Originally Posted: October 20, 2020, Updated: January 30, 2023

For those that are charitably inclined, there are some good options to consider when naming a charity as a beneficiary of your IRA. In this article, we explore the reasons why.

SECURE Act Changes IRA Retirement Distribution

Charitable Beneficiary Options for IRA Owners

Donor-Advised Fund (DAF)

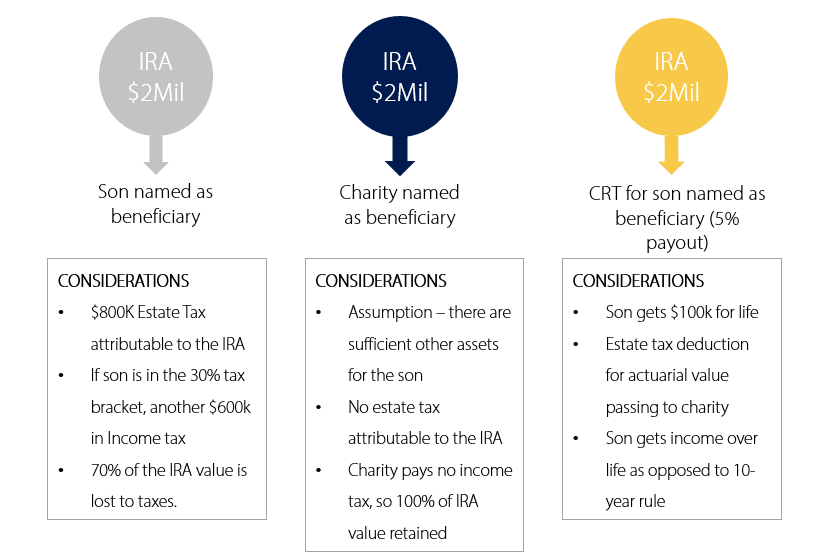

You can easily name a charity of your Donor-Advised Fund (DAF) as the beneficiary of all or a percentage of your IRA or company retirement plan. Because the charity or DAF is tax-exempt, after your death it can withdraw the assets from the retirement account without having to pay income taxes on the withdrawal. Any individuals named as beneficiaries of the retirement account must pay income taxes at ordinary rates on any distributions they receive from the retirement account. Hence, the best income tax result is to name a charity or DAF as the beneficiary of a retirement account and leave your loved ones other tax-advantaged assets that will not be subject to income tax when they receive it. In addition, any amounts left to a charity at death would also receive an estate tax charitable deduction, thus reducing any applicable federal estate taxes.

Charitable Remainder Trust (CRT)

Another option to consider, which could benefit both a charity AND a family member other than a spouse, is naming a Charitable Remainder Trust (CRT) as beneficiary of your IRA or company retirement plan. An individual you choose will receive annual payments from the CRT for a period of time or their full lifetime. A CRT can be either a Unitrust, in which case payments are based on a fixed percentage of the beginning-of-year CRT balance, or an Annuity Trust, in which a fixed payment is paid to the beneficiary. When the CRT terminates, the remaining amount is distributed to charities of your choosing or a Donor-Advised Fund. There are specific rules about how a CRT must operate, including how much an individual can receive from a CRT and how long he or she can receive it. In addition, the charities must receive a minimum percentage of the trust assets at the trust termination, based on the beginning balance of the CRT. Due to the various complexities of a CRT, an attorney is essential to create it properly.

The main reason to consider using a CRT is that the trust itself is tax-exempt during its existence (similar to a charity). When you name a CRT as beneficiary of the IRA, the CRT will receive funds from the IRA at your death and not pay any income taxes at that time. When the individual identified in the CRT receives annual payments, he or she will then owe income taxes on the amount received at that time. In addition, a partial estate tax deduction is allowed upon the IRA owner’s death.

Below is an illustration for three different IRA distribution options payable to a non-spouse beneficiary at your passing.

Note that the scenarios below assume there is a taxable estate.

Mission Wealth Can Help. Get Trusted Support and Advice.

These are a few of the many ways to benefit charities, either during your life or at your death. Which way you select can have different tax implications. Giving consideration to income and estate taxes when planning your charitable giving strategy can ultimately increase the amount received by the charity and your family members/loved ones in the end.

Your Mission Wealth Client Advisor can help facilitate your family legacy and Charitable Giving discussions. We can review your current giving strategy and identify if any updates may be in order.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Copyright © 2023, Mission Wealth is a Registered Investment Advisor. All rights reserved.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00379389 01/23