Behavioral Finance and The Psychology of Wealth

Using behavioral finance to help our clients make better financial decisions.

What is the Psychology of Wealth?

At Mission Wealth, we recognize that making wise financial decisions goes beyond having the best technical information. The Psychology of Wealth is where human psychology meets the intricacies of wealth management. Through the fascinating field of behavioral finance, we are exploring how our thoughts, emotions, and biases influence our decisions—whether it's investments, estate planning, tax strategy, or multigenerational legacy planning.

By integrating behavioral finance and psychology into your financial roadmap, your wealth advisor can help you gain a deeper understanding of your own mental roadblocks. This understanding can help you to make decisions that you can stand by, and which align with your long-term goals.

The Costly Human Element

It’s common knowledge that people are not always rational when it comes to money, even the affluent. Emotions, biases, and social factors can play a significant role in why we make predictable and preventable financial errors. Through a combination of economics, psychology, and finance we have gained a better understanding of how individuals make financial decisions and how to avoid the most common pitfalls.

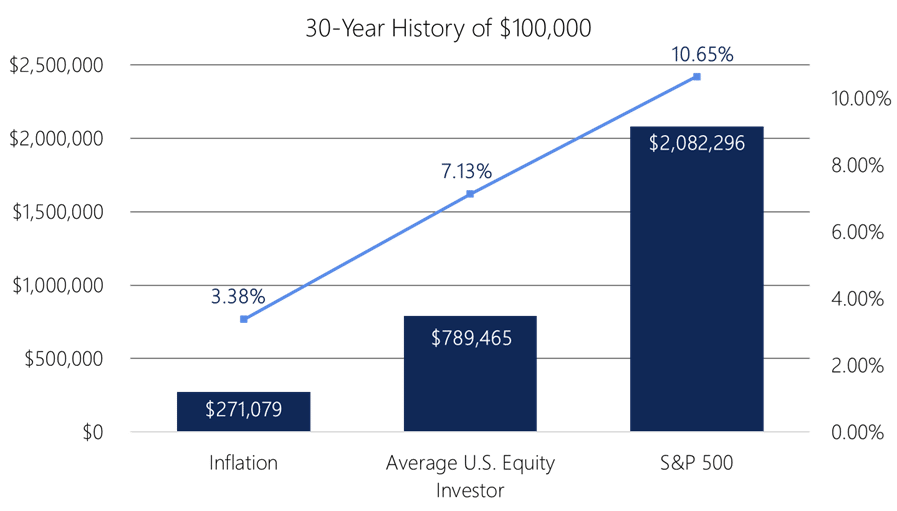

Over time, making the “right” decisions can be life-changing for yourself, your family, and your community. Per a 2022 study by Russell, a 2015 study by Vanguard, and the 2022 Dalbar QAIB, the behavioral differences between markets and “average” investors can account for more than 50% of investors' missed returns.

For example, from 1992 to the end of 2021 the average U.S. equity investor earned about 7.13% per year. At first, this may not sound bad, until you consider that the average U.S. equity market itself (the S&P 500) performed an average of 10.65% per year over the same period. The effects of this are profound: a portfolio of $100k in 1992 would have grown to nearly $2.1 million if left alone in the market, yet the average equity investor only earned $790k over the same period. How is it possible that the average investor earned less than half of the very same market they were investing in ($790k versus $2.1M)?1

The answer is that it was exceptionally hard to manage the social, emotional, and psychological factors from 1992 to 2021. After all, in those three decades investors faced the dot-com crash, the great financial crisis, and a global pandemic - not to mention everything in between.

Through it all, investors were faced with a never-ending list of challenges: action bias, hindsight bias, confirmation bias, bandwagon effect, recency bias, loss aversion, etc.

Having an advisor who is familiar with these concepts is paramount to helping you identify and avoid them in your own investing decisions.

Need Additional Answers? Mission Wealth Can Help.

Partner with a fiduciary wealth advisor about the benefits of incorporating behavioral finance concepts into your investment strategy.

Start your journey today.

How Mission Wealth Works to Connect the Dots

These behavioral concepts are a lot bigger than just investments. We have found that additional wealth benefits can occur by taking a wider view of the entire financial picture. Below are a few examples of known psychological factors that affect how we make decisions across a broader scope of our financial lives:

- Spending & Saving: Lifestyle Creep, Money Illusion Effect, Restraint Bias

- Retirement Planning: Prudence Bias, Normalcy Bias, Optimism Bias

- Active Rebalancing: Disposition Effect, Recency Bias, Anchoring

- Tax-Loss Harvesting & Asset Location: Mental Accounting, Status Quo Bias, Loss Aversion

- Multigenerational Planning & Family Governance/Dynamics: Familiarity Bias, Social Comparison Bias, Reactive Devaluation

- Estate Planning: Endowment Effect, Decision Fatigue, Ambiguity Aversion

- Risk Management: Present Bias, Completion Bias, Illusion of Control

- Philanthropic Planning: Projection Bias, Loss Aversion, Framing

Recognizing our challenges is one thing, but solving them is another. At Mission Wealth, we’ve gathered academically-proven and Nobel-winning concepts to create over 400 connections to the financial planning process. Our service model integrates these ideas and translates them into actionable solutions.

For each known psychological hurdle (such as those mentioned above), we’ve paired tested and accurate solutions to help clients avoid decision-making traps. This foundation can help us all make better decisions in every area of our lives, including spending, retirement planning, investment strategy, tax planning, insurance protection, estate planning, philanthropic goals, and life event planning. Having an advisor integrate the psychology of decision-making with factual financial planning knowledge is vital for getting the best advice possible.

Five Behavioral Biases That Shape How We Care for Aging Parents

What Is the Best Way to Bring Fairness and Family Harmony to Your Estate Plan?