- Moving forward, we expect longer-term stock market returns to be more aligned with historic averages of mid-to-high-single digits.

- Bond yields are attractive and may be supported should the Fed begin cutting interest rates.

- We continue to like alternative asset classes, which may become increasingly important should we experience some moderation in stock market returns in the years ahead.

Fed Holds Rates Steady

The Fed held rates steady at its March FOMC meeting. This decision was widely anticipated by the market. The statement noted that economy activity has expanded at a solid pace, job gains have been strong, and the unemployment rate remains low. The Fed also noted that inflation has eased but remains elevated, and that the Fed doesn’t expect to cut interest rates “until it has gained greater confidence that inflation is moving sustainably toward 2%.” At the subsequent press conference, Fed Chair Powell noted that recent firmer inflation data had not changed the Fed’s view on a broader disinflation trend.

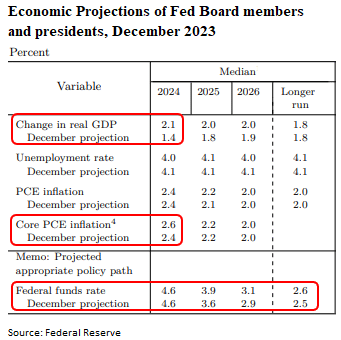

Projection Materials Indicate Soft Landing

A lot of attention was paid to the Fed’s supporting economic projection materials – aka the “dot plot” forecasts – for any hint of an adjustment to the future path of interest rate policy. The projection materials indicate an upgrade to the Fed’s assessment of the economy for 2024, with the Fed raising its expectation for GDP growth to 2.1% from 1.4% previously. This upgrade is underpinned by ongoing strength in the labor market, though inflation remains sticky. In essence, the Fed is forecasting a greater likelihood of a “soft landing” economic outcome.

Three Rate Cuts Projected in 2024

With this backdrop, the Fed kept its expectation for the appropriate number of interest rate cuts for 2024 at three 0.25% cuts. As of writing, the market assigns a ~70% probability that the first rate cut occurs at the Fed’s June meeting. The Fed marginally increased its outlook for the appropriate level of the fed funds rate by the end of 2025, from 3.6% to 3.9%, indicating one less rate cut than previously anticipated. The Fed’s longer run expectation (or equilibrium rate) for the fed funds rate was also revised marginally higher, to 2.6%. Looking at the composition of FOMC member economic forecasts, 9 of 19 FOMC participants currently believe that two or fewer 0.25% interest rate cuts would be appropriate this year, which could come to pass should inflation continue to remain sticky around current levels. On the other hand, and unless we see a significant deterioration in economic fundamentals, the Fed is unlikely to pursue more aggressive rate cuts than currently projected.

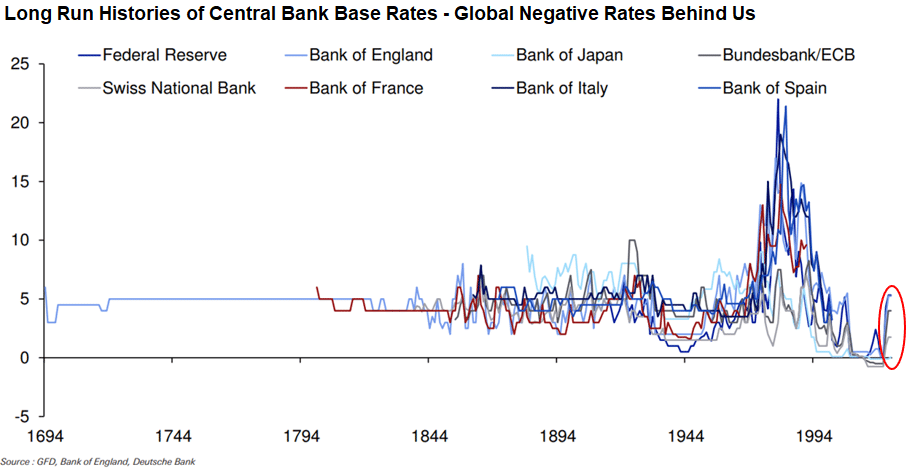

New Monetary Policy Regime

The Fed’s decision and accompanying economic projections underscore our view that interest rates will stay higher for longer (albeit with a downward bias) and that we have already entered a structural regime shift with respect to monetary policies globally. Gone are the post-2008 days of zero interest rate policy (ZIRP) or negative central bank base rates.

Asset Class Implications

Easy monetary policies acted as a tailwind for the stock market in the post-2008 era; going forward, we expect longer-term annualized stock market returns to be more aligned with historic averages of mid-to-high-single digits. Bond yields are attractive today and bond prices may be supported once the Fed begins cutting rates. Alternative asset classes may offer upside return potential and lower correlations to the broad market, which may be increasingly important should we experience some moderation in stock market returns in the years ahead.

Mission Wealth continues to monitor economic developments closely. We believe our portfolios are well positioned to continue to achieve the long-term financial goals of our clients.

Customized Investment Management Solutions

At Mission Wealth, we develop customized, globally diversified, tax-efficient portfolios tailored to your financial plan and built to stand the test of time. Contact us below for a free portfolio review.Investment Advice Fit For Your Needs

At Mission Wealth, we are deeply rooted in an evidence-based investment strategy built on decades of Nobel Prize-winning research. We ignore the media noise and Wall Street hype, relying instead on a long-term approach and proven principles that reward investors over time. For more information on Mission Wealth's investment strategies, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, please contact us online today or call us at (805) 882-2360.

Recent Investment Insights Articles

Market Indexes May Not Represent What You Think

July 15, 2024

PIMCO Investment Webinar Insights

June 26, 2024