Watch the INSPIREDtalk, “Redefining Retirement: How to Thrive in the New Era of Longevity,” with Simon Chan & Seth Streeter

On Wednesday, October 9, 2024, Mission Wealth’s Co-Founder, Seth Streeter, hosted our 11th INSPIREDtalk, an engaging and thought-provoking session with Simon Chan, Founder and CEO of Adapt with Intent Inc. Simon shared ten key strategies to make the most of the “longevity bonus” and ways to reframe your retirement as a new chapter of growth and opportunity. This article summarizes the key points and top takeaways from this enlightening talk.

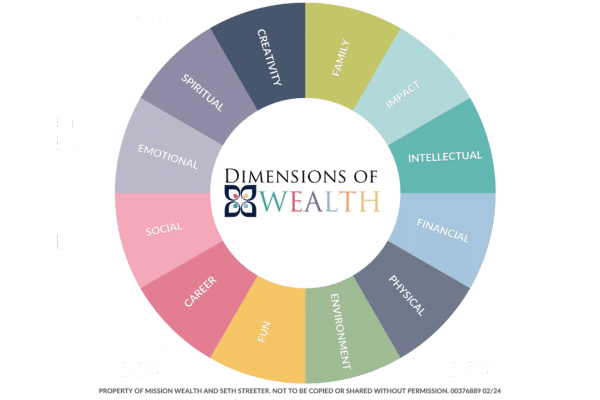

Mission Wealth’s purpose is to empower people to realize true wealth, which encompasses more than just financial optimization but living a fulfilled life. Seth kicked off the one-hour webinar by introducing the 12 Dimensions of Life™; with the focus of this talk being the career dimension, you have an opportunity to reimagine what retirement may look like.

Watch the Full Recap of our INSPIREDtalk with Simon Chan

Interactive INSPIREDtalks: Find Our Your Inspired Living™ Scores!

Participants were asked to reflect on their life experiences and share the positive aspects of aging they’ve discovered or are looking forward to. This set the stage for an engaging and interactive session about how this fundamentally changes our thoughts about our life stages and introduced our new assessment.

10 Takeaways to Thrive in the New Era of Longevity

- Retirement: A Modern Concept Evolving With Longer Lifespans – Historically, people didn’t live long enough to even consider retirement. Retirement is no longer a static life stage. With longer lifespans, retirement is constantly evolving. Approach it as an ongoing process, staying flexible and open to new opportunities for growth and learning.

-

The Longevity Dividend: Extended Lifespans Are Redefining Life Stages – With lifespans extending by decades, you can break free from the traditional three-stage life (education, work, retirement). Explore new life stages and transitions such as phased retirement, career changes, or sabbaticals that support a longer, richer life experience.

-

Reimagining Retirement: From Leisure to a New Chapter of Growth – Shift from viewing retirement as a period of rest to seeing it as a time for personal and professional development. Engage in lifelong learning with a growth-mindset, start new projects, or find meaningful ways to contribute to your community.

-

A Fluid Life Course: Moving Beyond Linear Life Stages – Life isn’t a straight path. Integrate gap years, part-time work, and phases of learning or leisure into your life, allowing for a more balanced and enjoyable retirement. Flexibility is key to making the most of your extended years.

-

Holistic Retirement Planning: Integrating Health, Purpose, and Connection – Retirement planning isn’t just about finances. A fulfilling retirement requires attention to your physical health, mental purpose, social connections, and personal development. Using our Dimensions of Wealth chart, you can build a plan that addresses multiple areas for a well-rounded, joyful retirement.

- Work Reimagined: Retirement as a New Frontier for Career Flexibility – Retirement doesn’t have to mean stopping work completely. Many are choosing part-time work, consulting, entrepreneurship, or volunteering in areas they’re passionate about. This can keep you engaged and purposeful in your later years.

-

Time Affluence: Managing The Gift of Abundant Time – Retirement gives you the gift of time, but how you use it matters. Plan to invest your time in activities that bring joy, growth, and connection, ensuring that your days are filled with meaning and fulfillment.

- Purpose and Connection: The Underappreciated Side of Retirement Planning – Purpose and community are essential for a rewarding retirement. Stay connected with others, and engage in activities that give you a sense of identity and contribution. Whether through social groups, hobbies, or volunteering, staying involved enhances your well-being.

-

Positive Aging: Embrace The Opportunities That Come With Age – See aging as an opportunity, not a limitation. A positive outlook on getting older has been shown to improve both longevity and quality of life. Celebrate the opportunities that come with age and make the most of them.

- Reinventing The Narrative: Craft Your Own Unique Retirement Journey – Retirement is no longer a one-size-fits-all experience. Design your own path by pursuing activities that align with your values, passions, and goals. Be intentional about how you want to spend this time, and continuously reinvent what retirement means for you.

Download the 10 Takeaways via PDF instead!

About Inspired Living™

Mission Wealth’s Inspired Living™ services integrate your financial plans with your broader life values and aspirations. Through our exclusive events, you’ll gain access to thought leaders, specialist research, and actionable advice, all designed to help you align each of the 12 Dimensions of Life™ with your best life.

Feeling inspired by these strategies? Join us for future INSPIREDtalks and explore our Inspired Living™ services at Mission Wealth. Our expert advisors can help you align your financial plans with greater life values, goals, and aspirations. Connect with us for actionable advice and exclusive events that support your journey to make a lasting impact.

Stay tuned for more opportunities to engage, question, and find your path to creating a significant difference in the world.

Please fill out our contact form to join our client community and expand your sense of financial security and ability to live a more fulfilling life today!

Copyright © 2024 Mission Wealth. All rights reserved—property of Seth Streeter and Mission Wealth. Not to be copied or shared without permission.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Recent Insights Articles

Market Update 3/2/26

March 2, 2026

Market Perspectives Q1 2026

February 25, 2026