2021 in Review

Dominant themes influencing the market throughout 2021 included: COVID vaccination rates, continued easy central bank policies, fiscal stimulus, record corporate earnings, an improving labor market and strong consumer spending. On the other hand, concerns remained elevated regarding the ongoing pandemic and the emergence of new variants, supply chain disruptions, inflationary pressures, the Fed’s more hawkish stance, and concerns around stretched valuations.

We continue to monitor developments closely and believe our portfolios are well positioned to continue to meet the long-term goals of our clients.

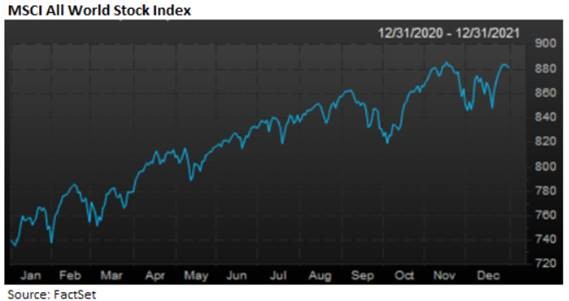

Stocks Post Strong Gains

Global stocks were higher in the fourth quarter of 2021, with the MSCI All World Index producing strong returns to end 2021 up +16.8% and finishing just off record highs. This marks the third straight year of positive gains for global stocks.

There was some dispersion across sectors and themes. Value and Growth stocks ended the year with similar performance, but there was significant disparity intra-quarter, particularly in the first half of the year, which provided enhanced rebalancing opportunities. Real estate was one of the best performing asset classes in 2021 on the back of favorable supply-demand dynamics, which helped buoy property prices after experiencing a weak 2020. We had been adding to real estate exposures through the back half of 2020 and early in 2021 based on relative performance at the time.

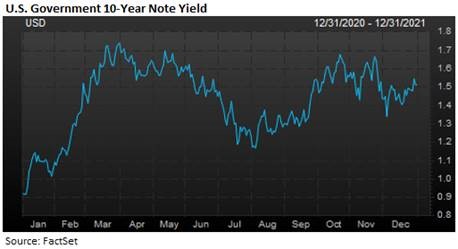

Core Bonds Lower as Yields Rise

Bond yields ended the year higher, with the benchmark 10-year Treasury yield finishing the year at 1.51%, up from 0.91% at the beginning of the year. Consequentially, the broad bond market – as measured by the Core U.S. Aggregate Bond ETF – finished the year down -1.8%. Inflation concerns weighed on the bond market, and the Fed’s policy pivot announcement put upward pressure on interest rates due to the accelerated tapering timeline and signaling the likelihood of three rate increases in 2022.

Given this backdrop and outlook, we have positioned our core fixed income with less duration risk (or interest rate sensitivity) than the broad bond market and are avoiding fixed income securities most susceptible to rising interest rates, such as Treasuries with maturities of 10 years or more. Our less liquid income oriented strategies performed particularly well in 2021 and we believe are well positioned to continue to outperform with a backdrop of rising interest rates and above-trend economic growth.

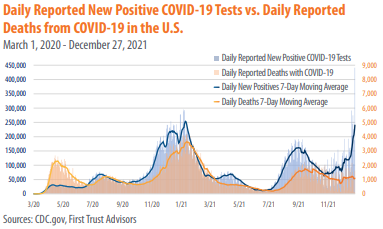

COVID Dominates Headlines

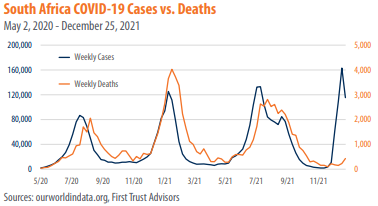

Delta concerns gave way to omicron late in November. While initial uncertainties regarding its increased transmissibility and then-unknown severity caused some market volatility, subsequent studies indicate the variant causes much more mild symptoms relative to earlier mutations. With that being said, it does also appear to better evade existing vaccines currently in distribution. Recent data have confirmed that even as absolute case numbers soar, the number of severe cases and hospitalizations have not. This decoupling has led to increased optimism, with some medical experts believing omicron’s enhanced transmissibility may cause so much immunity that it will help subdue the pandemic.

There is also a clear hesitancy to impose renewed restrictions, with the White House stressing the U.S. is not going back to March 2020 levels of mitigation measures. We believe this hesitancy and the relatively mild symptoms, combined with the fact businesses and consumers have now largely adapted to the COVID environment, means the economic impact of the omicron variant may be much lower than prior strains. Indeed, we anticipate future mutations to have less of an economic impact over time.

Inflation & Fed Policy

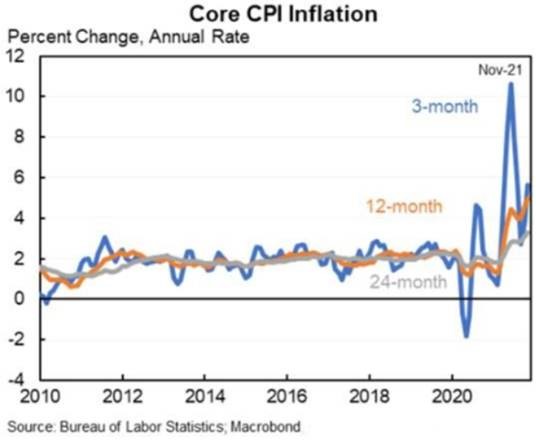

Inflation was a key economic theme for much of the year, and it became evident inflation would stay elevated for longer than previously anticipated as supply chain issues are yet to be resolved. Headline CPI posted the highest annual increase since 1982 in November, as strong demand on the back of accommodative policies coupled with supply chain constraints led to upward pricing pressures. Energy prices in particular surged from very weak levels in 2020. With that said, we believe inflation will migrate lower in 2022 as manufacturing bottlenecks eventually ease and virus improvements reduce production disruptions. Notably, if we normalize for the weak base effects caused by COVID in 2020 and go back 24 months, core CPI is running at an annualized rate of 3.3%.

Elevated inflation appears to have forced the Fed’s hand into a more hawkish stance. At its December FOMC meeting, the Fed announced an acceleration to its tapering program and its “dot plot” economic forecasts indicated three rate hikes are likely in 2022. In explaining the decision, Fed Chair Powell continued to acknowledge strength in the economy and persistent price pressures, stating it was time to retire the term "transitory" to describe inflation. Expectations are for the Fed to conclude its tapering program by March 2022, with the first interest rate increase likely in June. Against this backdrop, we expect risks to the upside for interest rates and have positioned our fixed income allocations accordingly.

Fiscal Policy Support Waning

Economy Strong

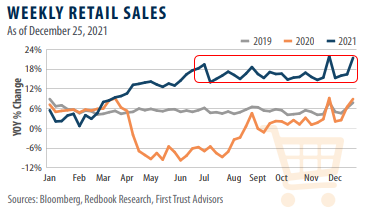

Economic data continued to show strong consumer spending and continued improvement in the labor market. Retail sales were very strong despite the emergence of the omicron variant, supporting the notion that consumers have already adjusted spending habits to account for COVID. Consumer spending has been helped by robust consumer balance sheets and the strength in the labor market. We anticipate these fundamentals may help support ongoing above-trend economic growth over the near-term. Consensus expectations are for the U.S. economy to post 5.6% growth in 2021 and 3.9% growth in 2022, far above the long-run trend growth rate of 2%.

With this backdrop we believe our client portfolios are well-positioned. We are constructive on the long-term outlook for stocks and consider any near-term volatility may offer a rebalancing opportunity. At the same time, we are finding unique opportunities that may offer enhanced risk-adjusted returns within less liquid income-oriented strategies.

Should you have any questions, please don’t hesitate to contact your Client Advisor.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

00432982 1/22