Bear markets, downturns, crashes — they are inevitable. No market will stay consistently stable and investors need to be prepared to navigate rapidly changing market conditions. With help from a financial advisor, you can weather any market storm and come out in good shape.

Keep Emotion Out of It

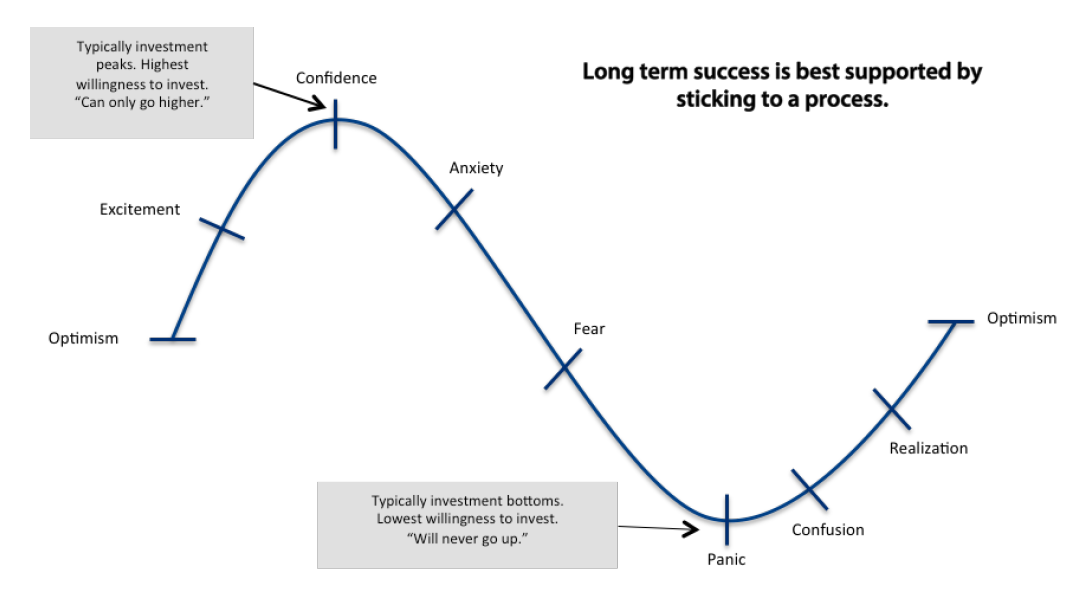

An emotional reaction to changing market conditions can lead you to impulse decisions and bad choices. While it’s understandable that you are deeply tied to your investments, don’t let panic, fear, anger, or other emotions guide you. You can rely on the technical and analytic know-how of your financial advisor, who can make market decisions without feeling so personally involved in the investments (usually involves buying on corrections).

Being successful as an investor always involves putting logic over emotions. Ignoring rumors and speculation while being focused on the bigger picture is usually leads to better results. By keeping emotion out of it, you won’t feel pressed to make a decision about whether to sell a stock / fund or hang onto it when things start to shift. An educated strategy is one based on fact, not feeling.

Plan Ahead

Of course, it’s impossible to know exactly what is going to happen in the market but if you can plan just enough ahead to be able to adjust your portfolio, you can save yourself from more loss.

Switch Your Stock Portfolio

Take a look at how risky each holding you have is. Pay attention to how much you have allocated to Growth vs. Value, Large vs. Small, Stock vs. Bond, and Developed vs. Emerging.

Be Sure to Diversify

Diversification is a popular way to manage risk, whether the market is doing well or struggling. By investing in various companies and industries, one single bad event will not crush your entire portfolio, so you can still come out ahead even if one of your holdings stumbles.

Finally, Know That The Market Should Swing Up Again

The market has always rebounded, so when you look at things in the long term, downturns have not lasted forever. Patience and time usually brings you through even the worst changing market conditions. Rebalancing into market corrections (selling bonds and buying stocks) can be fruitful trades (i.e. buy low).

Of course, you should listen to financial advice about how to best get through the time between a potential downturn, and the market rebounding, but know that you will come out of it on the other side.

953684 5/17