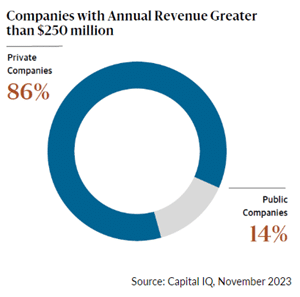

For many investors, the public market represents the entirety of their equity exposure. But here’s the reality: over 85% of sizable U.S. companies are privately owned. That means most portfolios are built on only a small slice of the opportunity set.

Private equity provides investors with access to opportunities that may offer high-growth potential, strong risk-adjusted returns, and reduced correlation with public markets. With today’s evolving investment environment, it may be time to consider whether this powerful asset class belongs in your portfolio.

What Is Private Equity?

Private equity involves investing in private companies—those not listed on stock exchanges. Private equity is one of the illiquid Alternative Investments, financial assets that are not typically traded publicly and do not fit into traditional investment asset classes (e.g., stocks, bonds, or cash), offered by Mission Wealth.

When you invest with private equity, you gain an ownership stake in businesses that may be early-stage, growth-focused, or undergoing transformation. While these investments are less liquid, they offer differentiated exposure that may complement public equities.

“In the United States, over 85% of substantial-sized companies are private, yet most investors hold 100% of their equity in public markets.”

Why Consider Private Equity Now?

We believe we are entering a new investment regime—one shaped by higher interest rates and moderating returns in public stocks. In this landscape, private equity presents several key advantages:

- Higher Return Potential

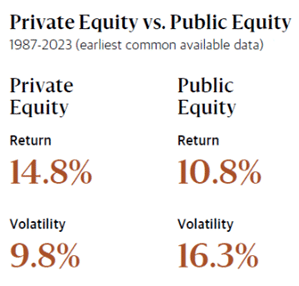

Private equity has historically outperformed public equities on an annualized basis, while exhibiting lower volatility over full market cycles.

Source: Morningstar, as of December 31, 2023. Private Equity is represented by the Cambridge Associates US Private Equity Index. Public Equity is represented by the S&P 500 Index.

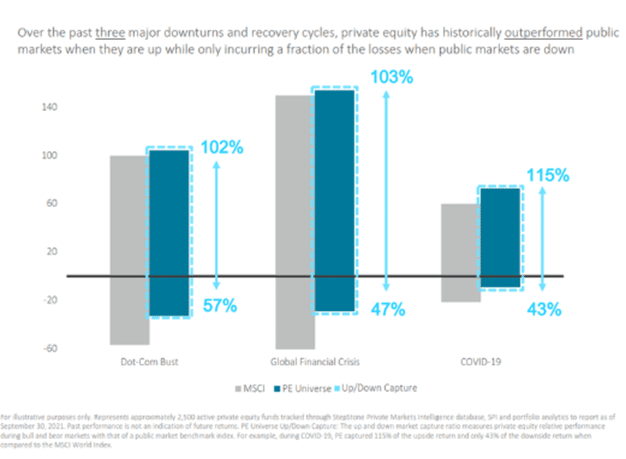

- Downside Protection

During major market drawdowns, private equity has captured only 40%–60% of the downside but 100%–115% of the recovery, offering a smoother ride when markets get bumpy.

- Broader Opportunity Set

From tech and healthcare opportunities to niche manufacturing and industrials, private equity unlocks access to a wider array of private growth engines not available on public exchanges.

Breaking Down the Barriers

From tech and healthcare opportunities to niche manufacturing and industrials, private equity offers access to a wider array of private growth engines not available on public exchanges.

- Large minimum investments, oftentimes of $5M or more

- Capital calls over several years

- Relatively concentrated portfolios

Mission Wealth removes these roadblocks by extending our partnerships with institutional-quality funds with diversified portfolios across sectors, geographies, and strategies.

Is Private Equity Right for You?

Private equity investments are less liquid than public markets. As such, they are best suited for long-term, buy-and-hold investors who don’t need immediate access to their capital. If you’re seeking:

- Enhanced return potential

- Diversification beyond public markets

- Exposure to high-growth companies

…then private equity may be worth exploring.

Additionally, private equity funds may carry higher fees and investment minimums than daily-liquid investments. As with any investment, it’s important to weigh the potential risks and rewards before making a decision.

Take the Next Step

Interested in whether private equity fits into your broader financial plan? Explore Mission Wealth’s Alternative Investments solutions and schedule a complimentary portfolio review today.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 10/29/25: Fed Delivers Rate Cut as Economy Shows Resilience

October 29, 2025

Market Update 9/17/25: Fed Resumes Rate Cutting Cycle — What Does This Mean for Markets and Investment Portfolios?

September 17, 2025