This article was originally published in full on Tacoma’s The News Tribune. Gary Brooks has been a contributing author for the paper since 2008 and is also a Partner and Senior Wealth Advisor at Mission Wealth in Gig Harbor, WA.

Estate planning is one of the more underutilized aspects of personal finance. Addressing our own mortality is rarely something we want to spend much time contemplating even though it is one of just a few inevitable life events and can have an impact well beyond yourself.

Partly because it covers subject matter that people would rather not think about, there are several common mistakes in estate planning.

Common Mistakes in Estate Planning

Not Doing Anything or Incomplete Documents

The most prominent mistake is failing to get started. National surveys consistently report that two-thirds of people don’t have a will, and even more lack other useful documents like power of attorney and health directives.

Many people who do make estate decisions are susceptible to another common oversight, not finalizing their documents with witnessed signatures. Signing the documents is just as important as the decisions that are defined in the documents. Those decisions might be invalidated without proper completion.

Failing to Factor in Beneficiary Designations

A common inconsistency could disrupt intended plans among people who complete their estate documents. A will could provide instructions about assets that do not have their own assigned beneficiaries. For individual retirement accounts (IRAs), employer retirement plans, life insurance policies, or other accounts that have listed beneficiaries, the beneficiaries designated on the accounts are the heirs, even if there is different instruction in the will.

You could have many different accounts, possibly with different beneficiary assignments. They don’t all have to match. You might want to purposefully bequest certain types of accounts or assets to certain heirs based on the investments held in those accounts, how the accounts are taxed, or for other reasons. But make sure those instructions are applied to the beneficiaries of each account, not via instruction in the will. Sometimes, beneficiary assignments are incomplete or are not updated (such as in the case of a pre-deceased spouse). That is generally not advisable because it could cause an account or asset that otherwise would not have to go through the probate process to be included, increasing time and cost.

Partial Trust Planning

Some people try to limit the amount of their assets subject to probate (the process of state administration of asset transfer from the deceased to heirs) by creating a revocable trust. If that is the chosen strategy, make sure that assets are re-titled with the trust as their owner. Sometimes, people go through the work and cost to create a trust but then don’t change the title of their home or brokerage account, leaving it outside the trust. When you create a trust, you can retain access to those assets even if you no longer personally own them. The function of the trust helps ease the administration of the estate and allows your personal representative or trustee access without needing to be appointed by a court.

Naming the Wrong Executor

There could be a tedious set of tasks to complete upon your death. It’s important that you identify a capable executor/personal representative to finalize your estate. Some people identify executors who are not well-suited. It’s best to name a younger person who is comfortable with financial, tax, and legal matters as well as communicating with heirs. Make sure your executor is aware of your designation, willing, and has the capacity to do the work, which could take several months. Lack of communication with an executor has its complications.

Lack of communication with family is another mistake. Headaches can be avoided with some proactive communication and expectation setting. While helpful to you, it might also provide peace of mind to your heirs when they know that plans are in place.

Not Taking Advantage of Other Family Giving Opportunities

While estate planning often focuses on the distribution of assets after death, using options for family giving before death could be equally important. Especially if an estate exceeds state estate tax exemption amounts ($2,193,000 in Washington for example), it could be advantageous to use family giving of assets that could otherwise be subject to estate tax. Any person can give another person up to $17,000 per year with no tracking of the gift required. Exceeding that amount doesn’t mean that tax is due but does mean gifts need to be reported on the tax return. Most people would not reach their lifetime gift tax exemption ($12.92 million per person in 2023).

In addition to family giving, some estate plans miss the opportunity to extend charitable giving that might have been in place for years. Whether related to tax benefits or simply philanthropic desires, communicating with nonprofits about your estate plans could help you deepen relationships with the organizations you’ve chosen to support. The South Sound Planned Giving Council and Leave 10 South Sound have significant resources on their websites to help with charitable giving and broader estate planning.

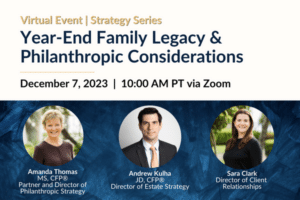

Join Our Upcoming Estate Planning and Charitable Giving Webinar

Year-End Family Legacy & Philanthropic Considerations

Date & Time: December 7, 2023, 10:00 AM PT

Join us for a free virtual discussion on year-end planning, estate strategies, and the transformative impact of philanthropy. Explore how you can leave a meaningful legacy for your family and contribute to the greater good. Director of Philanthropic Strategy, Amanda Thomas and Director of Estate Strategy, Andrew Kulha will share valuable insights to help you navigate the complexities of financial planning and family charitable discussions, all while making a positive difference in the world.

Key Takeaways:

- Gain a comprehensive understanding of the crucial steps involved in year-end financial planning. Discover how to optimize your financial resources, reduce tax burdens, and ensure your financial goals align with your values.

- Explore effective estate planning techniques that preserve and transfer your wealth seamlessly to future generations. Learn how to communicate your wishes with your family, and advanced strategies to safeguard your family’s financial future.

- Delve into the world of philanthropy and discover how charitable giving can make a meaningful impact on the causes you care about. Learn how to create a philanthropic strategy that aligns with your values and involves your family in the planning process.

At Mission Wealth, we’re committed to helping you make informed financial decisions. Reach out to your Wealth Advisor or contact us for a free consultation. Let’s make the most of the year-end planning opportunities together.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

FA Magazine Names Mission Wealth One of 2025’s Top and Fastest-Growing RIA Firms

July 11, 2025

Is Your Child Headed to College? Don’t Forget This Insurance Checklist

July 10, 2025