Can Direct Credit Add Income and Potential Volatility Dampening to Your Portfolio?

If you’re an income-seeking investor frustrated by traditional bonds, it may be time to look beyond public markets. Direct credit—a specific type of private credit—is one of the fastest-growing areas of alternative investing, offering attractive yields, potential volatility dampening, and consistent distributions.

At Mission Wealth, we believe direct credit deserves a seat at the table for investors looking to build durable, income-producing portfolios.

What Is Direct Credit?

Direct credit is a form of private debt financing in which non-bank lenders, such as private credit funds, provide loans directly to companies, bypassing traditional banks. These loans are typically made to middle-market or private equity-backed companies and can be customized to meet the needs of both borrowers and investors.

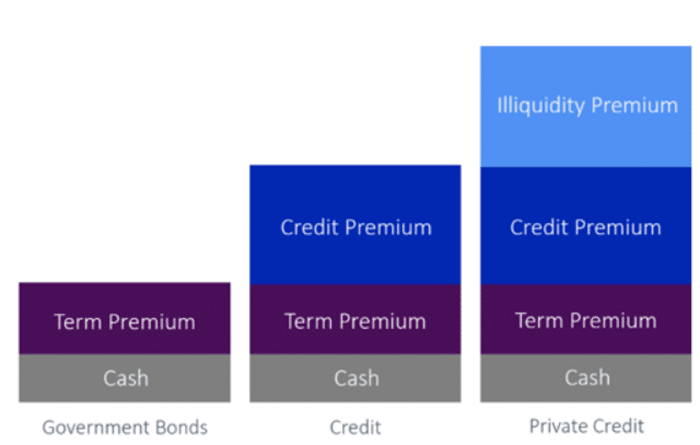

Unlike public credit (e.g., syndicated loans or bonds), direct credit loans are privately negotiated, less liquid, and generally offer higher yields to compensate investors for the reduced liquidity.

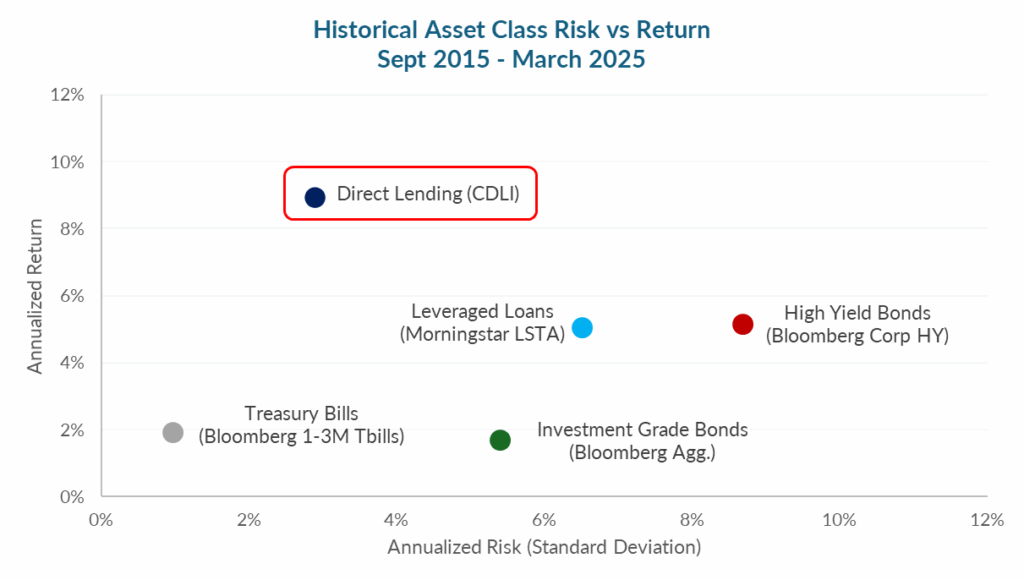

Sources: Cliffwater Direct Lending Index, Morningstar, Bloomberg (graph date as of March 31, 2025)

Why Direct Credit Now?

Several structural and economic trends make direct credit increasingly relevant:

- Attractive income generation from illiquidity premium, underwriting spreads, and the ability to negotiate directly with borrowers.

- Potential volatility dampening, since these assets do not trade on public exchanges, they tend to be less susceptible to large swings in value.

- Potential resilience during downturns, with higher positions in the capital stack via direct borrower engagement and senior secured loans.

- Inflation alignment, as floating interest rates can rise alongside rate hikes.

In short, direct credit can help insulate portfolios while enhancing returns.

Real Access. Real Income.

Historically, access to private debt was limited to institutions. Today, Mission Wealth clients can participate in institutional-caliber direct credit funds that offer:

- Low investment minimums

- No capital calls — you’re invested from day one

- Quarterly liquidity (subject to fund-level constraints)

- Recurring income distributions* (typically monthly or quarterly) and 1099 reporting

*It’s possible for a fund to suspend distributions or redemptions based on the market environment or investor requests to protect the portfolio during adverse events.

The Role Within a Broader Alternatives Strategy

Direct credit sits neatly between private equity and private infrastructure, offering a unique blend of income, capital preservation, and diversification. It’s especially well-suited for clients seeking stability without sacrificing yield.

Looking to build a stronger, income-focused foundation? Let’s explore if direct credit is right for your plan.

Interested in whether direct credit fits into your broader financial plan? Explore Mission Wealth’s Alternative Investments solutions and schedule a complimentary portfolio review today.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Perspectives Q1 2026

February 25, 2026

Market Update 1/29/26

January 29, 2026