Why is Asset Allocation Important?

Asset allocation is a tool that allows you to minimize your losses whilst still benefiting from potential gains, by spreading out any risk. But what is asset allocation and how can you effectively use it? Click the video below from Chief Investment Officer Kieran Osborne, or read the text beneath it to learn more.

The intent of Asset Allocation within portfolio design is to identify the right ‘mix’ of investments that align with your financial goals. It is the portfolio allocation across stocks, bonds, cash, and other assets such as real estate. Well-designed portfolios help produce more consistency in returns.

At Mission Wealth, we design portfolios with target asset allocations that provide an appropriate level of risk and return based upon your personal financial plan and your risk tolerance.

Why is asset allocation important?

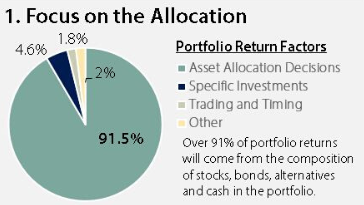

Portfolio design – the allocation across asset classes – is the single largest determining factor in portfolio returns, with studies showing it contributes over 91% of the total return on a portfolio.

At the broadest level, asset allocation can be thought of as the split between stocks and bonds. Stocks tend to be more growth-oriented and volatile, meaning they experience larger swings in value, both up and down, whereas bonds tend to act as an anchor of the portfolio, providing more stability and also providing a relatively consistent income yield.

Historically, stocks and bonds have often moved in opposite directions to each other, particularly during stock market sell-offs, so having a dedicated allocation to core bonds may help protect against large market downswings and ultimately produce more consistency in returns from one period to another.

The chart below illustrates how a well-diversified asset allocation can produce more consistent returns over time. Let's examine a full 10-year cycle. This one is from 2008 through to 2017.

Why this ten-year period?

It represents a time period that encompasses both good and bad years, which is fairly typical for how things tend to unfold for investments. Sometimes we do experience longer stretches of up or down markets, but this is a good example that has a mixture of returns. This data specifically uses index returns as a measure of how various asset classes performed.

Each colored square represents the annual performance of an asset class over a 10-year period, and includes the Great Financial Crisis of 2008. Asset classes are ranked annually from best-performing to worst-performing. The purple highlighted boxes represent a portfolio comprised of 60% stocks and 40% bonds.

The first observation is that this portfolio is never the best performer, but also never the worst. It consistently ranks in the mid-to-top end of the pack, year in and year out.

In 2008, bonds were the best-performing asset class, returning 5%, while stocks experienced significant declines across the board. As you can see, a diversified portfolio helped mitigate the negative stock market returns in 2008.

In 2009, stocks reversed course and rallied significantly, while bonds trailed and were the worst-performing asset class. In this instance, the portfolio comprised 60% stocks and 40% bonds, participating in the upside of stocks and outperforming bonds.

The reality is that the performance of each individual asset class can differ significantly from one period to the next. However, a well-designed portfolio, allocated across various asset classes, can yield much more consistent results.

Indeed, over the 10-year period illustrated, the same portfolio, which comprised 60% stocks and 40% bonds, produced about three-quarters of the return of the S&P 500, but with about 60% of the risk.

We also highlight the 10-year performance of other portfolios, ranging from 20% stock exposure to 80% stock exposure. You can see that they consistently rank in the mid-to-top end of the pack.

This highlights the crucial role that asset allocation plays in portfolio construction.

Finding the right mix, or asset allocation, is a critical step in ensuring your portfolio performs in alignment with your risk tolerance and produces more consistent returns on the way to achieving your long-term financial goals.

If you'd like to learn more about incorporating asset allocation benefits into your portfolio, please contact our experienced and dedicated team.