Financial Planning and Investment Management for Women

Our experienced financial advisors work closely with women who are looking for a trusted relationship to feel more confident and enjoy more security in their financial future.

Are you looking for guidance and support to help you make the best decisions with your money?

The best financial advisors for women should understand the unique challenges and demands that women experience. Our experienced financial advisors can be your support system. Whether you're a single woman, retiree, widow, business owner, professional, or are approaching a life change, gain the support of a financial planner who understands your needs and can help build your financial future.

Additionally, our experienced advisors will provide guidance on investments, retirement planning, budgeting, and other financial complexities as they arise. We will also help you identify risks and develop strategies to mitigate them. We will work with you to create an effective plan that enables you to achieve your long-term objectives. With our comprehensive approach, you can trust that your financial future is in good hands.

What Keeps You Up at Night?

Planning for your future is crucial to ensuring financial security. This includes saving for unexpected events and expenses. In addition to considering how certain life events could impact your finances, you might also want to consider how others’ finances will be affected should something happen to you.

Most of us hope that the financial decisions we make today will help us cover our wants and needs as we age. For women, understanding how your money can best work for you is even more critical, which means that we may need to be more intentional about our financial planning as the following financial conditions arise:

- Anxiety About Work

- Assisting a Family Member Financially

- Bag Lady Fear

- Business Planning

- Buying or Selling Home or Real Estate

- Charitable Planning & Philanthropy

- College Planning for Loved Ones

- Divorce or Separation

- Empty Nest

- Estate Planning

- Expecting or Adopting a Child

- Fear of Success

- Healthcare Concerns

- Inherited Wealth or Investment Gain

- Job Loss

- Long-Term Care Planning

- Loss of a Loved One

- Marriage

- Philanthropic Goals

- Retirement Planning

- Single Parenthood

- Societal Pressures

- Solo Aging

- Special Needs Planning

- Tax Management

Women in Wealth Management

At Mission Wealth, we are happy to pair you with a female financial advisor who can help you plan your financial goals. We understand that women have different needs than men when it comes to financial planning, and we want to provide the best advice and resources to empower you to make the most informed decisions. Our experienced female advisors stay up to date on the latest financial trends and will work with you to create a comprehensive financial plan that fits your lifestyle and goals. With Women on a Mission, you will have the support and guidance you need to make smart decisions about your finances.FAQs for Women Choosing a Financial Advisor

At Mission Wealth, we understand that choosing a financial advisor is a profoundly personal decision, especially during transition or change. Below are some of the most common questions asked when exploring a relationship with our firm.How to Harness Your Investment Strengths

A practical guide to empower women investors.

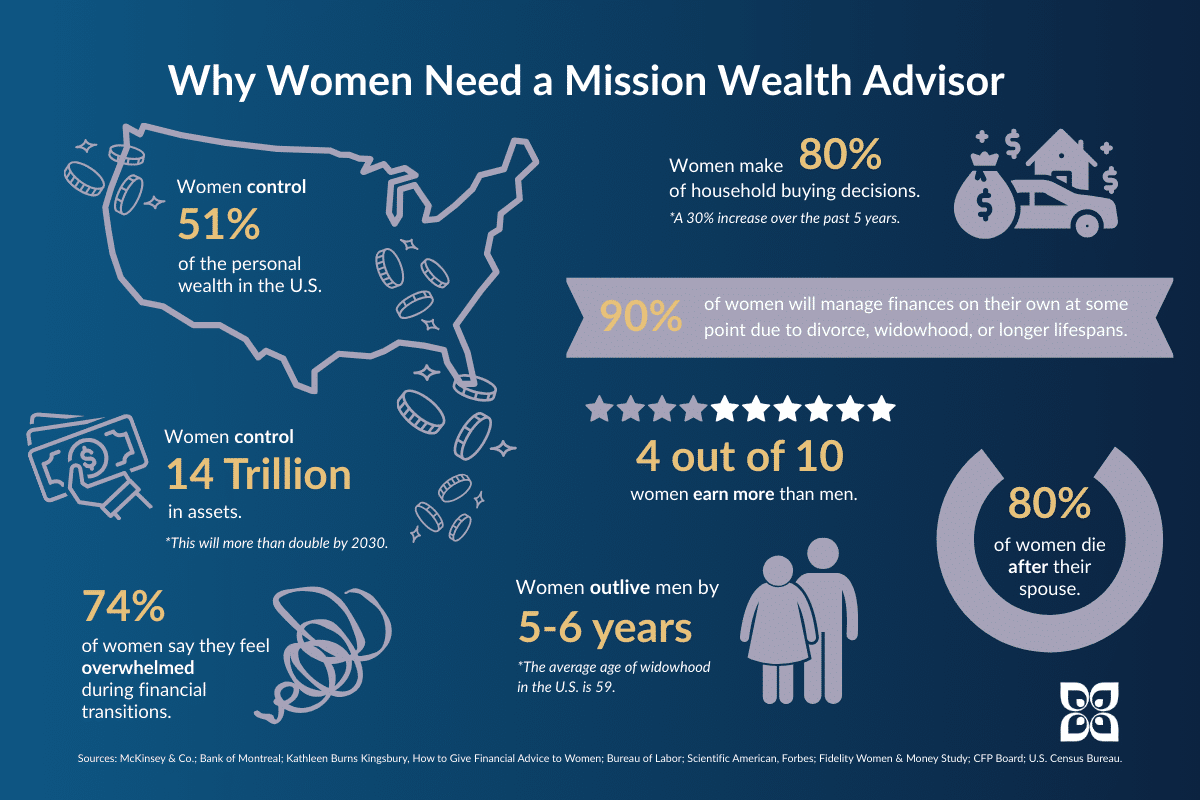

Women control 51% of the personal wealth in the U.S. But here’s the catch: many women still feel less confident in their investing abilities. That lack of confidence can lead to inaction, second-guessing, or putting off big financial decisions. The result? Missed opportunities.

This guide will help you shift your mindset and use your natural financial instincts to your advantage.

Common Financial Questions Women Ask Us

We believe that women can benefit greatly from working with a fiduciary financial advisor who can help them understand their options and implement plans designed to provide women and their families with financially secure lives. Here are a few questions we can help you answer.How do I minimize the probability of running out of money?

What is the maximum amount of financial support I can provide to my loved ones?

What is the most cost-effective option for me to acquire a new vehicle or make a significant expenditure?

Is it necessary to obtain insurance in order to safeguard my kids?

What is the required amount of money necessary to set aside for my retirement?

As new questions and situations arise, who can I rely on for advice?

I desire to remain self-sufficient, yet who will look out for me if I become weak and unable to care for myself?

Am I taking the right amount of risk in my investments to meet my goals?

Who can make sure my attorney and accountant are collaborating on my behalf?

What is the best way for me to educate my kids about finances?

What goals should I make to achieve financial stability in the future?

I prefer to work with a woman financial advisor, is that possible?

We Help Women Create a Plan

We understand that these questions can be overwhelming. Our team of experienced advisors are here to provide you with the personalized guidance and resources you need to make the best financial decisions for your future.

With our help, you can feel confident that you’re taking the right steps to meet your financial goals. We will work with you to create a customized plan that takes into account your current and future needs and will also help you make informed decisions about your investments and estate planning. You can count on us to provide you with the expertise and support you need to achieve financial security.

It’s hard to believe that it’s been five months since my husband passed away. During this time, I have experienced some breaks in concentration, which I attribute to the "widow fog." As my husband's Alzheimer's disease advanced, Rory has been a constant support to help me cope with the changes that have occurred and those yet to come.

I am writing to express my gratitude for Mission Wealth's unwavering assistance to my husband and me over the last decade. Without your support, I could not have managed it all. Thank you once again.