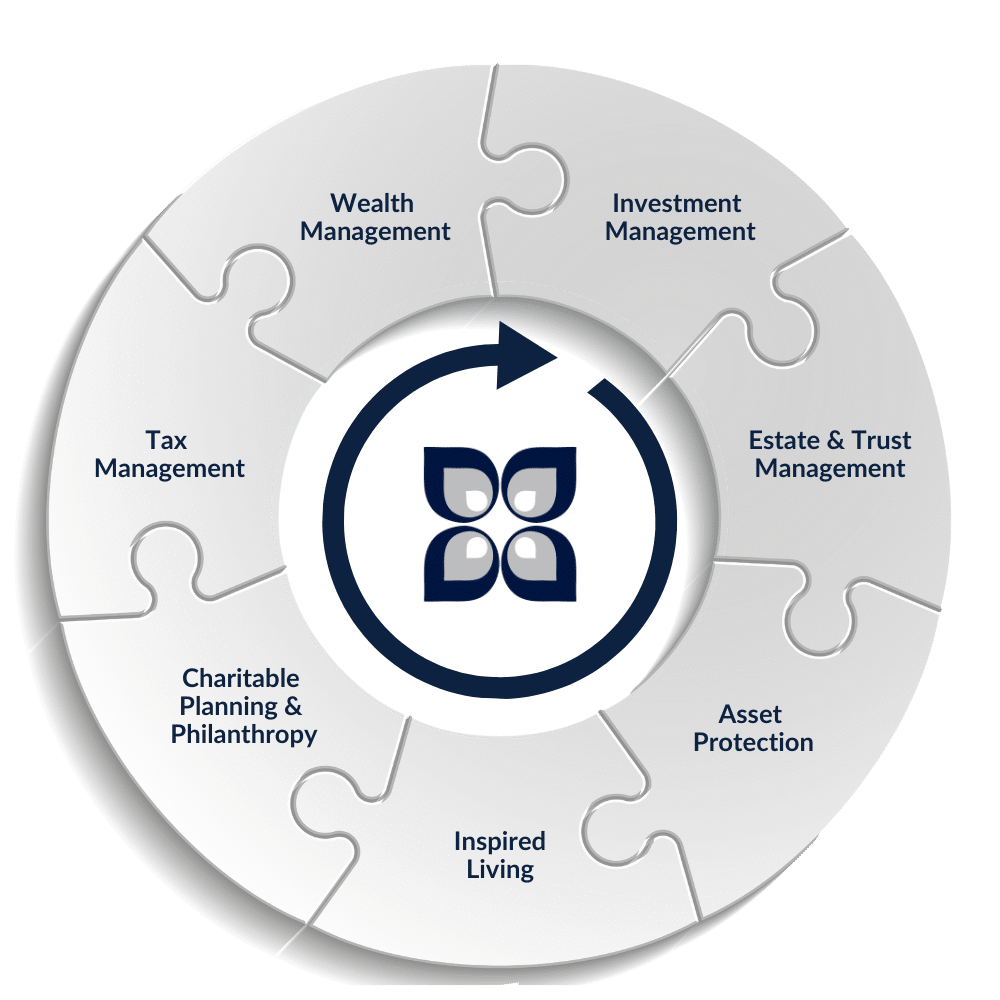

Mission Wealth Services

Our dynamic planning process ensures that every piece of the puzzle is put into place as our clients’ lives unfold and their needs evolve. This offers them a complete financial picture with confidence in their future.Investment Management

Invest and grow your wealth.We develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. We partner with you to find the right balance between risk and return, while monitoring your portfolio and keeping you up to date with ongoing refinements.

Investment Services Include:

- Custom Portfolio Management

- Non-Discretionary Relationship

- Stock Concentration Strategies

- Stock Option Planning

- Alternative Investments

- Portfolio Income Strategies

- Behavioral Finance Strategies to Overcome Investment Biases

- Tax-Smart Implementation and Trading

- Ongoing Monitoring, Rebalancing, Tax-loss Harvesting and Performance Reporting

- Individual Securities

- Socially Responsible Investing

- Cash Management Strategies

- Current Events: Portfolio Sensitivity

- Secure Client Portal

- 401(k) Guidance

Learn More

Wealth Management

Integrate all aspects of your financial picture.Our all-inclusive view goes beyond just investments; it’s a road map that puts you on track with your financial goals and life dreams. Working closely with you, we use a holistic process to help you develop a customized plan that integrates all aspects of your financial life.

Wealth Management Services Include:

- Financial Planning

- Budget Analysis and Spending Review

- Psychology of Wealth & Decision-Making Strategies

- Goals Assessment and Prioritization

- Wealth Planning Organizer

- Real Estate Advice and Support

- Access to Lower Negotiated Borrowing Rates

- Social Security Maximization

- Medicare Enrollment Assistance

- Retirement Home Analysis and Community Living Options

- College Savings Plans and Analysis

Learn More

Tax Management

Minimize your tax burdens.We realize that taxes may be one of your largest ongoing expenses. We will bring tax reduction strategies to you and coordinate with your CPA on implementation. We also manage your investment portfolio in a tax-efficient manner.

Tax Management Services Include:

- Annual Tax Management Review

- Proactively Communicate the Tax Impact of Recommended Financial Strategies

- Integration and Coordination with CPA on Tax Savings Strategies

- Direct Access to our CPAs on Staff Who Can Review Tax Returns or Documents With You in a Way That's Easy to Understand

- Roth Conversion Modeling Strategy

- Cross Border Tax Optimization

- Tax Return Preparation services

- Answer Any Additional Tax Questions

- Prepare Tax Projections

*Tax services available to private and family office clients.

Learn More

Estate Planning & Trust Management

Maximize the impact of your assets.Whether your goal is to leave your estate to heirs or charity, to minimize taxes or to maximize lifetime giving, we are here to provide clarity and direction. We have the knowledge to guide you through all phases of your estate plan and our professional trust services help you transition your legacy and your wealth to empower your beneficiaries into the future.

Estate Planning and Trust Services Include:

- Estate Plan Review, Including Balance Sheet Review, and Net Worth Forecasting

- Estate Tax Reduction Strategies

- Generational Planning

- Family Legacy Planning

- Communicating with Beneficiaries

- Strategies for Transferring Wealth and Managing Your Estate

- Estate Plan Drafting

- Special Needs Planning

- Trust Planning, and Trustee and Fiduciary Support

*Estate and trust services available to private and family office clients.

Learn More

Charitable Planning & Philanthropy

Create opportunities to give, learn tax-free friendly tactics, and maintain your charitable values.Through our continued planning process, we determine the most efficient way for clients to do their giving. This may include distributions from retirement plans, using donor advised funds for the transfer of appreciated stock, or more sophisticated solutions through charitable gift annuities or charitable remainder trusts.

Charitable Planning & Philanthropy Services Include:

- Strategic Philanthropic Planning

- Tax-Efficient Giving Strategies

- Donor-Advised Funds

- Family Philanthropy

- Planned Giving Discussions

- Charitable Trusts

- Charity and Impact Evaluations

- Non-Profit & Foundation Support

- Corporate Philanthropy Strategy

- Planning Giving Strategies

Learn More

Asset Protection & Risk Management

Understand your liabilities and protect against different kinds of loss.Through our thorough review process, we will determine if you have adequate coverage to protect your family in the event that something unexpected happens. We will discuss the risks with you and introduce you to an insurance professional who may be able to provide solutions. We will also review any existing policies you have in place and determine how they fit into your current financial picture.

Asset Protection & Risk Management Services Include:

- Personal Insurance Review for Life, Disability, and Long-Term Care Insurance

- Property & Casualty Insurance Review

- Cyber Security Insurance Review and Solutions

Learn More

Inspired Living Platform

Design your life in a way that makes you feel alive and fulfilled.Our exclusive events offer opportunities where an advisor and/or thought leader provides ideas to support you through life changes or transitions that may occur. As life transitions occur, we will provide you with actionable advice, create new goals for you, and define targeted strategies that all integrate into your financial plan.

Inspired Living Services Include:

- Inspired Living Annual Review

- 12 Dimensions of Life Assessment

- Inspired Life Purpose Assessment

- INSPIREDtalk Events

- Conversation Circle Events

Learn More

Women on a Mission

Feel empowered with the financial confidence and resources you need to take control of your money and wealth.Our female wealth advisors, financial planners, and charitable planning strategists share a passion to help other women achieve their financial goals. We have many female financial advisors that work closely with women who are looking for a trusted relationship in order to feel more confident and enjoy more financial security.

We Help Women Investors With:

- Assistance to a Family Member

- Business Planning

- Buying or Selling a Home

- Charitable Planning & Philanthropy

- College Planning

- Divorce or Separation

- Empty Nest

- Expecting or Adopting a Child

- Health Concerns

- Inherited Wealth or Investment Gain

- Loss of a Loved One

- Marriage

- Retirement

- Single Parenthood

- Special Needs Planning

- And More!

Learn More