By Kieran Osborne, MBus, CFA®

By Kieran Osborne, MBus, CFA®

Chief Investment Officer

Welcome to Mission Wealth’s market perspectives for the fourth quarter of 2020.

I’m Kieran Osborne, a Partner and the Chief Investment Officer at Mission Wealth and I’m pleased to be presenting our outlook for financial markets and the economy today.

Firstly, I’d like to wish everyone good health – we hope you’re staying safe and well during these unprecedented times.

It has certainly been an unprecedented year with the coronavirus pandemic having a pronounced impact on all facets of daily life, as well as the global economy and financial markets. 2020 will certainly be remembered as the year of the virus. I’d like to wish everyone good health and hope you are all safe and well during these unprecedented times.

This presentation will cover three broad themes: an update on markets, our views on the economy and our outlook moving forward. Each theme has it's own video so it's easy for you to watch or read your market updates.

Key Themes

Market sentiment improved significantly since bottoming in March, with global equities rallying through the second and third quarter, albeit experiencing some weakness in the month of September. So what drove markets higher? Well, massive and coordinated global monetary and fiscal policy stimulus helped underpin stronger than anticipated economic growth, while vaccine optimism has substantially improved. The weakness experienced in September was largely due to some sector rotation out of technology stocks in particular. On this point, we would caution on being overly concentrated in large tech and mega-cap growth stocks, and have been actively trimming concentrated positions across client accounts where appropriate.

Turning to the economy, while we acknowledge significant near-term uncertainties remain – amongst others, the recent uptick in Coronavirus cases both here and abroad, the election and the timing of a widely available vaccine – however economic data does indicate the economy is doing a lot better than previously anticipated and we believe we are in the early stages of a new economic growth phase. After many parts of the economy effectively hit a brick wall earlier in the year, we expect economic growth in the third quarter to rebound significantly and post the strongest quarterly growth rate since WWII. And this economic backdrop may bode very well for the current earnings season, which we anticipate will be particularly strong. Longer-term, the Fed has communicated it will continue to help support the economy via easy monetary policies – amongst others keeping short-term rates near zero through at least 2023.

The election may provide some near-term volatility, but the reality is an election is just one factor amongst thousands that have historically impacted markets; we believe maintaining a focus on the long-term, staying disciplined and looking through the short-term noise will serve investors well.

Mission Wealth Actions

So with this backdrop, what is our outlook moving forward? Well, given continued uncertainties, we do expect volatility to remain elevated over the near-term, however we believe longer term growth potential does exist. As such, we believe medium to long-term returns for global equities remain compelling and any short-term uptick in volatility may offer a rebalancing opportunity. We continue to favor high quality corporate bonds and agencies over Treasuries and maintain dedicated satellite fixed income allocations. Less liquid credit funds in particular may offer attractive return potential in the current environment.

I think it’s useful to reflect on some of the actions we’ve taken in such an unprecedented year.

- Firstly and critically, we maintained our disciplined approach to portfolio construction and rebalancing, adding broadly to stock exposures throughout March and April.

- We took the opportunity to tax loss harvest where appropriate to enhance our clients after tax returns and have also reduced legacy concentrated stock exposures where it makes sense, with a particular focus on large and mega-cap tech and growth stocks.

- We continue to favor dedicated allocations to global equities. Despite recent strength, we believe longer-term return expectations remain relatively attractive. And we believe any near-term volatility may offer a rebalancing opportunity to add to stock exposures.

- We have favored allocations to high quality corporate bonds and Agency securities over Treasuries, and believe unique opportunities exist in certain areas of the bond market which may offer relative return upside for our bond funds.

- Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Market Update

After concerns surrounding the coronavirus pandemic drove volatility and the fastest bear market in history, market sentiment improved significantly since the market bottom in late March.

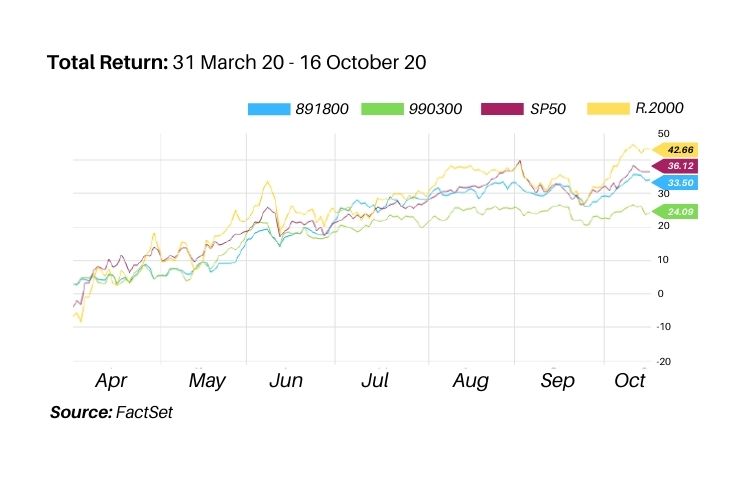

As you can see in this chart, Global stocks rallied significantly throughout the second and third quarters, albeit moderating somewhat in September.

Small cap stocks particularly benefited from many of the stimulus measures enacted that were focused on smaller sized businesses.

So what drove stocks higher?

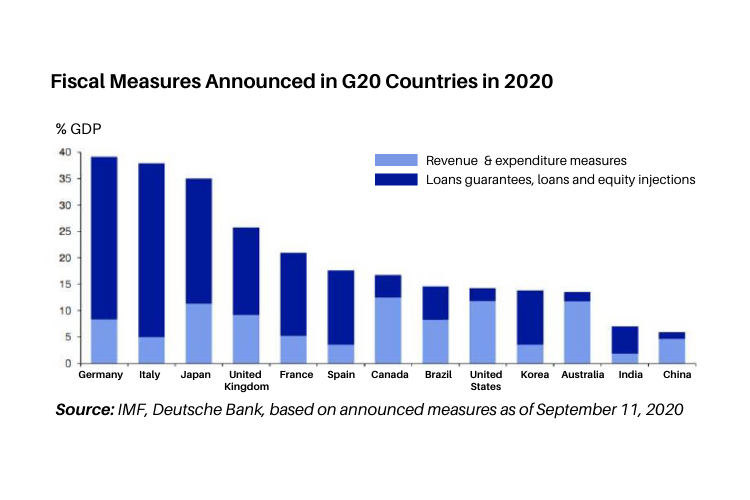

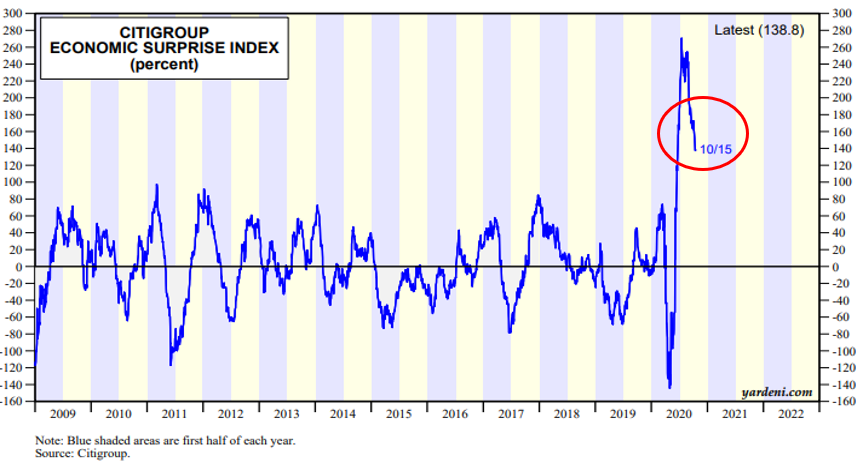

Unprecedentedly Massive and coordinated global Fiscal and Monetary support helped underpin economies. As the chart above illustrates, the level of fiscal support globally has been enormous. And this helped support stronger than anticipated economic growth, which is reflected in a still very elevated economic surprise index.

As a point of reference, many economists had expected the unemployment rate would exceed 20%. Some were expecting 25% or more. It’s currently 7.9% and is forecast to fall further by the end of the year. See the full unemployment predictions from congress here.

We’ve also seen a substantial increase in optimism regarding potential vaccine candidates, with prediction markets currently expecting more than a 90% chance that a vaccine will be widely available by September of next year.

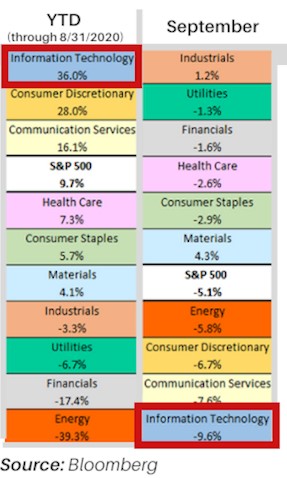

We have witnessed an interesting divergence in sector performance this year, with large technology & mega-cap growth companies significantly outperforming.

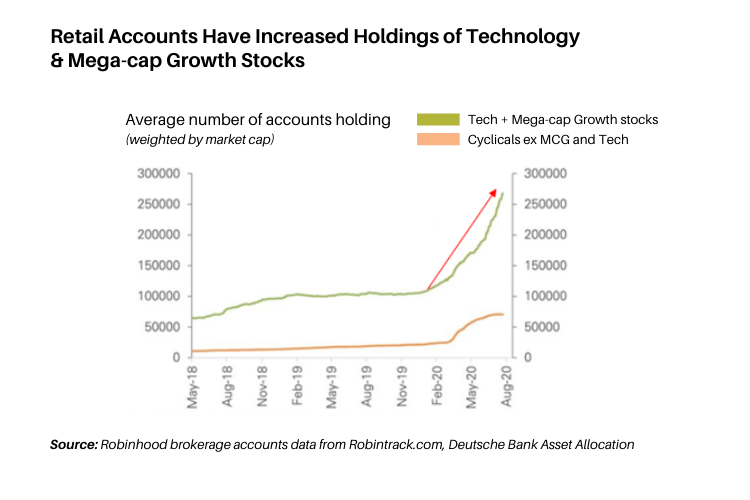

The impact of the coronavirus pandemic naturally benefited many tech-oriented businesses, as spending trends migrated online and businesses were forced to invest in technology to remain competitive in a socially distanced world. However we also saw some worrying retail investor trends piling into many tech and mega cap growth stocks and driving technology stock valuations to levels not seen since the dot.com bubble.

Consequently, valuation concerns drove some sector rotation in September, with technology and mega-cap growth stocks leading markets lower.

Importantly, we would caution on being overly concentrated in technology & mega-cap growth stocks.

As the chart below depicts, we have historically experienced consistent rotation in performance across sectors from one period to another.

While we don’t have a crystal ball, if history is a guide we should expect some rotation in sector performance moving forward.

Lastly, as the chart below illustrates, after companies become amongst the largest by market cap they subsequently experience diminished expected returns moving forward. And it’s worth noting that the top 5 companies in the U.S. are all technology-oriented businesses.

Indeed, we have taken advantage of recent strength and have actively reduced large tech and mega-cap growth exposures across client accounts where appropriate.

Indeed, we have taken advantage of recent strength and have actively reduced large tech and mega-cap growth exposures across client accounts where appropriate.

The Economy

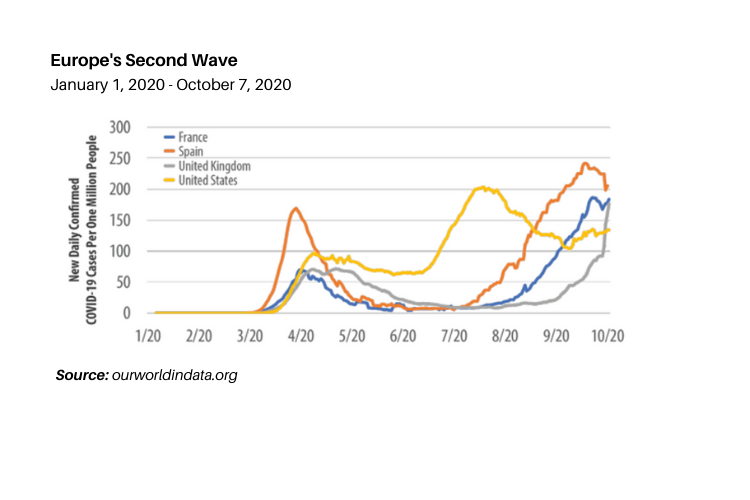

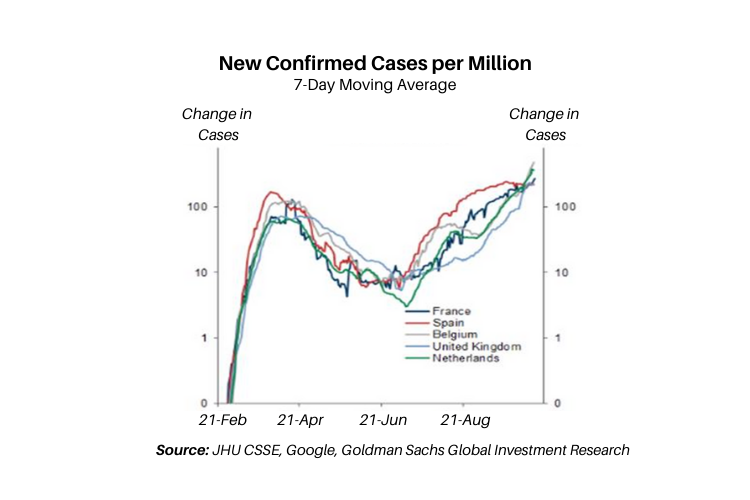

We have recently experienced an uptick in new coronavirus cases, both here and abroad. As shown in this chart, the U.S. Midwest in particular is causing some concerns.

At the same time, certain European countries have experienced a recent increase in new cases, which has led to re-imposition of restrictions in some countries, such as closing bars and restaurants during certain hours or in the case of France, outright curfews in some of its major cities. This has caused some concern that the nascent economic recovery could be hampered.

But on the flipside, Vaccine Optimism Remains High.

- In fact, prediction markets assign a 92% probability that a vaccine will be widely distributed and available by September of 2021 and a 46% chance that a vaccine is widely available by March of next year.

- As this chart illustrates, six vaccines are now approved for early or limited use and another 11 are currently in Phase 3 trials.

Importantly, many companies are preparing to ramp production of potential vaccine candidates and have expanded global logistics networks in anticipation of approval – this will be critical in rapidly distributing a potential vaccine candidate once approved.

While we acknowledge significant near-term uncertainties, economic data indicates the economy is doing a lot better than previously anticipated and we expect we are at the beginning of a new economic growth phase.

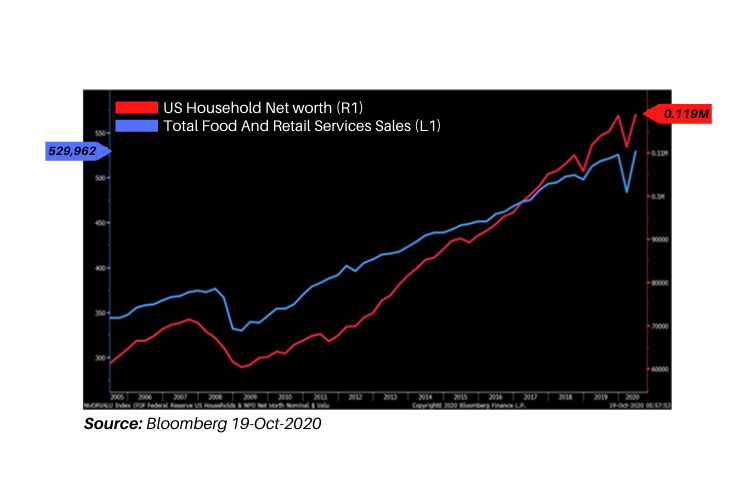

- As mentioned earlier, the economic surprise Index remains elevated, and both Household Net worth & Total Retail Sales data have now eclipsed pre-COVID levels. This is particularly important because consumer spending makes up approximately 70% of GDP.

- After many parts of the economy effectively hit a brick wall earlier in the year and precipitated the shortest sharpest hit to economic growth, we expect the U.S. economy to rebound by 30-35% in the third quarter, which would be the strongest since WWII.

And we continue to see economic projections positively revised upwards.

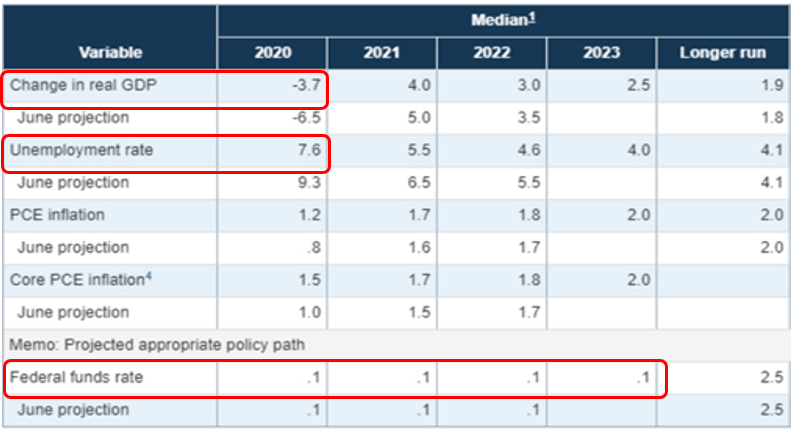

Amongst those upgrading their forecast is the Fed. The Fed now expects economic growth to decline by -3.7% in 2020, which is substantially better than their previous estimate of -6.5% in June. Likewise, their current projection for year-end unemployment is 7.6%, which is dramatically improved from the prior estimate of 9.3% which they had forecast in June. These estimates are based on the average taken from the dot plot forecasts of individual FOMC members. To give you an idea of the extent of positive improvement in these forecasts, even the most pessimistic current member projection is far better than the June average projection.

Over the medium-term, the Fed has clearly communicated it will use all the tools at its disposal to help support the economic recovery. Amongst others the Fed expects to maintain near-zero interest rates until at least 2023.

As such, we do expect a moderation in core fixed income returns, particularly Treasuries.

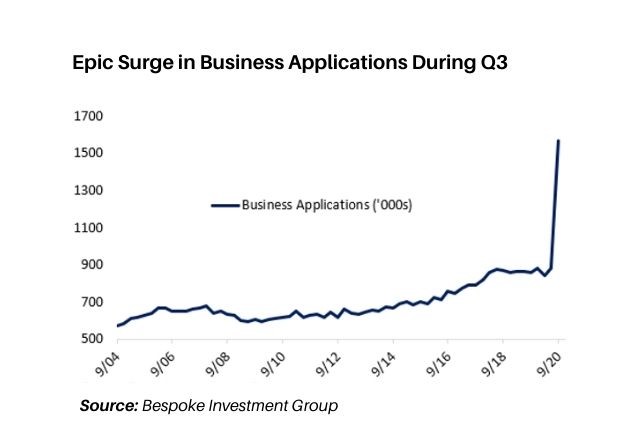

Some positive economic data points we have seen recently include new business applications, which have surged. Businesses and individuals appear to be re-tooling at an unprecedented pace, with an increase in new business applications of nearly 80% in the third quarter, with significant growth across the nation.

We said this early in the pandemic but it’s important to repeat it:

Don’t underestimate the ingenuity of individuals to adapt and find solutions in the current environment.

Indeed that appears to be what’s happening. We believe the “Creative destruction” brought about by the coronavirus pandemic – forcing individuals to rethink business processes and provide enhancements and innovations may help spur future economic growth.

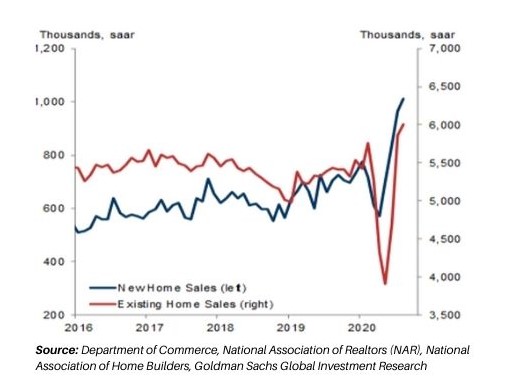

The housing sector is also a particular bright spot for the economy.

- Despite the uncertain backdrop, new and existing home sales have reached new cycle highs.

- Low mortgage rates, demographic tailwinds with millennials increasingly moving from apartments to owning homes, pent up demand and constrained supply as a legacy of the financial crisis in 2008 have all been supportive of house prices.

In fact, housing is likely to contribute positively to 2020 GDP growth. We also believe the strengthening economy may bode well for earnings.

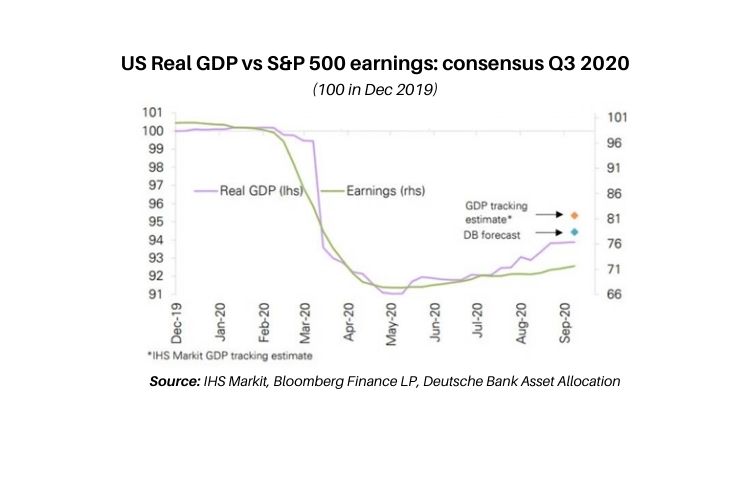

As the chart above depicts, consensus expectations for earnings growth has not kept pace with broader economic growth expectations. Historically, S&P company profit growth outpaces economic growth in early stages of an economic expansion. As such, we expect a very strong earnings season with positive earnings surprises.

And this makes sense when you consider that while companies did lay off workers, they didn’t cut payrolls as rapidly as production and revenues fell in the first half of the year. So as revenues and production now accelerates, Payroll costs are unlikely to proportionally increase as quickly, which may lead to enhanced margins and greater profitability growth.

Additionally, many businesses have trimmed other costs, such as travel and office space, that are likely to boost the bottom line.

However, it’s not all a one way street and uncertainties certainly remain.

Amongst others, we have experienced a recent uptick in coronavirus cases and uncertainties still surround the timing and details of an additional fiscal stimulus package. Both of which could hamper consumer spending and risk slowing or derailing the nascent economic recovery.

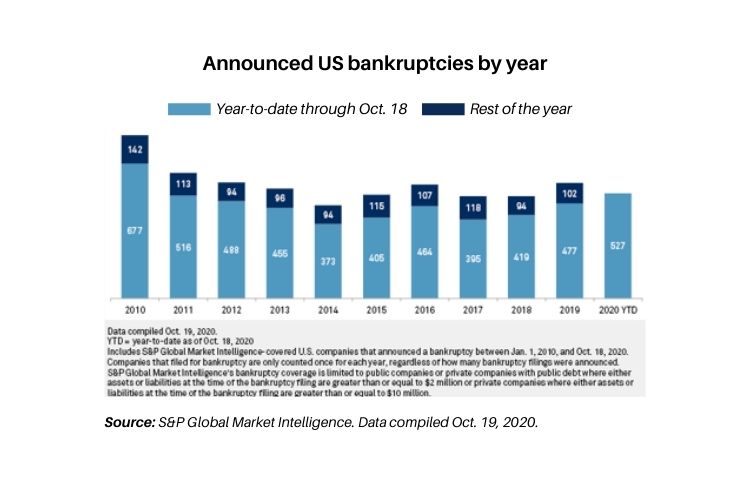

Bankruptcies are up year-to-date, though as the chart above shows, they have yet to increase dramatically.

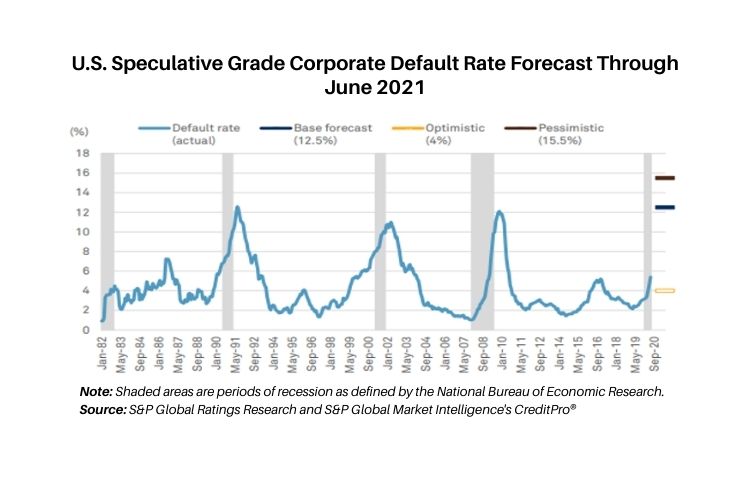

Default rates – particularly for high yield bonds – are forecast to increase. Typically defaults have a lag to economic growth and as this chart indicates, defaults are likely to increase in 2021, though we would note those defaults are likely to be concentrated in the energy and hospitality and leisure sectors and our high yield bond managers have largely avoided those sectors. As mentioned earlier, valuations concerns remain for many mega-cap tech and growth stocks in particular.

And last but not least, uncertainties surrounding the election, particularly if the outcome is not immediately clear or if the results are disputed by either party.

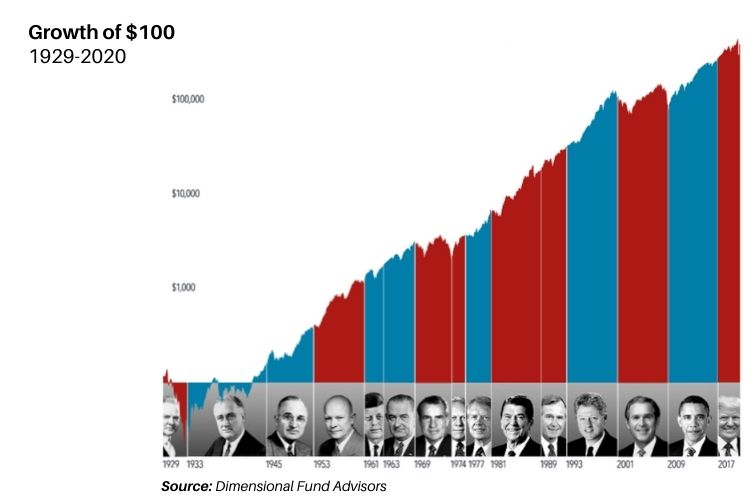

Speaking of the election, while it may provide near-term headline noise and volatility, we believe the importance of focusing on long-term fundamentals cannot be overstated.

What I mean by that and what is clearly illustrated in this chart is stocks exhibit a consistent upward trajectory regardless of who is in the White House.

From an investment standpoint, we would caution on not getting too caught up in the short-term noise associated with the election because the reality is an election is just one factor among thousands that have historically impacted markets – from global pandemics, interest rate changes, rising and falling oil prices, geopolitical tensions and all out wars – to name just a few. Despite this, long-term expected returns for stocks are soundly positive. Indeed, remaining fully invested, and not letting emotions dictate investment decisions, can help long-term investment performance.

Regardless of the outcome of the election, feedback from investment partners and current prediction markets indicate that we’re Unlikely to get a stimulus package before the election. While it is a very fluid situation and negotiations are still in process, our current base case expectation is that we could get a smaller support package by year-end – perhaps extension of unemployment benefits or targeted industry support for airlines as examples, but ultimately we are expecting a larger stimulus package is likely in the new year and would include unemployment support, extension of the PPP, and probably some infrastructure spending under either a Trump or Biden presidency.

Outlook

- While significant near-term uncertainties remain, we do anticipate we are at the beginning of a new economic expansion.

- As such, we expect longer-term growth potential and discipline to be rewarded by not reacting to or focusing on any potential short-term noise.

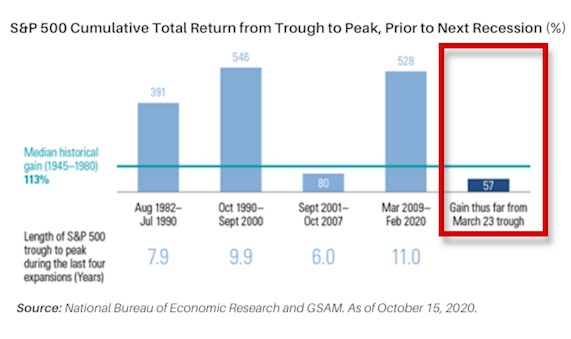

- As depicted in the chart below, we believe long-term returns for global equities remain compelling, with further upside potential based on historic trends during similar periods of economic expansion, which is further supported by ongoing accommodative policies.

We think any near-term volatility may offer a rebalancing opportunity to add to stock exposures. Watch our video on the benefits of rebalancing to learn more.

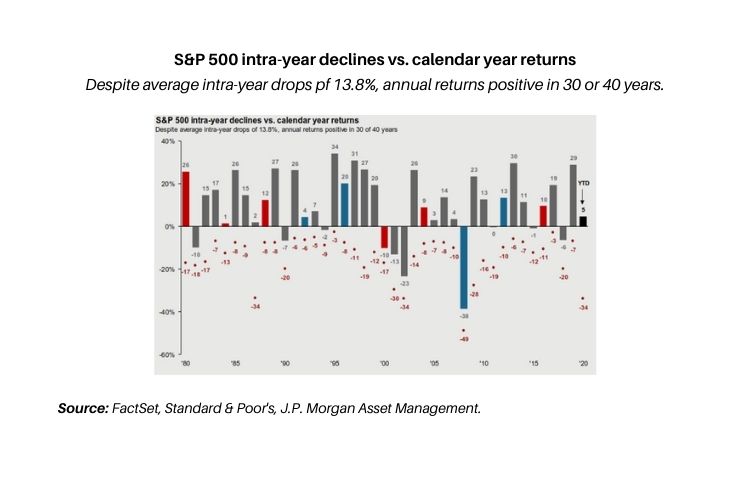

It’s also important to take a step back and consider that volatility is par for the course for the stock market.

The Average intra-year decline for the S&P 500 has been -13.6%, yet stocks have still ended positive 3 out of 4 years, which underscores the importance of maintaining a long-term view and staying fully invested despite short-term noise. Among the worst things investors can do to degrade long term portfolio performance is to allow emotions to dictate investment decisions and sell out as stocks sell off. That’s because some of the best stock market returns often come immediately after some of the worst days; this year is a primary example of that: despite declining -34% earlier in the year, the S&P 500 has since fully recovered and is now positive for the year.

Turning to bonds, We continue to favor high quality corporate bonds and agencies over Treasuries and maintain dedicated satellite fixed income allocations.

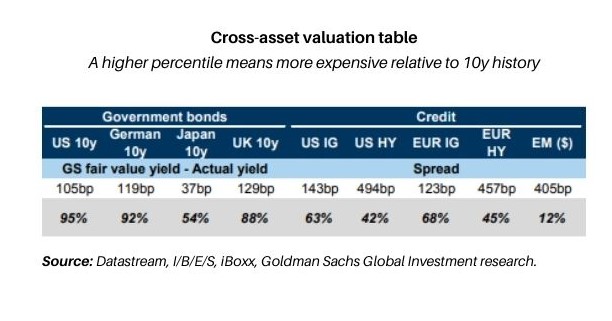

- As highlighted in this chart, Treasuries are expensive whereas investment grade corporate bonds, High yield bonds and Emerging market debt all offer relative value.

- With a backdrop of low interest rates and accommodative policies, Treasury returns may be challenged, whereas we believe those same policies may be supportive of credit.

- Additionally, we believe unique opportunities currently exist across less liquid areas of the bond market, which may offer upside return potential.

Less liquid credit funds in particular may offer equity-like return potential with lower volatility in the current environment.

Ultimately, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the financial goals of our clients.

Thank you for your time today. Should you have any questions, please don’t hesitate to contact your Client Advisor.

00381228 10/20