Fed Raises Rates

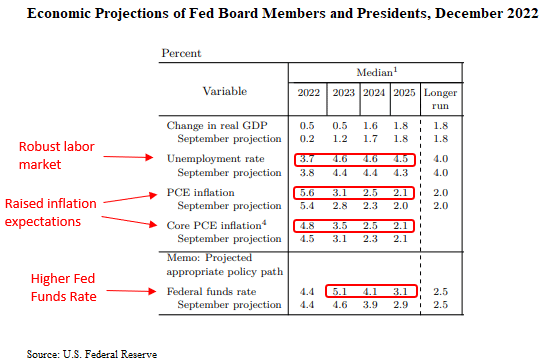

As was widely expected, the Fed raised the fed funds rate by 0.5% today, bringing the target to 4.25-4.50%. This marks a slowed pace of interest rate increases, with the Fed previously raising the fed funds rate by 0.75% in each of the June, July, September and November meetings. At the subsequent press conference, Fed Chair Powell reiterated the view that current policy still isn’t sufficiently restrictive and played down the idea of rate cuts in 2023. The stock market reversed earlier strength and finished Wednesday lower, with the S&P 500 down -0.61%.

Client portfolios remain highly diversified with the intention of creating current cash flow for today’s needs and capturing future growth opportunities as an inflation hedge. We believe a combination of stocks, bonds, and alternative income-generating assets provides portfolio balance and helps optimize risk-adjusted returns.

Strong Labor Market, Sticky Inflation

Increased Guidance for Future Rate Increases

Structural Shift Underway

Asset Class Implications

With this backdrop, we anticipate a moderation in equity market returns from the very high levels experienced leading into 2022 (for example, the 10-year annualized return on the S&P 500 ending 2021 was 16.5%). This is not to say we’re bearish on the outlook for stocks, as we’re not. We believe there may be attractive near-term upside from current levels, but over the long haul, we think expectations should be reset for stocks to produce mid-to-high-single digit returns, lower than previous years but more consistent with historic averages.

Bond yields are a lot more attractive today and we are constructive on the outlook for bond market returns from current levels. We also think alternative income-generating asset classes may produce enhanced risk-adjusted returns in the years ahead. These asset classes offer the potential for attractive returns and income streams, with less volatility and a lower correlation to the stock market.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00488282 12/22