The tax filing deadline is fast approaching, which means time is running out to fund an IRA for 2023. If you had earned income last year, you may be able to contribute up to $6,500 for 2023 ($7,500 for those age 50 or older by December 31, 2023) up until your tax return due date, excluding extensions. For most people, that date is Monday, April 15, 2024.

You can contribute to a traditional IRA, a Roth IRA, or both. Total contributions cannot exceed the annual limit or 100% of your taxable compensation, whichever is less. You may also be able to contribute to an IRA for your spouse for 2023, even if your spouse had no earned income.

Making a last-minute contribution to an IRA may help you reduce your 2023 tax bill. In addition to the potential for tax-deductible contributions to a traditional IRA, you may also be able to claim the Saver’s Credit for contributions to a traditional or Roth IRA, depending on your income. For more information, visit irs.gov.

Traditional IRA Contributions May Be Deductible

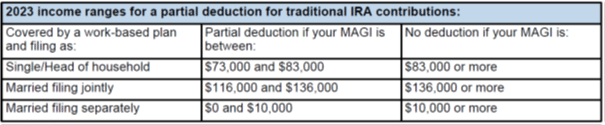

If you and your spouse were not covered by a work-based retirement plan in 2023, your traditional IRA contributions are fully tax deductible. If you were covered by a work-based plan, you can take a full deduction if you’re single and had a 2023 modified adjusted gross income (MAGI) of $73,000 or less, or married filing jointly with a 2023 MAGI of $116,000 or less. You may be able to take a partial deduction if your MAGI fell within the following limits.

If you were not covered by a work-based plan but your spouse was, you can take a full deduction if your joint MAGI was $218,000 or less, a partial deduction if your MAGI fell between $218,000 and $228,000, and no deduction if your MAGI was $228,000 or more.

Consider Roth IRAs As An Alternative

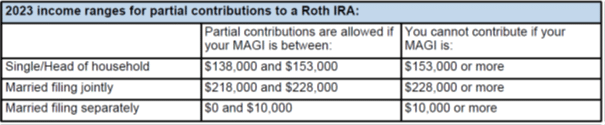

If you can’t make a deductible traditional IRA contribution, a Roth IRA may be a more appropriate alternative. Although Roth IRA contributions are not tax-deductible, qualified distributions are tax-free. You can make a full Roth IRA contribution for 2023 if you’re single and your MAGI was $138,000 or less, or married filing jointly with a 2023 MAGI of $218,000 or less. Partial contributions may be allowed if your MAGI fell within the following limits.

[click_to_tweet tweet=”You have until your tax return due date, excluding extensions, to contribute up to $6,500 for 2023 ($7,500 if you were age 50 or older on December 31, 2023) to all IRAs combined. For most taxpayers, the deadline for 2023 is April 15, 2024. @missionwealth” quote=”You have until your tax return due date, excluding extensions, to contribute up to $6,500 for 2023 ($7,500 if you were age 50 or older on December 31, 2023) to all IRAs combined. For most taxpayers, the contribution deadline for 2023 is April 15, 2024.”]

PRO TIP: If you can’t make an annual contribution to a Roth IRA because of the income limits, there is a workaround. You can make a nondeductible contribution to a traditional IRA and then immediately convert that traditional IRA contribution to a Roth IRA. (This is sometimes called a backdoor Roth IRA.) Keep in mind, however, that you’ll need to aggregate all traditional IRAs and SEP/SIMPLE IRAs you own — other than IRAs you’ve inherited — when you calculate the taxable portion of your conversion.

A qualified distribution from a Roth IRA is one made after the account is held for at least five years and the account owner reaches age 59½, becomes disabled, or dies. If you make an initial contribution — no matter how small — to a Roth IRA for 2023 by your tax return due date, and it is your first Roth IRA contribution, your five-year holding period starts on January 1, 2023.

Qualified IRA Conversion Planning Advice

It’s important to note that the suitability of a conversion depends on individual circumstances, including income, retirement timeline, and financial goals. Before making any decisions, it’s advisable to consult with a qualified financial advisor or tax professional who can provide personalized advice based on your specific situation.

At Mission Wealth, our Strategy Group can review your tax situation and perform an in-depth analysis of the pros and cons of converting your IRA.

Contact us today for a free discovery consultation and to be matched with a financial advisor who can accompany you through every step of your financial journey.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

Market Update 12/10/25: Fed Cuts Rates for Third Time – Implications for Markets and the Economy

December 10, 2025

Five Behavioral Biases That Shape How We Care for Aging Parents

December 10, 2025