How to Choose the Right Financial Advisor for Your Needs

Selecting the right financial advisor is a crucial step toward financial security. Whether you’re planning for retirement, growing your investments, or seeking guidance on estate planning, a knowledgeable advisor can help you navigate the complexities of personal finance. But with so many options available, how do you choose a financial advisor that aligns with your goals?

Why Hiring a Financial Advisor Matters

A financial advisor does more than manage investments—they provide strategic guidance to help you make informed financial decisions. Studies have shown that people who work with an advisor tend to accumulate more wealth over time compared to those who don’t.

At Mission Wealth, our team of fiduciary financial advisors offers personalized financial planning, investment management, estate and trust planning, and tax-efficient strategies to help you reach your financial goals. Learn more about our services here.

Step 1: Identify Your Financial Needs

Before you begin searching for an advisor, determine what type of financial help you require. Typical financial planning needs include:

- Investment Management: Creating diversified, tax-efficient portfolios

- Retirement Planning: Ensuring long-term financial security

- Estate Planning: Protecting and passing on wealth to heirs

- Tax Strategies: Reducing tax burdens through thoughtful planning

- Charitable Giving: Structuring philanthropy in a tax-efficient manner

Mission Wealth offers additional options such as financial planning, education planning, asset protection and risk management, and our Inspired Living services. If you’re unsure what services you need, scheduling an initial consultation can help clarify your goals. Book a free consultation with a Mission Wealth advisor.

Step 2: Look for a Fiduciary Financial Advisor

One of the most critical aspects of choosing an advisor is ensuring they operate as a fiduciary. A fiduciary financial advisor is legally obligated to act in your best interest, whereas some advisors may earn commissions for recommending specific products.

We operate as fee-only fiduciary advisors, meaning we are transparent about costs and always put your financial interests first. Mission Wealth is a Registered Investment Advisor (RIA). RIAs are financial firms that manage the assets of individual and institutional investors. Depending on the value of the assets under the RIA’s management, RIAs must register with the U.S. Securities and Exchange Commission or a state regulatory agency. Unlike broker-dealers, RIAs have a fiduciary duty to put the client’s best interests first.

Your Wealth Advisor can review our fee schedule in the initial consultation.

Step 3: Understand Different Types of Advisors

There are several types of financial advisors, and knowing the difference can help you make the best choice:

- Financial Planners with Advanced Professional Designations: Experts in comprehensive financial planning have been awarded advanced professional designations in various specialized areas of expertise, such as financial planning, insurance, Social Security, estate planning, and investments.

- Investment Managers: Focused primarily on managing investment portfolios.

- Wealth Advisors: Combine financial planning with investment strategies.

- Robo-Advisors: Automated investing platforms, often with lower fees but limited personalization and services. Read more about our thoughts on Robo-Advisors here.

Choosing the right type of advisor depends on the level of service and personalization you need. Mission Wealth provides comprehensive wealth management that goes beyond just investing. Explore our solutions here.

Step 4: Ask the Right Questions

Before hiring a financial advisor, it’s essential to vet them properly. Here are some important questions to ask a financial advisor:

- Are you a fiduciary?

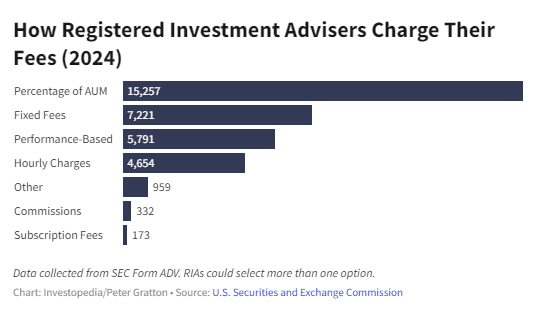

- What is your fee structure? (AUM-based, flat fee, or commission?)

- What is your investment philosophy?

- Do you specialize in a specific area of financial planning?

- How often will we communicate?

Step 5: Review Their Fee Structure

Financial advisors charge fees in different ways, and understanding these structures is vital:

- Fee-Only: Advisors charge directly for services (hourly, flat, or AUM-based)

- Fee-Based: Combination of fees and commissions on certain products

- Commission-Based: Earn income by selling financial products or charge based on performance (often not fiduciaries)

Step 6: Finalize Your Decision & Start Your Financial Plan

Once you’ve researched and asked the right questions, it’s time to choose your financial advisor. Schedule an introductory meeting (or a few) to interview and discuss your financial goals and determine if the advisor is a good fit.

At Mission Wealth, we provide customized financial planning tailored to your needs. Our fiduciary advisors are ready to help you confidently navigate your financial future. Schedule your free consultation today.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To schedule a meeting with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Mission Wealth is a Registered Investment Advisor. This commentary reflects the personal opinions, viewpoints, and analyses of the Mission Wealth employees providing such comments. It should not be regarded as a description of advisory services provided by Mission Wealth or performance returns of any Mission Wealth client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mission Wealth manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

Market Update 3/2/26

March 2, 2026

Market Perspectives Q1 2026

February 25, 2026