Now that the tax filing deadline is behind us (and a happy belated Tax Day to those who celebrate), it’s time to turn our attention to a topic we touched on last year: the possible 2025 sunset of the current tax laws. If Congress can’t pass new tax legislation by year-end, tax rates will statutorily increase effective January 1, 2026, rolling back all of the changes passed as part of the 2017 Tax Cuts and Jobs Act (TCJA).

This sunset will also have a significant impact on estate and gift tax laws. Currently, the lifetime unified credit exemption—the amount an individual can pass before owing estate and/or gift taxes—is $13.99 million per person, with a top estate tax rate of 40%. If the sunset occurs, the exemption amount will be cut roughly in half to $7 million per person, and the top tax rate will increase to 45%.

Why Is the TCJA Set to Expire?

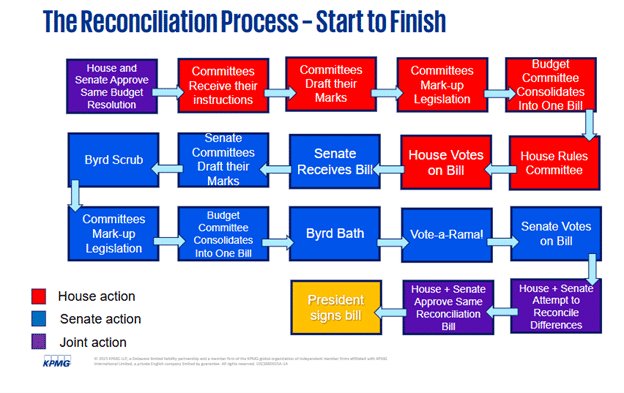

We’re facing this potential sunset because of how the original TCJA was passed. In the Senate, debate on any bill can last indefinitely unless 60 Senators vote to invoke cloture, ending debate and moving the bill forward. However, Congress has an alternative path for budget-related legislation—the Reconciliation process, introduced in 1974.

Through Reconciliation, the Senate can bypass the 60-vote threshold and proceed with a simple majority. But there’s a catch: the bill’s provisions must not raise deficits beyond an initial ten-year period.

Aside from the TCJA, other well-known bills passed via Reconciliation include:

- The Bush-era tax cuts (later made permanent in 2012 under President Obama),

- The Health Care and Education Reconciliation Act of 2010 (amending the ACA),

- The American Rescue Plan of 2021, and

- The Inflation Reduction Act of 2022.

Where Are We Now? Enter the 2025 Reconciliation Process

Earlier this month, both the House and Senate passed their versions of a budget resolution, kicking off the Reconciliation process. We’re currently on Step 2: committees within each chamber have received instructions to begin drafting the bill.

These initial resolutions provide a high-level framework for spending and revenue, but specific tax code changes haven’t yet been detailed.

What Do We Know So Far?

There is a significant gap between the House and Senate approaches to spending reductions and deficit allowances.

- House Version: Allows for $4.5 trillion in deficit increases if $1.5 trillion in spending cuts are achieved. If $2 trillion in cuts are made, the allowable deficit increases to $5 trillion.

- Senate Version: Allows for $2 trillion in deficit increases if $4 billion in savings can be found. However, the Senate treats the TCJA as current policy and, therefore, does not include the cost of extending it in its deficit calculations.

This interpretation conflicts with the original spirit of the Reconciliation process, which requires revenue neutrality after 10 years. Independent estimates place the cost of extending the TCJA at around $4.6 to $4.7 trillion. Factoring in the Senate’s approach, the deficit increase could total $6.6 to $6.7 trillion if only $4 billion in savings are found.

Additional Tax Reforms Under Consideration

The House Ways & Means Committee released a preliminary report earlier this year identifying several areas under review for reform. The report spans over 50 pages, but some of the most notable proposals include:

- Eliminating taxes on tips

- Reducing or eliminating taxes on Social Security income

- Modifying the $10,000 SALT deduction cap (which would significantly impact high-tax states like CA, NY, NJ, IL, MA, CT, FL, PA, TX, MD, and VA)

- Adding a new top bracket of 39% on income over $1 million

We expect further details around Memorial Day as committee work continues. It’s also important to remember that the Byrd Rule, which limits “extraneous” measures in Reconciliation bills, requires review by the Senate Parliamentarian. A recent example of this rule in action occurred during the American Rescue Plan of 2021, when an amendment to raise the federal minimum wage to $15/hour was removed as extraneous.

What Is the Likelihood of Reconciliation Passing?

Both Republican leadership and President Trump have signaled that extending the TCJA is a top legislative priority in 2025. Still, the path forward faces several challenges:

- Budgetary Constraints: Republican leaders are navigating deep spending cuts while attempting to preserve essential social programs. Achieving consensus is difficult given slim majorities in both the House and Senate.

- Policy Disagreements: There are intra-party divides on the size and scope of both tax cuts and spending reductions. For example, the House Freedom Caucus is pushing for significant federal spending cuts, while other members are concerned about the impact on essential services.

- Senate Dynamics: The Senate’s position on excluding the TCJA extension from deficit calculations must still be approved by the Senate Parliamentarian. If rejected, the Senate will need to revise its approach or potentially vote to remove the Parliamentarian altogether.

Why This Matters

We’re continuing to monitor the Reconciliation process closely, as it may present both time-sensitive challenges and opportunities for our clients. If the TCJA is extended, taxpayers may gain a longer window to:

- Implement large-scale legacy planning moves

- Complete Roth conversions while middle brackets remain low

- Strategically gift or transfer assets while the exemption remains high

Plan Proactively, Before the Window Closes

The potential sunset of the Tax Cuts and Jobs Act could bring sweeping tax changes in 2026. Whether you’re planning your estate, evaluating Roth conversion opportunities, or considering gifting strategies, now is the time to act.

Let’s create a proactive plan tailored to your goals. Contact a Mission Wealth financial advisor today to schedule a personalized tax and estate planning session.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Let's Keep in Touch!

Subscribe for exclusive content and timely tips to empower you on your financial journey. Our communications go straight into your inbox, so you'll never miss out on expert advice that can positively impact your life.Recent Insights Articles

5 Estate Planning Steps to Review Before December 31 (and Why They Matter)

October 17, 2025

Mission Wealth Increases Ranking on Forbes 2025 America’s Top RIA Firms List

October 2, 2025