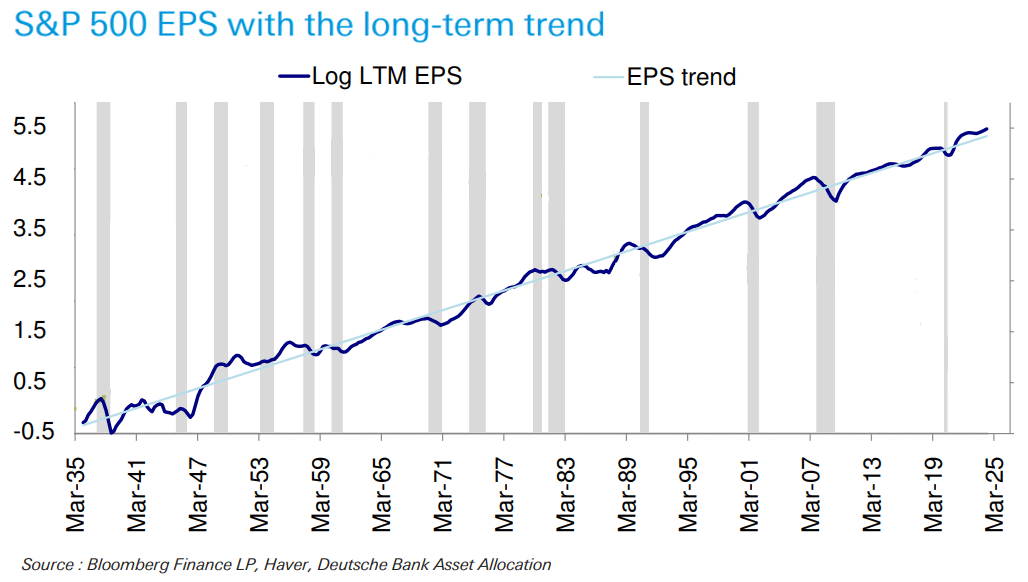

S&P Profitability Strong Regardless of Presidency

Companies also adapt to new realities and presidential shifts. Historically, we’ve witnessed solid stock market gains on the back of economic growth and company profitability under Democrat-controlled, Republican-controlled, and divided governments. S&P 500 earnings growth has been persistently steady over the years, with earnings per share (EPS) growth hugging a long-run trend rate of ~6.5% amazingly tightly, regardless of the US Presidency.

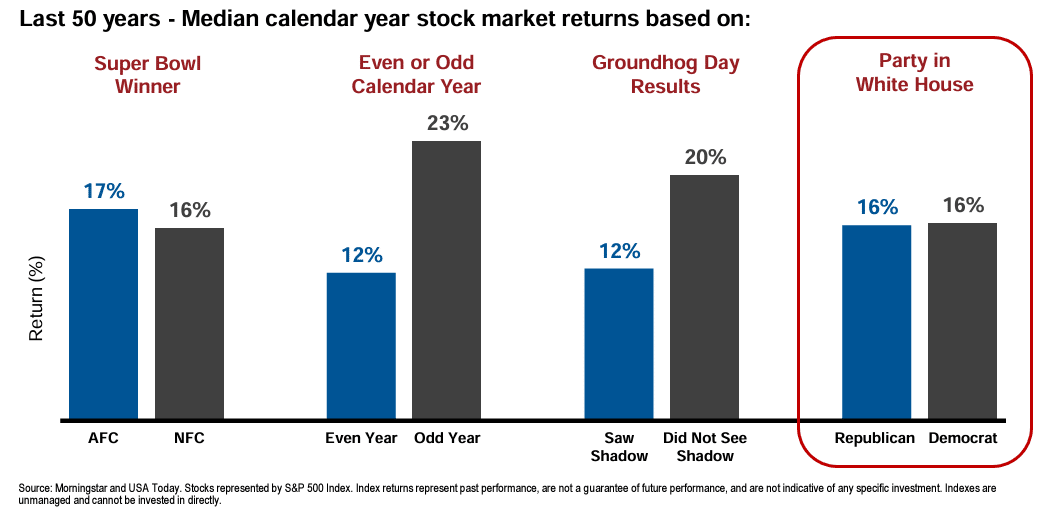

Little Disparity Regardless of Who Wins Election

Extending this point, and in a more humorous light, data shows that factors such as whether an American Football Conference (AFC) or National Football Conference (NFC) team wins the Super Bowl, whether it is an odd or even year, or even whether the groundhog does or doesn’t see its shadow, have historically resulted in wider disparity in stock market performance than the party that wins the US presidential election.

Volatility Historically Subsides Following Election Results

Recent market bumpiness is consistent with history: market volatility tends to increase as we approach an election. However, if history is a guide, we should also expect volatility to subside following the election and once the results are known. Given how tight the election appears to be, there is a chance we won’t know the results until sometime after election night. However, regardless of the outcome, uncertainty is removed once the result is determined. The market can then price in the new reality and move on.

Avoid Short-Term Noise and Focus on the Long Term

Regarding investment portfolios, investors should try to ignore the short-term noise, avoid bias and emotional decisions, and focus on the long term. Staying fully invested has historically been rewarded time and again. We remain focused on long-term fundamentals, disciplined with our investment decision-making, and believe any near-term volatility may offer enhanced rebalancing opportunities.

As always, if you have any additional questions, don’t hesitate to get in touch with your Wealth Advisor. We value your trust and remain committed to your financial wellbeing.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 9/17/25: Fed Resumes Rate Cutting Cycle — What Does This Mean for Markets and Investment Portfolios?

September 17, 2025

Market Update 8/22/25: Powell’s Jackson Hole Remarks Signal Possible Fed Rate Cuts Ahead

August 22, 2025