Market Update 1/20/26

Volatility is back, but not out of the ordinary. 1-3% market moves (and upwards of 5% for any individual stock) on any given day have historically fallen into the “normal/expected” range. This is especially true for any response to rising uncertainty tied to elevated trade tensions. How current dynamics ultimately unfold remains unclear, but history (i.e., 2025) suggests that periods of initial trade escalation are often followed by de-escalation over time. As we have seen repeatedly, investors are best served by remaining steady and avoiding reacting to headline-driven volatility.

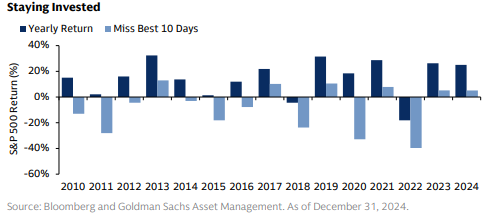

Staying Invested Best Serves Investors

A useful reminder comes from last April’s tariff concerns. Investors who exited the market at the height of that uncertainty missed the subsequent and meaningful recovery in stocks. Maintaining long-term allocations and adhering to disciplined rebalancing strategies has historically been rewarded.

It is also important to remember that the market’s strongest days often occur immediately after its weakest. Missing out on those strong days can have a materially negative impact on your long-term financial performance. Since 1990, missing the 10 best days of each year would have resulted in an annual loss of -13% vs. the S&P 500’s annual return of over 10%.

While we remain confident in the strength and resilience of the U.S. economy (which is the most dynamic in the world), investors may want to assess whether their portfolios are overly concentrated in U.S. stocks. Mission Wealth consistently favors diversification over concentration. Within the broadly diversified portfolios we manage, we maintain dedicated allocations to alternative asset classes, including private equity, direct lending, and real assets. These strategies can offer attractive risk-adjusted return potential with less correlation to broader public markets. Additionally, international stocks continue to trade at relatively attractive valuations compared to the U.S. and may benefit from supportive monetary and fiscal policies abroad.

Despite recent volatility, equity markets have delivered strong returns over the past few years. The current environment may present an opportunity to thoughtfully rebalance portfolios, taking some chips off the table while reinforcing diversification and staying aligned with long-term investment objectives.

Looking for perspective on how today’s market volatility fits into your long-term plan?

Our Wealth Advisors help clients stay disciplined through changing market conditions by building diversified portfolios aligned with their goals. Schedule a complimentary conversation to review your strategy and ensure your portfolio remains positioned for the long term.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 3/2/26

March 2, 2026

Market Perspectives Q1 2026

February 25, 2026