Market Update for 4/10/25

Market Update

Current policy continues to dominate headlines, with tariff developments impacting global markets. Please find our key points below:

- Despite heightened uncertainty, Mission Wealth’s broadly diversified portfolios have navigated the current period well, performing much better than the U.S. stock market year to date.

- While uncertainty is inherent for investments in the stock market, and there are no guarantees, staying fully invested and focused on the long haul has historically been rewarded time and again.

- The economic and geopolitical situation remains very fluid, and current policy and related uncertainty are expected to reduce economic growth for 2025. Our base case is not indicating a recession, although risks have increased.

- Uncertainty regarding tariffs remains, but the hope is that many countries come to an agreement on trade during the 90-day window. This would provide greater clarity and may help support asset prices.

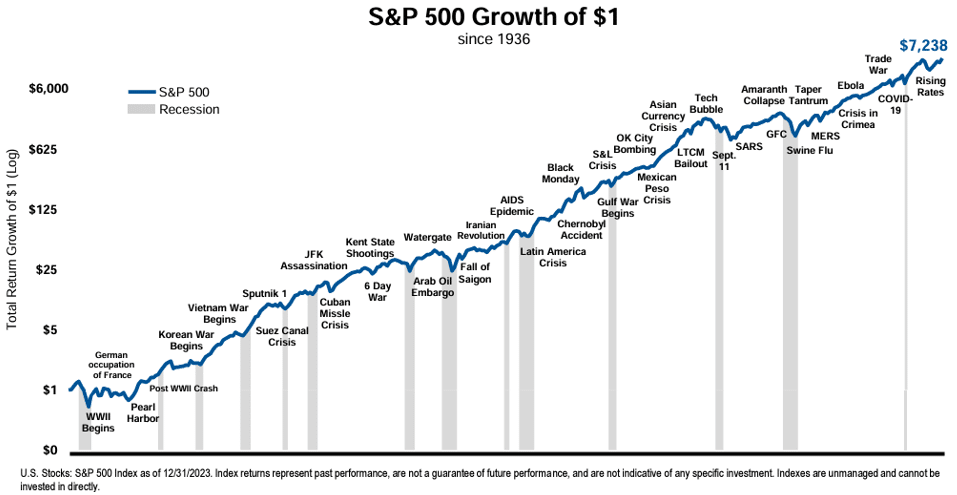

- For the past 90+ years, there have been numerous “reasons to sell.” However, staying the course and remaining fully invested has resulted in strong long-term returns. The “S&P 500 Growth of $1” chart below provides a good perspective.

- We continue to monitor developments closely and believe our portfolios are well-positioned to weather any ongoing uncertainty in the days and weeks ahead.

90-Day Pause

On Wednesday, April 9th, President Trump announced a 90-day pause on tariffs over the 10% base rate for most countries except for China. The White House clarified on Thursday (April 10th) that tariffs on Chinese imports would be raised to 145%. Trump indicated the decision to pause tariffs for 90 days was based on a lack of retaliatory action by those countries and a strong interest in reaching negotiated settlements. The market rebounded strongly on Wednesday, with the S&P 500 returning +9.5% on April 9th, the strongest single-day performance since October 2008.

Uncertainty Remains

While the announcement of a 90-day pause was a welcome reprieve for markets on Wednesday, it remains a highly fluid situation. Indeed, markets gave up some of Wednesday’s gains on Thursday, given the overhang of trade uncertainty and the developing U.S.-China trade war.

The reality is trade negotiations and deals won’t occur overnight; they will likely take weeks or months to unfold. The hope is that previously announced tariff rates are a starting point for negotiations and may be lowered or removed over time as agreements are reached. The U.S. has received requests to negotiate from a large number of countries. Any announced agreements will provide greater clarity and may, in turn, help support asset prices. However, China has already announced countermeasures, and recent developments have only escalated U.S. and China trade tensions.

Lower Economic Growth is Expected

Current policy and related uncertainty are likely to weigh on economic growth. Our investment partner research indicates still-positive growth for 2025 but more likely in the +0.5% range vs. the 2%+ expected at the beginning of the year. As of now, current uncertainty hasn’t resulted in a deterioration in hard economic data, though sentiment has certainly weakened, and feedback from the industry indicates a slowdown in activity.

We expect economic resilience, given the strong underlying fundamentals ahead of the current period of uncertainty. The economy is relatively robust, with strong consumer and corporate balance sheets and a notable lack of excesses. As a result, it may be better positioned to withstand the current levels of uncertainty. While the risk of a recession has certainly increased, that is currently not our base case.

Importance of Diversification

The start of this year is a prime example of the importance of well-diversified portfolios. All other major asset categories have fared much better than the U.S. stock market so far this year. International and emerging market stocks have both outperformed U.S. stocks, and the broad bond market, private equity, private real estate, and direct credit have all produced positive returns. As a result, Mission Wealth’s broadly diversified portfolios have navigated the current period of uncertainty well, and we believe they will continue to weather any ongoing uncertainty in the days and weeks ahead.

Stay Invested

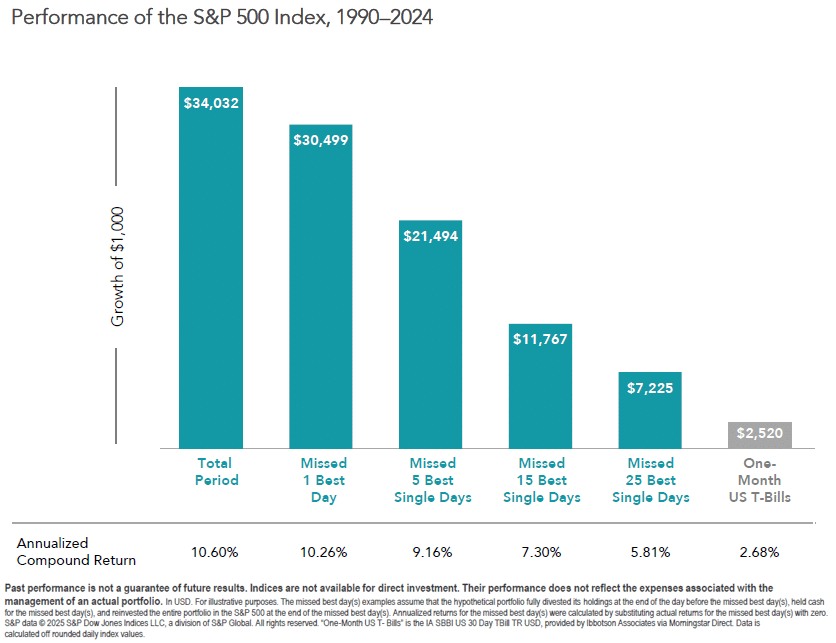

While it can be hard to block out the noise during times of increased headline risks, staying disciplined and fully invested during periods of uncertainty is critical to your long-term goals and investment success. Indeed, the single best stock market performance days often follow some of the worst days, and missing only a few of those best days can dramatically reduce long-term investment performance. This time appears to be no different, with the S&P 500 returning +9.5% on Wednesday (April 9, 2025).

Focus on the Long-Term

Historically, there have been numerous reasons to sell, and every time is always different. However, staying the course by being fully invested has resulted in strong long-term returns. The longer you are invested, the better the chance of success. For the period beginning in 1979, rolling 15-year stock market returns have consistently been positive despite some individual years experiencing losses. Staying invested and focused on the long term has been rewarded time and again.

We continue to monitor developments closely and believe our well-diversified portfolios will continue to help our clients achieve their long-term financial goals. If your long-term financial goals or risk tolerance have changed, please contact your Wealth Advisor to discuss further.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026