Key Takeaways

- While we believe the current economic backdrop may be positive for stocks and bonds, we also anticipate a bumpier ride ahead, underscoring the importance of well-diversified portfolio allocations.

- The Fed appears to be approaching a wait-and-see mode, albeit with a downward bias for interest rates.

- Balancing act: the Fed wants to cut rates it considers still-restrictive amid a weakening labor market, but avoid the risk that rate cuts lead to rising inflation that is already elevated.

- In our view, the Fed remains more attentive to its employment mandate than its inflation mandate, and we expect a cautious approach to additional rate cuts.

Asset Class Implications

The current economic environment may be positive for stocks and bonds. With a backdrop of lower interest rates driven by easing Fed policy and stronger-than-anticipated economic growth, we are constructive on the outlook for U.S. stocks but cautious about concentration and stretched stock market valuations. As a result, we expect positive, but more moderate, stock market returns in the years ahead relative to the very strong performance experienced over the last three years.

Many of our preferred bond funds are currently yielding mid- to high single digits, and returns may be supported by the economic backdrop and a Fed oriented towards lower interest rates, albeit on a slower path. We particularly like alternative investments, and believe investments in private equity, real assets, and private credit may provide enhanced risk-adjusted returns and diversification beyond public markets.

Contentious Cut

The Fed chose to cut rates for the third consecutive meeting, bringing the target range for the federal funds rate to 3.50-3.75%. While the market had anticipated this rate cut – the market implied probability of a rate cut was approximately 90% in the days leading into the announcement – the decision was nonetheless not an easy one, and likely contentious internally at the Fed, as evidenced by three dissenting votes (one to cut rates further, and two who preferred no change at this meeting).

Threading a Needle

Current Fed policy is a balancing act. On the one hand, the Fed wants to cut interest rates it considers still-restrictive amid a weakening labor market. On the other hand, the Fed wants to avoid the risk that rate cuts further stimulate inflation or lead to rising inflationary expectations, especially at a time when economic growth has been better than anticipated, and inflation has risen on the back of tariffs.

The statement highlighted this challenge, noting that “downside risks to employment rose in recent months” due to a moderation in the labor market, with job gains slowing and the unemployment rate rising. At the same time, the statement noted that inflation has moved higher and remains elevated, while economic activity has expanded “at a moderate pace.” At his press conference, Chair Powell further underscored the Fed’s challenge, indicating that near-term risks to inflation are tilted to the upside, while near-term risks to employment are to the downside. As he put it, the Fed has one tool; it cannot do two things at once.

Approaching Wait-and-See Mode

It appears the Fed is approaching wait-and-see mode, albeit with a downward bias for interest rates. Powell indicated that after today’s cut, the fed funds rate is within range of neutral policy, and the Fed is well positioned to “wait and see how the economy evolves from here.”

In our view, the Fed remains more attentive to its employment mandate than its inflation mandate. While the economy has performed better than anticipated, the area of the economy that is clearly weakening is the labor market. The Fed is closely monitoring the labor market due to potential spillover effects on consumer spending, given that consumer spending is the most important component of U.S. GDP (making up approximately 70% of total GDP). At the same time, despite elevated headline inflation, Powell indicated the Fed anticipates the inflationary impact of tariffs is likely to result in a one-time boost to the price level and be relatively short-lived. As a result, we anticipate the Fed will maintain a bias towards lowering rates, albeit at a slower pace.

Lower, But Slower, Interest Rate Bias

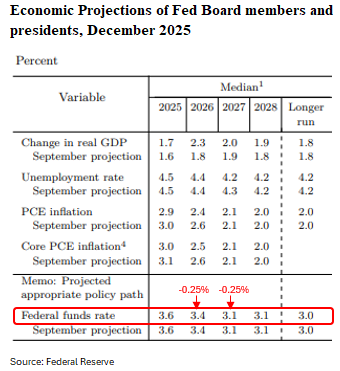

Per the Fed’s projection materials, aka “dot plot” forecasts, a neutral policy interest rate for the Fed funds rate is ~3%. To put it another way, two additional 25 bps rate cuts would bring the Fed funds rate into line with a neutral policy stance. To this end, the Fed’s projections indicate a bias toward cutting rates moving forward, but at a slower pace, with only one 25 bps cut forecast in 2026 and another in 2027.

Overall, we believe our well-diversified portfolios will continue to meet the long-term goals of our clients.

Mission Wealth clients, if you have any questions, please don’t hesitate to contact your Wealth Advisor.

Not Yet Working with an Advisor?

Contact us today for a complimentary consultation and review of your investment portfolio.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 12/10/25: Fed Cuts Rates for Third Time – Implications for Markets and the Economy

December 10, 2025

Market Perspectives Q4 2025

November 19, 2025