Market Commentary for Fall 2023

In August 2023, Mission Wealth had the pleasure of hosting a webinar with J.P. Morgan’s Chief Global Strategist, Dr. David Kelly, and our Chief Investment Officer, Kieran Osborne, who shared their views on the outlook for the economy and asset classes.

Key Themes for the Fall 2023 Market

Some key takeaways from the conversation are highlighted below, along with implications for asset classes and investment portfolios.

- It’s increasingly important to maintain diversified investment portfolio allocations and investment discipline in such a dynamic market environment.

- Inflation has fallen and may continue to fall towards the Fed’s long-term target of 2%.

- A recession may be inevitable but it is not imminent. If and when one occurs, it is likely to be relatively shallow, particularly in comparison to the two most recent recessions, 2008 and 2020.

- While the Fed may pause rate increases shortly, the years ahead are likely to be marked by higher interest rates vs. those witnessed in the years ending 2021.

- In such an environment, we believe stock market returns may moderate relative to the strength experienced over recent years.

- Bond yields are more attractive today and high-quality core fixed income offers the potential to outpace inflation while acting as the ballast of a portfolio.

- Alternative investments may offer attractive upside risk-adjusted returns, but manager selection is key.

You can watch the full video recap on YouTube here.

Inflation Trending Lower

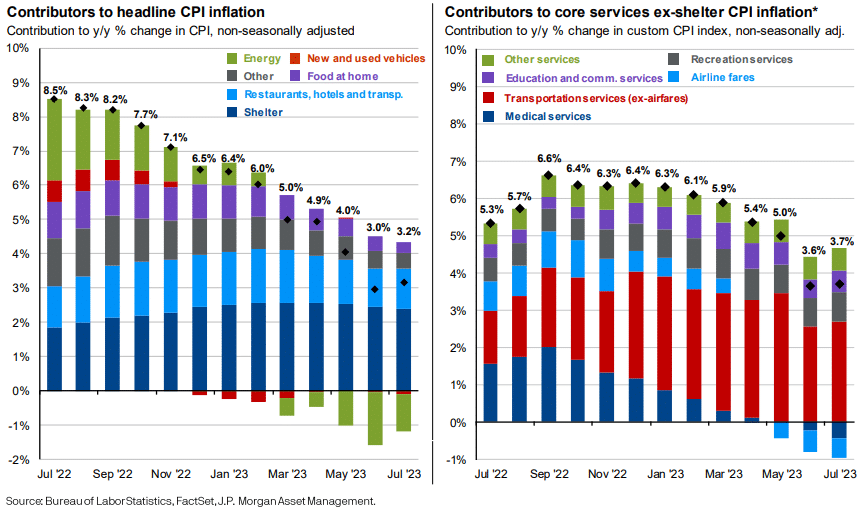

One topic that’s top of mind for investors is inflation, which we discussed in detail. J.P. Morgan’s view is that inflation is likely to continue to trend lower toward the Fed’s long-term target of 2% throughout 2024.

While food and energy price pressures have abated, shelter inflation has been sticky and kept inflation elevated, but is beginning to trend lower. Rents have already stalled out and there is more multifamily property coming online, which should lead to lower inflation over time. Core services inflation outside of shelter has largely been driven by transportation services: particularly auto leases, auto insurance costs, auto repair, and maintenance, which have been increasing at double-digit rates because automobile prices increased so sharply during the pandemic. As a result, consumers are now having to repair, lease, and insure much more expensive vehicles. However, this trend may reverse course, as vehicle prices have stopped rising, which should help to further moderate inflation.

Looking at longer-term data, inflation tends to move cyclically over time – and as it moves up and down it tends to be very symmetrical. Dr. Kelly likened this dynamic to a rollercoaster: no matter how high the roller coaster takes you, you eventually get off where you got on, and we got on at 2% inflation; J.P. Morgan believes we will return to 2% inflation before too long.

Next Recession Likely Mild

The economy has shown resilience. Economic data has broadly surprised to the upside and economic growth projections have been revised higher. The chance of a soft-landing economic outcome has increased on the back of a strong labor market and consumer spending. The third quarter is likely to show robust growth, but beyond that, the economy may start to slow. We aren’t in a recession now, but a recession is inevitable at some point. However, it’s important to understand the next recession is unlikely to be as deep or painful as the two most recent recessions.

The economy has shown resilience. Economic data has broadly surprised to the upside and economic growth projections have been revised higher. The chance of a soft-landing economic outcome has increased on the back of a strong labor market and consumer spending. The third quarter is likely to show robust growth, but beyond that, the economy may start to slow. We aren’t in a recession now, but a recession is inevitable at some point. However, it’s important to understand the next recession is unlikely to be as deep or painful as the two most recent recessions.

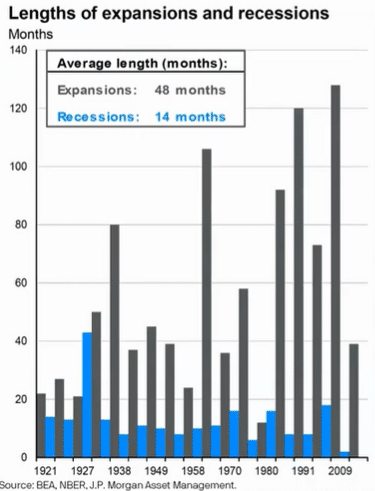

J.P. Morgan estimates the chance of a recession beginning by the end of 2024 to be approximately 50%, and higher by the end of 2025. If and when one occurs, it is likely to be relatively shallow, particularly in comparison to the 2008 Global Financial Crisis or 2020’s global pandemic-driven downturn. There simply aren’t the same levels of excesses built up in the economy relative to what was evident leading into 2008 or similar “boom-bust” driven economic downturns. It’s also important to bear in mind that over the long haul, the economy experiences much longer expansions and much shorter recessions – as Dr. Kelly puts it, the U.S. is an economy of “long summers and short winters”. Moreover, expansions have tended to become longer in duration over time, underpinning the importance of a long-term disciplined investment focus; a mild recession may offer an attractive rebalancing opportunity for disciplined investors.

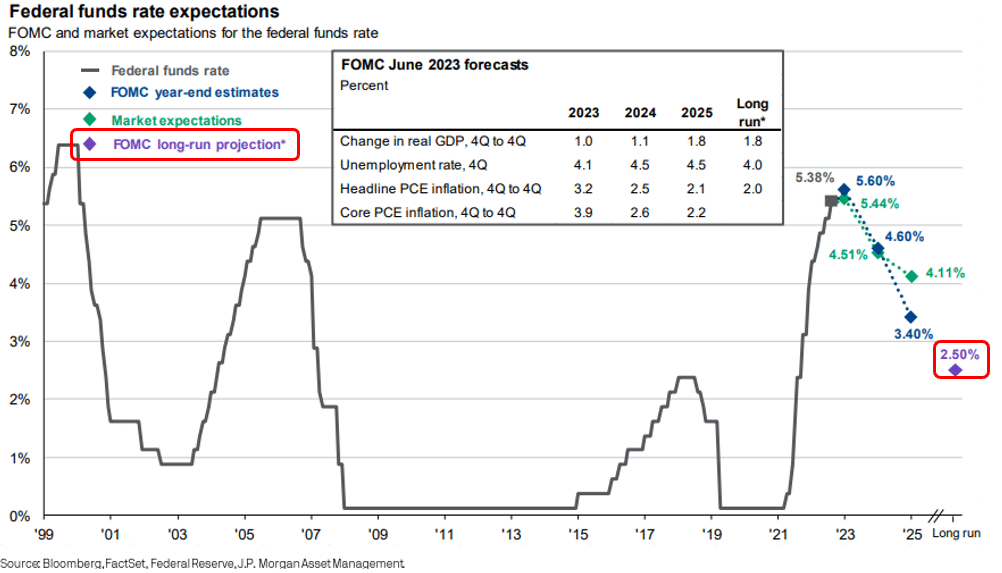

Structural Shift for Monetary Policy

We may have entered a structural shift concerning monetary policy, where the years ahead are likely to be marked by tighter monetary policies – higher interest rates and quantitative tightening – relative to the years post-global financial crisis of 2008 through the end of 2021. As a point of reference, even if the Fed can achieve its stated goal of 2.5% for the fed funds rate, that would still be a higher average interest rate than during the post-2008 years. Especially when you factor in ongoing quantitative tightening; the Fed is adamant it will continue to shrink its balance sheet, which in and of itself is a tighter policy and may counteract the impact of some – or all – of any future interest rate cuts.

We’re very close to the Fed pausing interest rate increases, and the Fed is likely to begin cutting rates sometime next year. With that being said, interest rates are likely to stay elevated for some time, especially if we experience a relatively shallow economic downturn. The Fed is cognizant of the downside risks of a zero interest rate policy (ZIRP). As such, we’re unlikely to see a 0% fed funds rate for the foreseeable future, like we did for many years following the global financial crisis.

Investment Implications

It’s increasingly important to maintain diversified investment allocations in such a dynamic market environment while matching the risk profile of your portfolio to your unique situation. Think about investment opportunities and risks in the context of your financial plan and personal risk tolerances. Within this context, a broadly diversified investment portfolio can be created that provides exposure to investment opportunities, and balances risks, while optimizing the chances of achieving your long-term financial goals.

Managing Stock Market Expectations

With a backdrop of tighter monetary policies, we expect a moderation in stock market returns in the years ahead. We’re not bearish on the outlook for stocks but believe expectations need to be reset for returns more commensurate with historic averages of mid-to-high single-digit annualized returns. As a point of reference, the 10-year return on the S&P 500 ending 2021 was 16.5%. The return rate is unsustainable and was arguably supported by the easy monetary policies of the time, which incentivized increased speculation and investments into riskier assets with “free borrowing.” Higher interest rates are likely to have the opposite effect and may temper returns, relative to those experienced during the post-2008 through 2021 years.

Bonds in Focus

Bond yields are a lot more attractive today relative to recent years and are offering real returns (outpacing inflation) for core, high-quality bonds. Many of our preferred bond holdings are now yielding mid-single digits or even higher. As a result, bonds are not only offering lower volatility and downside protection relative to stocks – acting as the ballast of a portfolio – but bonds are also offering a compelling, real income even in the face of still-elevated inflation. The current environment may be advantageous from the standpoint that yields are relatively high, while inflation is likely to move lower, which should help underpin total returns for bonds. Moving forward, we anticipate the spread between stock and bond returns is likely to narrow, and – given current bond yields – there is a chance that select bond funds may even outperform stocks in the years ahead. Hence we believe in the importance of maintaining a dedicated allocation to core fixed income across our portfolios.

Alternative Opportunities

We believe alternative investments are an area that can offer upside risk-adjusted return potential, particularly should we enter an environment of moderating stock market returns. Alternatives comprise asset classes such as private equity, real estate, and direct lending. While these strategies may offer attractive return potential, it’s important to select high-quality managers and be smart with allocations. Take real estate as an example. There are known issues within the office and in lower-tier retail properties – those are areas we want to avoid. However, there’s a real opportunity within select top-tier retail, industrial properties are still showing relative strength and data centers are an area that is seeing increased demand and investment. Within private equity, many of the fastest-growing companies and best ideas may be found within the private space, where those companies may be more nimble and entrepreneurial, and thus command enhanced return potential.

Overall, maintaining broad portfolio diversification and investment discipline is likely to be rewarded over the long haul.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026