Geopolitical Headlines, Market Resilience, and the Value of Long-Term Perspective

Key Investor Takeaway: Geopolitical headlines can drive short-term market volatility, but long-term investment success is more often determined by discipline, diversification, and a focus on fundamentals, not reactionary decisions.

Geopolitical developments involving Venezuela dominated headlines over the weekend, prompting understandable questions from investors about market stability and risk. While global events can feel unsettling—particularly when they involve military or political intervention—the market response so far has been notably measured.

Despite the elevated news cycle, broader market sentiment has remained resilient, reinforcing an important principle for investors: headlines do not always dictate outcomes, and markets tend to respond more to fundamentals than to short-term uncertainty.

Markets Look Through the Noise

U.S. equities extended their gains on Monday, supported by strength across several key sectors, including financials, energy, and consumer cyclicals. The Dow Jones Industrial Average advanced roughly 1.23% (595 points) to reach a new record high, while the S&P 500 gained 0.64% and the Nasdaq 100 rose 0.69%.

This market behavior suggests that investors, rather than reacting emotionally, remained focused on economic data, earnings expectations, and monetary policy—factors that historically carry more weight in determining long-term market direction.

Energy in Focus as Oil Prices Rise

One area where geopolitical headlines did have a measurable impact was the energy sector. Oil prices moved higher following developments in Venezuela, driven by concerns about supply dynamics and the potential for future infrastructure investment.

West Texas Intermediate (WTI) crude rose approximately 1.8%, trading near recent highs after an initially muted reaction. Energy stocks benefited accordingly, making the sector one of the stronger performers in the session. While short-term price movements can be volatile, energy markets often respond quickly to geopolitical risk—particularly when it involves major oil-producing regions.

The Fed Remains a Key Market Anchor

Beyond geopolitics, markets continue to be supported by expectations for potential Federal Reserve rate cuts later this year. Inflation trends, economic growth data, and monetary policy remain central drivers of investor sentiment.

For long-term investors, this reinforces an important distinction: while geopolitical events can influence markets in the short run, interest rates, earnings growth, and economic fundamentals typically play a much larger role in shaping returns over time.

Investing Through Uncertainty

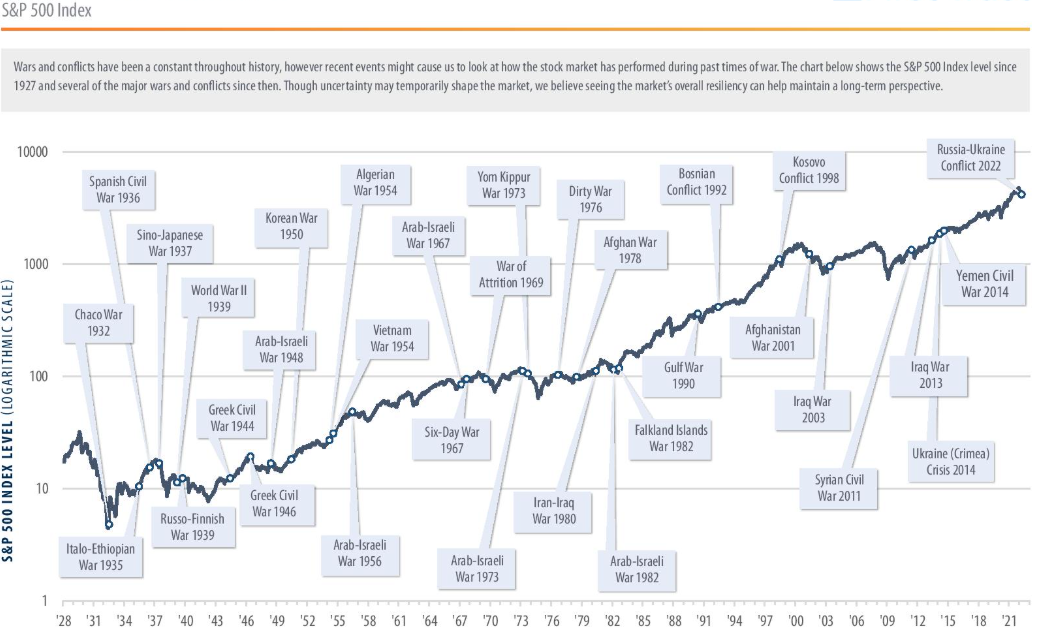

Uncertainty is an inherent part of investing. Markets periodically face geopolitical tension, economic slowdowns, policy shifts, and unexpected events. Outcomes are never guaranteed, and volatility is unavoidable.

However, history has consistently shown that disciplined investors, those who remain strategically invested, diversified, and focused on long-term objectives, have often been rewarded over time. Reacting to headlines by making abrupt portfolio changes can introduce unnecessary risk and potentially derail long-term plans.

Rather than attempting to predict short-term market reactions, a sound investment approach emphasizes diversification, risk management, and alignment with personal goals and time horizons.

A Disciplined, Long-Term Approach

At Mission Wealth, we closely monitor global developments and assess how evolving conditions may influence markets and investment strategies. Our philosophy emphasizes long-term thinking, diversification across asset classes, and thoughtful portfolio construction designed to navigate periods of uncertainty without losing sight of broader financial objectives.

For investors evaluating their current strategy, or considering whether their portfolio is positioned appropriately for today’s environment, periods like this can be a valuable opportunity to step back, reassess goals, and ensure decisions are grounded in strategy rather than emotion.

If you’d like a professional perspective on how current market conditions may relate to your long-term financial goals, a Mission Wealth advisor is available for a complimentary conversation.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Investment Insights Articles

Market Update 1/29/26

January 29, 2026

Market Update 1/20/26

January 20, 2026