Welcome back to our series on state-level estate tax peculiarities! If you’ve been following along (and we hope you have), we’ve already explored the quirks of Oregon, Washington, Minnesota, and Illinois. Today, we’re jumping into the Empire State—because nothing says fun like trying to dodge the New York estate tax cliff.

As the old saying goes, “Nothing in life is certain except death and taxes.” But let’s be honest: whoever said that probably hadn’t tried to navigate the New York estate tax code. The federal estate tax tends to hog the headlines, especially with the potential 2025 sunset of the Tax Cuts and Jobs Act, but the state-level taxes catch more families off guard. So, let’s dive into how New York handles estate taxes (spoiler: it’s got some drama).

New York vs. Federal Estate Tax: The Basics (and the Cliff)

New York has one of the highest state-level estate tax exemptions at $7,160,000 per person in 2025. But while that’s higher than most estate-tax states, it’s still significantly lower than the federal exemption of $13,990,000. So, if your estate falls somewhere in that in-between zone, congrats! You’ve officially entered tax-planning territory.

New York’s exemption is similar to the federal exemption, in that it works as an offsetting amount for every dollar up until the top. Meaning you owe nothing if you have an estate worth $7,160,000, and the exemption fades as you add to your assets.

Here’s the twist: you lose the exemption entirely if your estate exceeds the New York exemption by more than 5% (i.e., over $7,518,000 in 2025). Yes, you read that right. One dollar too many and you fall off the dreaded estate tax cliff, where your entire estate becomes taxable. Cue the dramatic music.

Let’s make a quick comparison example:

- Estate just under the cliff: $0 owed.

- Estate at $7.35M: Partial phase-out of exemption: your estate tax exclusion is reduced to $3,360,000 (Form ET-706-I, worksheet on page 4). Without this phase-out as you approach the 5% cliff, your estate tax liability would be $25,840, but due to the phase-out, your estate tax liability is $469,040.

- Estate at $7.518M (the cliff edge): The full exemption is gone. The non-cliff estate tax liability would be $48,688, but due to the cliff, the estate tax liability is $707,648.

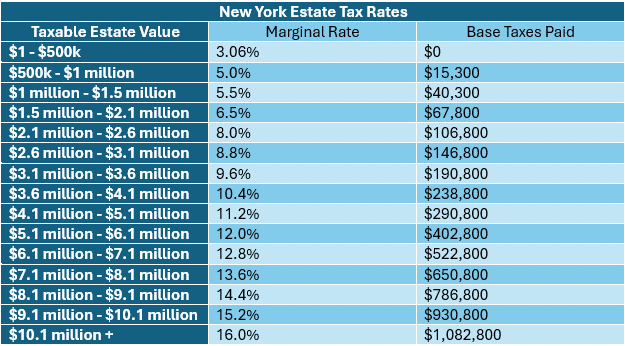

New York Estate Tax Rates

New York has 14 different tax brackets for its estate tax. The lowest rate is 3.06% and the highest is 16%. The chart below outlines the different brackets.

Use It or Lose It: No Portability Here

Like at the federal level, New York allows unlimited transfers to a surviving spouse with no immediate tax (the “unlimited marital deduction”). However, unlike the federal level, New York doesn’t allow “portability” of any unused exemption between spouses. If you don’t use your $7.16M exemption when the first spouse dies, it’s gone.

Planning Strategies for the New York Estate Tax

There are several ways to effectively plan for the New York estate tax and limit your potential future tax liability.

Exemption Planning with Trusts

As previously mentioned, the New York exemption is not a combinable tax credit, unlike the federal estate tax exemption. This means that a married couple’s estate plan needs to be different to effectively use each of their potential $7,160,000 exemptions.

Meet Chuck and Blair. They are lifelong New Yorkers and solid financial planners. Their net worth is $14.32 million. Their estate plan leaves everything to the surviving spouse and then to their two children.

When Chuck passes, everything goes to Blair—no tax due. But what happens when Blair passes with the full $14.32M in her estate? Boom: she’s over the cliff, and her entire estate is now taxable. Result: $1,758,000 goes to the state. Ouch.

Now, imagine if they’d set up a Credit Shelter Trust. At Chuck’s death, $7.16M would go into the trust for Blair’s benefit, reducing her estate to just $7.16 M. At her passing, no tax would be owed. Their kids inherit the full $14.32M, and the estate avoids the cliff altogether. The other benefit to this planning is that any appreciation that occurs inside the Credit Shelter Trust is sheltered from the estate tax going forward. Bravo.

Beneficiary Designations Matter

Your plan might be airtight, but if your retirement accounts or insurance policies list “spouse” or “child” as direct beneficiaries, those assets may bypass your trust—and undo your careful tax planning. Coordinate everything to avoid unintentional tax triggers.

Gifting

New York has no state gift tax, so gifting can be a savvy move. In 2025, the federal annual gift exclusion is $19,000 per person. And direct payments to schools or medical providers don’t count toward that limit. If you are considering funding 529 plans, you can fund up to 5 years’ worth of annual exclusion without using any federal exemptions. Just watch gifts made within 3 years of death—they may be pulled back into your estate for tax purposes.

Relocation (if you dare)

Only New Hampshire in the northeast does not have an estate tax. Thinking of escaping to a tax-friendlier state? It’s possible, but New York doesn’t let go easily. New York generally considers you a state resident for tax purposes if you maintain a permanent residence for substantially all of the tax year and spend more than 184 days during a tax year in the state. You’ll need to prove you’ve abandoned your New York domicile—think utility bills, new voter registration, time spent in-state, and more. And if you keep any property in NY, your estate might still owe tax on that portion.

It is also important to note that the New York Commissioner of Taxation and Finance has issued advisory opinions indicating that single-member LLCs treated as disregarded entities for income tax purposes count as tangible property. However, business interests (such as an S-Corp or an LLC that has elected not to be treated as a disregarded entity) are usually not counted as tangible property. So, holding NY property inside such an entity could help reduce exposure for non-residents.

Charitable Giving

Give now or later—it helps either way. Charitable gifts reduce your estate dollar-for-dollar and can be a meaningful way to leave a legacy (instead of writing a check to Albany).

Life Insurance

Life insurance can be a helpful liquidity tool if structured correctly. When owned outside your estate, the death benefit stays out of the taxable estate and can be used by heirs to pay any taxes due.

Estate Taxes in a New York Minute

Estate planning in New York? Think strategically. With proper planning, especially around the cliff, you can preserve more of your legacy for your loved ones and avoid accidentally funding a government budget line item.

Mission Wealth’s advisors help you navigate federal and state-level estate planning issues. Have questions? Reach out to our Wealth Strategy team today.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

Is a Roth IRA Conversion Right for You?

December 3, 2025

Making Charitable Giving Easier with Qualified Charitable Distributions

December 1, 2025