The Transformative Power of Women Investors in Philanthropy and Impact Investments

As Women’s History Month is upon us, it’s a perfect moment to recognize and celebrate the monumental role women investors play in philanthropy, legacy building, and impact investments. The growing influence of women in the financial realm isn’t just altering the landscape of investment; it’s reshaping the world for the better.

The Rising Tide of Women in Philanthropy

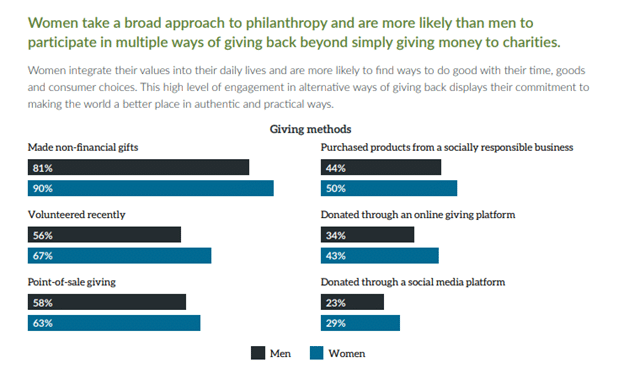

Philanthropy has long been a powerful tool for societal change, and women investors are leading a renaissance in this realm. Their approach often extends beyond traditional charitable giving, encompassing a broader vision for social impact and sustainability, and are more likely to give in multiple ways. Women increasingly use their financial clout to tackle global issues, from education and healthcare to climate change and social justice.

Source: Fidelity Charitable 2021 Women and Giving

Legacy Building: A Woman’s Touch

Legacy isn’t just about the wealth one leaves behind; it’s about the imprint one leaves on the world. Women investors are keenly aware of this and are crafting legacies that go beyond financial assets, embedding values like social responsibility, environmental stewardship, and ethical governance in their investment choices.

Legacy planning today looks different for the modern woman. Philanthropic efforts and legacy giving are a large portion of advanced planning, but interactions such as volunteering and mentoring also play a big part in the legacy one leaves.

Impact Investing: Women at the Forefront

Impact investing, which aims to generate social and environmental impact alongside financial returns, has found a strong ally in women investors. Women are more likely to invest in companies and funds that prioritize sustainability, ethical practices, and positive community impact. This approach reflects a deeper understanding of how interconnected our world is and a commitment to nurturing a healthier, more equitable society.

A Call to Action

Although the shift in charitable giving is happening now, women are less likely than men to talk to a financial advisor about advanced charitable giving or tax strategies.

This Women’s History Month let’s not only celebrate the achievements of women investors in philanthropy and impact investing but also encourage more women to explore these empowering financial avenues. At Mission Wealth, we are committed to guiding and supporting women in their journey to create a lasting, positive impact on the world through strategic financial planning.

We believe that by investing in women, we invest in a brighter, more equitable future for all. Contact our Women on a Mission group today to take your next steps.

Feel empowered with the confidence and resources you need to take control of your financial well-being.

Are you interested in working with a female advisor?Financial Advice for Women Investors

Mission Wealth was founded on a vision to empower families to pursue their financial dreams. That vision has grown into a mission to inspire people, optimize their finances, and achieve their life goals. With more women in a position to grow their wealth and take financial control of their own futures, in many cases for the first time, Mission Wealth has created Women on a Mission, a group of female wealth and financial advisors and strategists who share a passion to help other women achieve their financial goals.

If you are looking for more information about Mission Wealth’s financial planning or wealth management services, please call us or visit missionwealth.com.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

FAQs for Women Choosing a Financial Advisor

At Mission Wealth, we understand that choosing a financial advisor is a profoundly personal decision, especially during transition or change. Below are some of the most common questions asked when exploring a relationship with our firm.Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Articles for Women Investors

What Is the Best Way to Bring Fairness and Family Harmony to Your Estate Plan?

December 4, 2025

5 Estate Planning Steps to Review Before December 31 (and Why They Matter)

October 17, 2025