Planning for State-Level Estate Tax Peculiarities: Massachusetts Edition

The saying goes, “Nothing in life is certain except death and taxes.” But even that leaves out the nuances. Estate taxes, especially those at the state level, can often catch many families by surprise. While federal estate tax thresholds usually dominate headlines (and may change again in 2025), state estate taxes are more likely to impact everyday families.

In this article, part of our state-by-state estate tax series, we explore Massachusetts, one of 13 states (plus D.C.) with its own estate tax.

Massachusetts Estate Tax vs. Federal Estate Tax

Massachusetts updated its estate tax law in 2023, and the changes brought new thresholds and planning considerations. Unlike the federal exemption of $13.99 million per person (2025), Massachusetts provides a $2 million effective exemption (offered as a $99,600 tax credit) and requires filing an estate tax return if your gross estate exceeds $2 million, including taxable lifetime gifts.

Massachusetts’s exemption is similar to the federal exemption, in that it works as an offsetting amount for every dollar up until the top, meaning if you have an estate worth $2,000,000, you owe nothing.

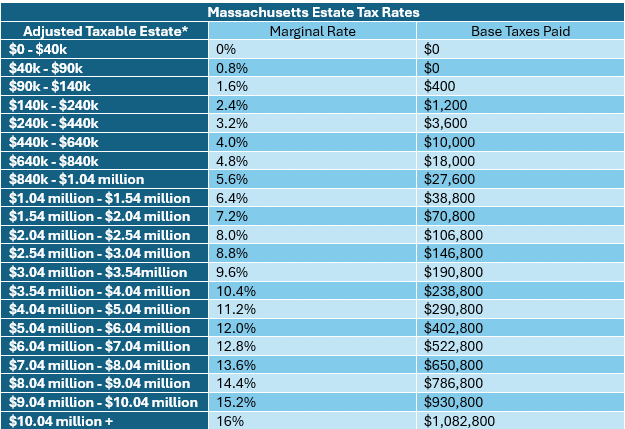

Massachusetts uses a progressive structure with 21 tax brackets, ranging from 0.8% to 16%, plus an additional exemption of $60,000 before determining any taxes owed.

Unlike federal estate taxes, Massachusetts does not offer “portability” between spouses. While the unlimited marital deduction allows assets to pass between spouses tax-free at death, any unused exemption from the first spouse is forfeited unless planning tools, such as trusts, are utilized.

Planning Strategies for the Massachusetts Estate Tax

There are several ways to effectively plan for the Massachusetts estate tax and limit your potential future tax liability.

Exemption Planning with Credit Shelter Trusts

Massachusetts’s lack of portability makes trust planning essential. For example, assume Sam and Diane have a $5.06M estate and their estate plan leaves all their assets to the surviving spouse at first death and the balance to their children once they’ve both passed.

One day, Sam passed away. His estate is being administered as the plan dictates, and everything continues in Diane’s name. Because Sam left everything to his spouse, no estate tax has been triggered in Massachusetts. However, when Diane passes away, her taxable estate value is $5,060,000, so her estate must file an estate tax return. The estate receives an initial exemption of $60,000, reducing her estate to $5,000,000, and her tax liability is $398,320, reduced by her $99,600 estate credit.

Diane’s estate ultimately owes $298,720 in taxes—the remaining $4,761,280 transfers to their children.

With a Credit Shelter Trust funded at Sam’s death, $2,000,000 would go into this irrevocable trust for Diane’s benefit. Diane could continue to use the assets as she needed. This also would reduce Diane’s net worth to $3,060,000. Then, at Diane’s death, her adjusted taxable estate would be $3,000,000, with a final estate tax liability of $87,680—roughly 30% of the original taxes due. The children would receive approximately $4,972,320.

Another benefit of this planning is that any appreciation that occurs within the Credit Shelter Trust is sheltered from the estate tax going forward.

Note: Beneficiary designations override trust instructions. Assets like IRAs or retirement accounts should be reviewed carefully to avoid unintended tax exposure.

Gifting Strategies

Massachusetts does not have a gift tax. However, the federal gift limits still apply. Currently, the annual exclusion at the federal level is $19,000 per recipient. If you gift more than that to someone, you will need to file a federal gift tax return. You can exceed this amount in a few ways as well – payments directly to providers for qualified education expenses and/or qualified medical expenses don’t count towards that $19,000 figure. If you are thinking of funding 529 plans, you can fund up to 5 years’ worth of annual exclusion without using any of your federal exemption.

Massachusetts’ treatment of federally taxable gifts is unique, however. Massachusetts updated its estate tax laws in 2023, and as mentioned previously, implemented a new rule that no estate tax filing was required at death unless your estate exceeded $2,000,000.

Massachusetts does, however, require that the value of any taxable gift made during your lifetime be included in the value of your estate for determining your filing status.

For example, if David has an estate valued at $2,500,000 just before his death and decides to gift $600,000 to his child, his estate’s value is reduced to $1,900,000. He files a federal gift tax return but owes no gift taxes. He then passes away. Under Massachusetts law, the value of the gift is added back to the estate, and the estate is required to file a return. However, the actual taxable value of his estate is $0 because of the $99,600 estate tax credit, which is equal to the tax due on an estate valued at $2,000,000. In contrast, if he did nothing, he would owe roughly $39,200 in estate taxes.

Changing Residency

Relocating to a state without an estate tax (e.g., New Hampshire) is another option—but it’s not as simple as just buying property out of state. Massachusetts considers you a resident for estate tax purposes if you maintain a permanent residence and spend more than 183 days in the state.

Even non-residents may be liable for taxes if they own real estate or tangible personal property in Massachusetts. However, property held in LLCs may not qualify for out-of-state exemptions, so structure ownership carefully.

Massachusetts residents who own out-of-state real estate are eligible for a prorated credit on their estate tax return for property located outside the state. This raises a potential issue for out-of-state real estate owned in a corporate structure, such as an LLC. An LLC is neither real estate nor tangible personal property, and an in-state resident may not receive the potential estate tax reduction had they owned the property outright. However, this raises issues with asset protection that are beyond the scope of this article.

Charitable Giving

Charitable gifts offer a dollar-for-dollar reduction in your taxable estate. Gifts made during your lifetime or as part of your will or trust can both support causes you care about and reduce estate tax exposure.

Using Life Insurance for Liquidity

Properly structured life insurance held outside the estate (e.g., in an irrevocable life insurance trust) can provide your heirs with tax-free liquidity to pay any estate taxes due, ensuring they’re not forced to sell assets to cover the bill.

Planning for Massachusetts Estate Taxes

Massachusetts residents should take the time to review their estate plans with state-specific tax considerations in mind. With a relatively low exemption and no portability, estate taxes can erode a significant portion of generational wealth if not adequately addressed.

At Mission Wealth, we help families proactively plan for these issues through trusts, gifting, charitable strategies, and other tools. Our estate strategy team stays informed about both federal and state developments to ensure your wealth plan is fully optimized.

Reach out to our team to explore strategies tailored to your needs.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

Is a Roth IRA Conversion Right for You?

December 3, 2025

Making Charitable Giving Easier with Qualified Charitable Distributions

December 1, 2025