Market Update 1/29/26

Following three consecutive rate cuts in 2025, the Fed decided to keep rates steady at yesterday’s Federal Open Market Committee (FOMC), maintaining the 3.50-3.75% target range for the fed funds rate. See below for our key takeaways and what it means for investment portfolios:

- We believe the current economic backdrop and lower interest rates may create a favorable environment for well-diversified portfolios, and we have confidence that our investment portfolios will continue to meet the long-term objectives of our clients.

- In the Fed’s assessment, upside risks to inflation and downside risks to employment have diminished.

- Economic growth has been better than anticipated, recession risks have reduced, and economic growth forecasts have been revised higher.

- With this backdrop, we believe the Fed is in wait-and-see mode and may be slower to cut rates further.

- The next Fed Chair is unlikely to materially change the trajectory of near-term Fed policy; we anticipate a gradual move toward 3.00% for the fed funds rate.

The Fed’s decision to hold rates steady was broadly expected: immediately ahead of the announcement, market-implied probabilities indicated a greater than 97% chance of no change in the policy rate.

The FOMC statement noted that economic activity has expanded at a solid pace, while job gains have remained low, and the unemployment rate has shown signs of stabilization. Though inflation remains elevated. The decision didn’t come without dissents: two members voted against the decision (Miran and Waller), both of whom preferred to cut the fed funds rate by an additional 0.25%. Despite these dissents, Fed Chair Powell noted at his subsequent press conference that there was broad support among the Committee to hold rates steady.

Risks More Balanced

One of the overarching themes from Powell’s press conference is that economic risks appear more balanced. Specifically, economic growth has been better than anticipated, and in the Fed’s view, upside risks to inflation and downside risks to employment have diminished. Powell noted that labor market conditions appear to be stabilizing, with the unemployment rate broadly stable. Stripping out the impact of tariffs, Powell indicated that measures of inflation are running just above the Fed’s 2% target and that longer-term inflation expectations reflect confidence that inflation will move towards 2% over time.

Positive Economic Trend

Despite some recent moderation in the labor market, economic data continues to broadly come in better than expected. We’re seeing a pickup in capital market activity and business investment, particularly in artificial intelligence (AI), which may drive productivity gains, while consumer spending continues to be relatively strong. All of which has led to a lower probability of a near-term recession and consistently higher revisions for economic growth for 2026.

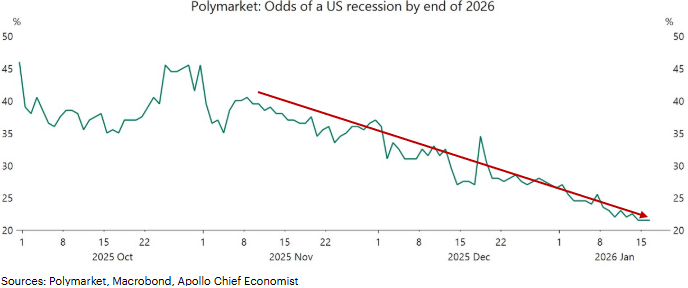

Reduced recession probabilities:

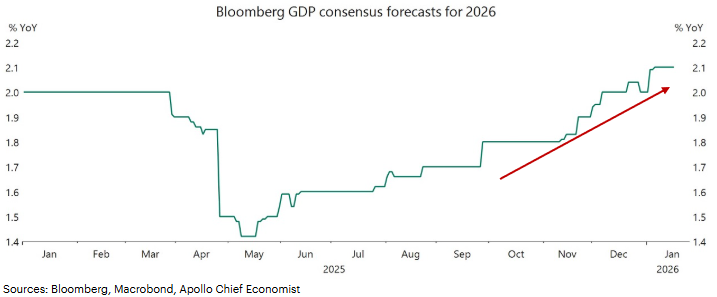

Improved expectations for economic growth:

Fed In Wait-And-See Mode

The Fed finds itself with an interesting economic backdrop with which to make monetary policy decisions: despite some weakness in the labor market, the economy has performed better than anticipated, with growth trending positively, while inflation remains above the Fed’s 2% target. At the same time, the Fed considers current interest rates as moderately restrictive and wants to move closer to a more neutral rate of approx. 3.00% for the fed funds rate over time. Given the economic backdrop, we believe the Fed is likely to be slow to cut rates, given the relative strength of the economy. This outlook is broadly reflected in market pricing, with implied probabilities as of writing indicating one or two additional 0.25% cuts this year.

We anticipate the Fed has entered “wait-and-see” mode and is likely to await further clarity on the economy before making its next interest rate decision. The statement indicated this, noting that in assessing any future adjustments to the fed funds rate, “the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.” This view was further underscored by comments Powell made at his press conference, indicating the Fed will remain data dependent and will see “where the data leads us.”

Next Fed Chair Unlikely To Change Fed Trajectory

As of writing and based on prediction markets, Rick Rieder and Kevin Warsh appear to be the frontrunners to replace Powell as Fed Chair in May. As the current CIO of global fixed income at BlackRock, Rieder will bring extensive experience in global capital markets. Interestingly, when Warsh previously served at the Fed, he was known as a relatively hawkish FOMC member. Both Rieder and Warsh have recently indicated a view that Fed policy rates should be lower. With that being said, we don’t anticipate that the incoming Chair will materially change the trajectory of near-term Fed policy. While the narrative may change slightly, given that they will become the spokesperson for the institution, they are also just one voting member amongst 12. Our base case is a gradual migration towards 3.00% for the fed funds rate.

Investment Implications

We believe the current economic backdrop and lower interest rates may offer a favorable environment for well-diversified portfolios. We consistently favor diversification over concentration. Equity markets have delivered strong returns over the past few years. To the extent investors may be overallocated to U.S. stocks, or to mega-cap tech names in particular, the current environment may present an opportunity to thoughtfully take some chips off the table in favor of broader diversification.

Within the broadly diversified portfolios we manage, we maintain dedicated allocations to alternative asset classes, which we believe may offer attractive, risk-adjusted return potential with lower correlation to broader public markets. International stocks continue to trade at relatively attractive valuations compared to the U.S. and may benefit from supportive monetary and fiscal policies abroad. Additionally, our core bond holdings continue to offer consistent mid-single digit yields and may serve as the anchor of a portfolio.

Overall, we are confident that our well-constructed portfolios will continue to meet the long-term objectives of our clients.

Should you have any questions, please don’t hesitate to contact your Wealth Advisor.

Not Yet Working with an Advisor?

Contact us today for a complimentary consultation and review of your investment portfolio.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026