My Income is Impacted by COVID-19, What Are My Options?

By Jenna Rogers, MS, CFP®, AAMS®, AWMA®

Client Advisor

The CARES Act hopes to bring some financial relief to individuals across the United States, but if your income is further impacted there are more options for support.

On March 27th, President Trump signed the Coronavirus Aid, Relief and Economic Security Act (known as the CARES Act), bringing it into law on Friday. The 600-page, $200 trillion stimulus package (which is the largest relief bill in American history) will provide direct one-time payments to Americans, known as “recovery rebates”. In addition to these rebates, there are also other options for those with impacted income.

We understand how stressful economic uncertainty can be, so we have put together 5 stimulus options for clients with impacted income going forward.

1. Borrow from your 401(k).

You can now take out twice the usual loan amount from your 401(k). For 180 days, with certification that you’ve been affected by COVID-19, you’ll be able to take out a loan of up to $100,000.

2. Take a withdrawal from your IRA.

You can withdraw up to $100,000 this year without the usual 10 percent penalty, as long as it’s because of the outbreak. You would also be able to spread out any income taxes that you owe over three years from the date you took the distribution. And if you want, you could put the money back into the account before those three years are up. This exception applies only to coronavirus-related withdrawals. You qualify if you tested positive, a spouse or dependent did or you experienced a variety of other negative economic consequences related to the pandemic.

3. Pause Your student loan payment.

The federal government has already waived two months of payments and interest for federal student loan borrowers. In addition, until Sept. 30, there will be automatic payment suspensions for any student loan held by the federal government. The bill says that interest “shall not accrue” on the loan during the suspension period.

4. Apply for unemployment benefits.

Self-employed workers, independent contractors, and freelance workers who lose their income are not normally eligible for unemployment benefits. However, the federal government is expanding unemployment benefits to cover the self-employed. In addition, self-employed workers will also be eligible for an extra $600 weekly benefit, which will be paid for four months.

5. Receive a stimulus payment.

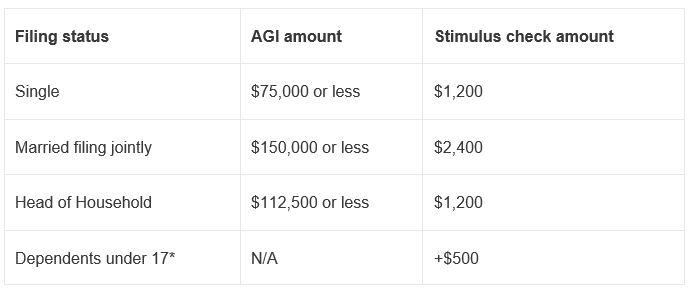

Qualifying adults will get $1,200 each as a one-time payment. For every qualifying child age 16 or under, the payment would be an additional $500. Single adults earning $75,000 or less would get the full amount. Married couples earning $150,000 would receive the full amount. Taxpayers filing as head of household would get the full payment if they earned $112,500 or less. Above those income figures, the payment decreases until it stops altogether for single people earning $99,000 or married people earning $198,000. It is based on your 2019 tax return, unless you have not filed yet, then it is based on your 2018 tax return. The checks will be mailed out automatically in the coming weeks. You do not need to apply.

If you need support, or would like to talk through your personal circumstances, our experienced advisors are happy to help.

DISCLAIMER:

Mission Wealth does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

00363414 03/20