What are the Benefits of Portfolio Rebalancing?

Ever wondered what the benefits of portfolio rebalancing are? How do financial professionals keep portfolios balanced over time? Click the video to watch, or read the text beneath it to learn more.

At Mission Wealth we follow a disciplined approach to rebalancing, reviewing accounts on at least a quarterly basis for rebalancing opportunities.

What is rebalancing? Simply put, it is a process whereby we sell assets that have experienced relative outperformance in favor of assets that have experienced relative underperformance. On the one hand it ensures our client portfolios maintain alignment with their defined risk-return target profiles – for instance that a 60% stock / 40% bond portfolio doesn’t migrate towards a 70% stock / 30% bond allocation. On the other hand, disciplined rebalancing implicitly forces us to follow a “buy low, sell high” methodology and has proven to add value over time.

So, let’s see how rebalancing works in practice. Let’s assume a very basic portfolio made up of just two asset classes – let’s assume just stocks and bonds with an equal target allocation of 50% to both.

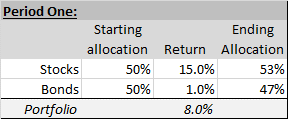

Now, let’s also assume some return parameters over two separate periods. In period one, stocks do very well and return +15%, while bonds trail, returning just +1%.

Again, we start with a 50% allocation to stocks and a 50% allocation to bonds. By the end of the first period, the total portfolio returns 8%, however the allocation split between stocks and bonds changes to 53% stocks and 47% bonds as a result of the relative outperformance of stocks.

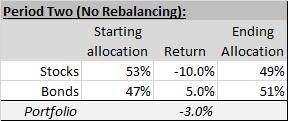

Now let’s assume that in the second period stocks sell-off and lose -10%, while bonds rally, returning +5%.

Now, let’s also assume we make no adjustments to the portfolio entering period two. At the end of the second period, the portfolio would have lost -3.0%.

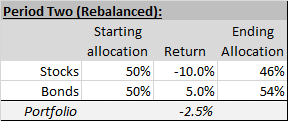

However, had we rebalanced the portfolio back to the original 50% stocks / 50% bonds target allocation, the portfolio would only have lost -2.5% during the second period, resulting in a +0.5% performance enhancement.

Obviously this is a hypothetical example over two periods with just two asset classes but it highlights the importance of a disciplined, periodic rebalancing methodology.

Our portfolios are typically made up of multiple asset classes within both stocks and bonds – such as large cap, small cap, US stocks and international stocks – to name just a few. Each additional asset class provides another opportunity to leverage the benefits of disciplined rebalancing, by trimming an asset on relative strength in favor of another asset class that has recently underperformed.

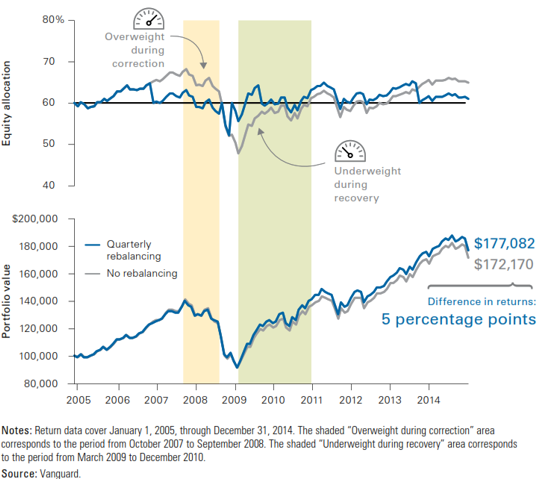

The benefits of disciplined rebalancing may be enhanced during times of market volatility. The following chart indicates the potential benefits of rebalancing during times of market dislocation, such as the period 2005 through 2014, which encompasses the Great Financial Crisis of 2008.

In this example, quarterly rebalancing added a full five percentage points to total return on a portfolio.

Indeed, following a disciplined approach to rebalancing has proven to add value over extended periods of time, with average estimates of 0.89% of additional annual portfolio performance benefits.

These benefits underscore the reasons why we follow a disciplined approach to portfolio rebalancing at Mission Wealth. If you'd like to learn more about our investment services, check out our investments page.

00366685 5/20