Fed Raises Rates and Forecasts More to Come

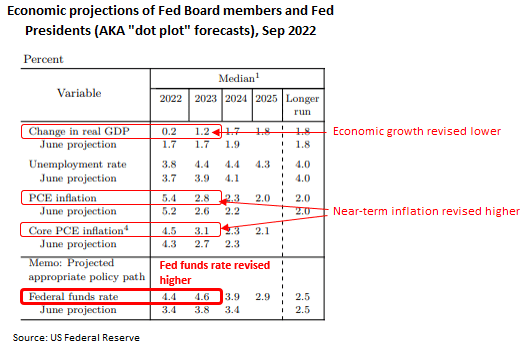

As was widely anticipated, the Fed raised the fed funds rate 0.75% at its September Federal Open Market Committee (FOMC) meeting, bringing the target range for the fed funds rate to 3.00% - 3.25%. Notably, the Fed’s “dot plot” forecasts for the fed funds rate at year-end 2022 increased to 4.4%, inferring a range of 4.25%-4.5% by December, or another 1.25% of rate hikes. There are only two remaining FOMC meetings this year, so it’s quite likely the Fed will raise another 0.75% in November and 0.50% in December. Thereafter, the “dot plot” chart infers one more rate hike in 2023, bringing the terminal rate forecast to 4.50% - 4.75%. These estimates come on the back of higher than previously anticipated inflation for this year and next.

The Fed also revised its estimate for economic growth lower over the near term, a theme reiterated at Fed Chair Powell’s press conference. Powell largely reiterated the hawkish tone from his Jackson Hole speech in late August and noted that combating inflation may require a sustained period of below-trend economic growth. He also stressed the outsized important of price stability, emphasizing the need to maintain a restrictive stance, and noted there has yet to be substantial evidence of economic cooling.

Cooling the Labor Market Key for the Fed

Clearly, the Fed is committed to bringing inflation under control. An area Powell highlighted in achieving this goal was the labor market. By raising interest rates, the Fed is hoping to cool the very hot labor market. A slowing labor market may reduce wage pressure and weigh on consumer spending, which in turn may help cool broad-based inflation by reducing demand for goods and services (notable here is that consumer spending makes up close to 70% of GDP).

Risk of Recession Elevated, but may be Mild

With this backdrop, the risks of a recession are elevated. The silver lining is we don’t have substantial excesses built up in the economy. If a recession were to occur, we believe it would be a relatively mild one, particularly in comparison to the last two experiences (COVID in 2020 and the Global Financial Crisis of 2008). In particular, 2008 had massive excesses built up in the housing market with extreme levels of leverage. We simply don’t see a similar phenomenon today, and it’s those excesses that tend to cause deeper economic contractions.

Recency Bias Contributing to Volatility

For perspective, the last two recessions can be classified as once-in-a-lifetime events; however, these experiences may be causing some recency bias and, in turn, negatively impacting investor sentiment. For many investors, the first recession they experienced was the Global Financial Crisis of 2008. For more recent investors, their only recessionary experience was COVID in 2020. Even for more established investors, the experiences of 2008 are still all too fresh in their minds. As a result, whenever the “R” word is mentioned, many immediately recall how bad it was at the height of the 2008 crisis. This bad memory has arguably weighed on market sentiment and contributed to market volatility. However, the reality is we are unlikely to experience anything near the economic pain of 2008, as we simply don’t have anywhere near the level of excesses in the economy. Indeed, in speaking with our investment partners, corporate and consumer finances remain relatively healthy.

Structural Shift in Policy May Moderate Returns

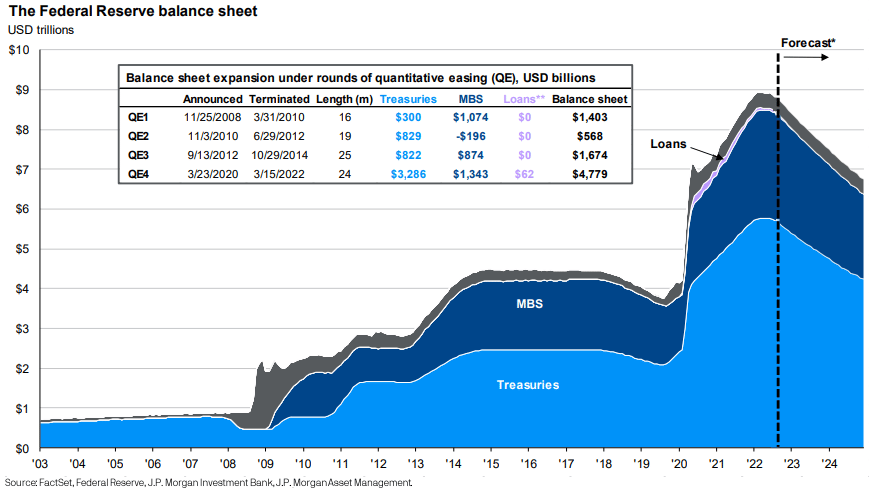

Moving forward, we believe expectations should be set for a moderation in stock market returns relative to the very strong returns experienced over the years following the GFC through the end of 2021. Structurally, we appear to be transitioning from an easy policy environment – marked by quantitative easing (QE) and low interest rates – to a tighter policy environment – marked by quantitative tightening (QT) and higher interest rates.

Whereas easy policies arguably acted as a tailwind for the stock market, tighter policies may act to moderate returns. With that said, we are not bearish on the stock market. We simply think expectations for long-term returns need to be reset to align better with long-term averages of mid to high-single digit annualized returns. Any ongoing volatility may provide us with enhanced rebalancing opportunities and a favorable entry point, given our long-term view.

We continue to favor alternative income generating asset classes in the current environment. Many of these strategies have done well with the backdrop of elevated inflation and rising interest rates. Longer-term, we believe these strategies may offer compelling risk-adjusted return potential, which may be especially important should we experience a moderation in public stock market returns over the years ahead.

We continue to monitor developments closely. We believe our portfolios are well designed to navigate any ongoing volatility and continue to achieve the long-term financial goals of our clients. Should you have any questions, please do not hesitate to contact your Client Advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00465736 09/22