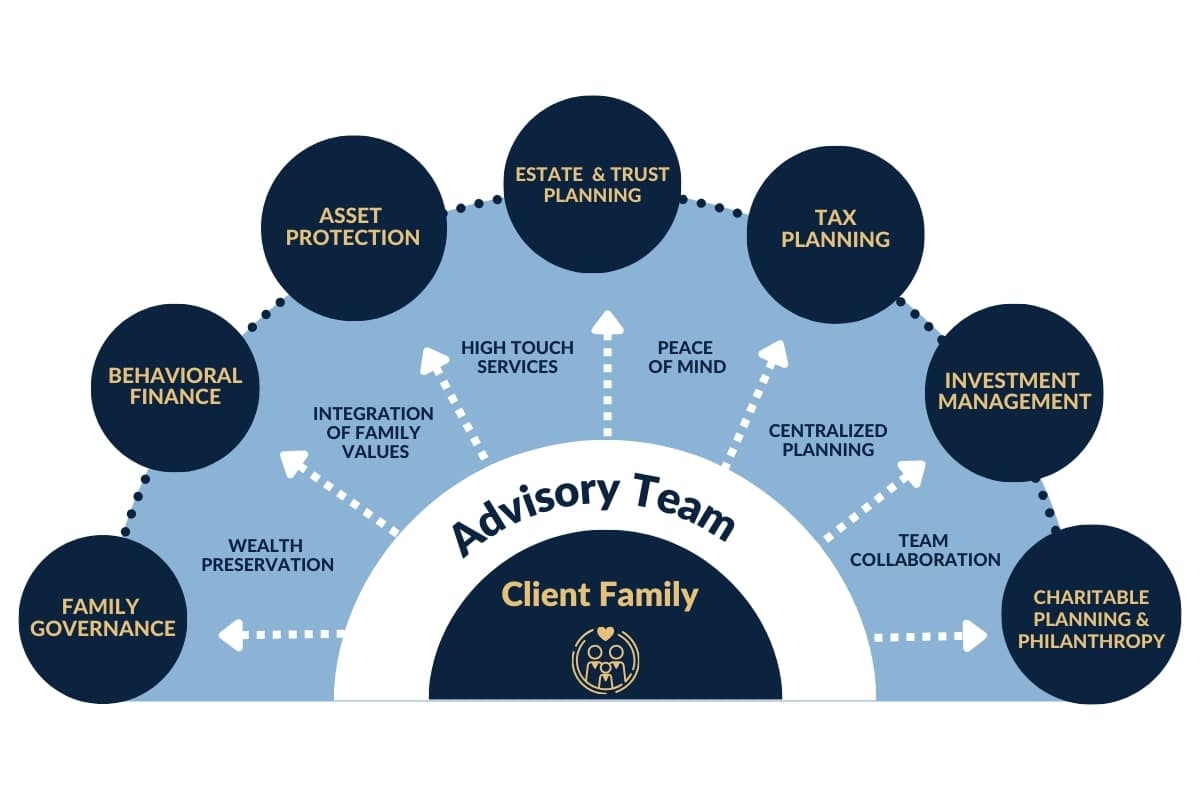

Family Office Solution at Mission Wealth

A high-touch, comprehensive offering designed to achieve the goals of the ultra-high net worth families we serve.

About Our Family Office Solution

Our Family Office Solution offers the highest level of sophisticated financial planning and expertise to support your family's goals.

Our in-house team of professionals with specializations in investments, taxes, charitable giving, estate and trust planning, asset protection, family governance, and generational education will partner with you and your other trusted advisors to address your family’s unique needs and complexity.

Family Office services are tailored for every unique client situation. Through our boutique offering, we will create and implement bespoke strategies to address your evolving needs and long-term goals. Our philanthropic planning, family governance, and generation education offerings will help you to establish and instill your family values in an impactful way to create a lasting legacy for you and your family.

Wealth Management

We offer a comprehensive perspective that extends beyond investments, providing a roadmap to align your financial goals with your life aspirations. Through a collaborative approach, we work closely with you to create a holistic process that incorporates all facets of your financial life. By tailoring a customized plan, we ensure that every aspect is integrated seamlessly, allowing you to pursue your financial objectives while fulfilling your life's dreams. Our firm's expansive selection of resources allows us to provide the following financial services to our Family Office Clients:

- Financial Planning

- Budget Analysis and Spending Review

- Goals Assessment and Prioritization

- Wealth Planning Organizer

- Real Estate Advice and Support

- Access to Lower Negotiated Borrowing Rates

- Social Security Maximization

- Medicare Enrollment Assistance

- Retirement Home Analysis and Community Living Options

- College Savings Plans and Analysis

Investment Management

We help Family Office clients create a personalized investment strategy based on their financial situation, goals, and risk tolerance. Mission Wealth conducts thorough research, due diligence, and recommends suitable investment opportunities across different asset classes. We help construct a well-diversified portfolio that aligns with a client's preferences. We continuously monitor the investments, track performance, and make necessary adjustments. By leveraging our expertise and personalized approach, we offer Family Office clients:

- Custom Portfolio Management

- Access to Specialized Alternative Investments

- Stock Concentration Strategies

- Stock Option Planning

- Socially Responsible Investing

- Tax-Smart Implementation, Monitoring, Rebalancing, Tax-loss Harvesting, and Performance Reporting

- Income Strategies and Cash Management Solutions

- Cash Flow Planning and Portfolio Income Projections

Estate & Trust Management

We help Family Office clients create and implement a plan so that your hard work will help the people in your life, protect your legacy, and preserve as much as you can. Whether your goal is to leave your estate to heirs or charity, to minimize taxes or to maximize lifetime giving, we are here to provide clarity and direction. We have the knowledge to guide you through all phases of your estate plan to ensure that your wealth is directed as you intend, including:

- Estate Plan Reviews, Including Balance Sheet Review and Net Worth Forecasting

- Estate Tax Reduction Strategies

- Generational Planning

- Family Legacy Planning

- Communicating with Beneficiaries

- Trustee and Fiduciary Support

- Independent Trustee Services: Post-Death Administration, Trust Splitting & Funding, Appraisals, Tax Optimization & Compliance, Trust Distributions, Bill Pay

-

Asset Protection

A well-crafted asset protection strategy can help you protect your assets and minimize potential losses. Through our thorough review process, we will determine if you have adequate coverage to protect your family in the event that something unexpected happens. We will discuss the risks with you and introduce you to an insurance professional who may be able to provide solutions. We will also review any existing policies you have in place and determine how they fit into your current financial picture. Our services include:

- Personal Insurance Review for Umbrella, Life, Disability, and Long-Term Care Insurance

- Property and Casualty Insurance Review

- Cyber Security Insurance Review

- Luxury Asset Planning

- Household Employee Planning

- Network of Legal Specialists

- Business Management Planning: Valuation, Transition Planning, and Protection

Tax Management

Mission Wealth assists Family Office clients with tax management by analyzing their financial situation and recommending strategies to minimize tax liabilities. We collaborate with tax advisors and accountants to ensure coordinated tax planning efforts. We also offer guidance on tax-efficient investment strategies and keep our clients informed about changes in tax laws. The following tax services are offered to our Family Office clients:

- Integration and Coordination with CPA

- Income Tax Planning & Savings Strategies

- Direct Access to our Director of Tax Strategy and CPAs on Staff

- Robust Tax Review with Complex Scenario Analysis, Including Tax Impact of Financial Recommendations

- Furnish Materials Required for Tax Preparation, Including Tax Forms and Other Relevant Items to CPA

- In-House Tax Preparation Services

- Outsourced Bill Pay Solutions

- Cross-Border and Residency Planning

Family Governance & Generational Education

We provide expertise and guidance on various financial matters that impact family dynamics and long-term, multi-generational planning. We assist in establishing clear financial goals and strategies, developing effective communication channels within the family, and implementing structures such as trusts and family foundations to preserve and grow wealth across generations. By providing objective advice and acting as a neutral third party, a financial advisor can help families navigate complex financial situations, mitigate conflicts, and foster a sense of unity and stewardship among family members.

- Moderate and Conduct Family Meetings, Including Next-Generation Financial Education

- Family Continuity Planning

- Behavioral Finance Coaching

- Personal Planning for Next-Generation Family Members

- Coordination with Professional Advisors and Coaches

- In-Person Retreat with Peer Families

Charitable Giving & Philanthropic Planning

We assist Family Office clients with philanthropy by helping our clients define their goals and develop a strategic philanthropic plan. We guide our clients in identifying causes aligned with their values and recommend philanthropic vehicles such as foundations or donor-advised funds. We have expertise in governance, legal requirements, and operational considerations for effective philanthropic activities. Our philanthropic specialist will advise on tax-efficient strategies and explore options like planned giving or charitable trusts. Overall, our guidance empowers Family Office clients to make a meaningful and lasting difference through their philanthropy.

- Direct Access to Our Director of Philanthropic Strategy

- Gain Access to Additional Philanthropic Specialists

- Philanthropic Research

- Impact Investing

- Complex Asset Group

- Corporate Donor-Advised Fund

- Philanthropic Perpetuity

Integrate all aspects of your family's financial picture.

Get in touch to discuss creating a Family Office wealth plan today.Why Choose Mission Wealth for Your Family Office

-

Expertise: We bring specialized knowledge and expertise in financial management, investment strategies, and wealth preservation, tailored to the unique needs of family offices.

-

Objectivity: As a neutral third party, we can provide objective advice and guidance, free from personal biases or conflicts of interest.

-

Customization: We offer personalized solutions and strategies that are specifically designed to meet the individual goals and preferences of the family office.

-

Comprehensive Approach: We take a holistic approach to family office management, considering all aspects of wealth management, including investments, taxes, charitable giving, estate and trust planning, asset protection, family governance, and generational education.

-

Access to Networks: We have access to an extensive network of professionals, including attorneys, tax advisors, and specialists in various fields, which can be beneficial in addressing complex family office needs.

-

Fiduciary Duty: As a Registered Investment Advisor, we have a fiduciary duty to act in the best interest of our clients, ensuring that we prioritize the client's financial well-being above all else.

-

Transparency: We provide transparent reporting and clear communication, keeping the family office well-informed about their financial situation, investment performance, and any changes or updates.

-

Continuity: We offer stability and continuity in managing the family office over the long term, providing consistent support and guidance even through generational transitions.

-

Risk Management: We can assess and mitigate risks associated with investments, asset protection, and overall wealth management, helping to safeguard the family office's financial assets.

-

Peace of Mind: By leveraging our expertise and providing comprehensive support, we offer peace of mind to the family office, allowing them to focus on their core priorities and enjoy the benefits of effective wealth management.

Who is the Family Office Solution best for?