Financial institutions across the world are seeing an uptick in cybercrime, and Mission Wealth needs your help in protecting your personal technology devices and financial accounts. This article is intended to assist our clients with specific instructions for better protecting their investment accounts with Fidelity.

Setting Up Multi-Factor Authentication at Fidelity

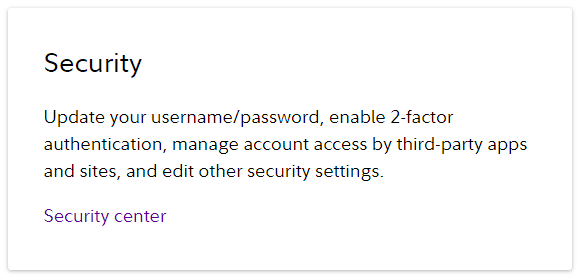

- Navigate to Your Profile Tab – Scroll down to the “Security Center“.

- Change Your Password – We recommend creating a long (15-20 characters) unique random password (i.e. something like this, but not this; 7O1^0y7gI9uusP5%RdP!).

- Review Trusted Devices – Do these look like yours? It is probably best to Remove All just to start cleanly. The next time you log in, it will ask if you want to “trust” the device you are using, and you can confirm that.

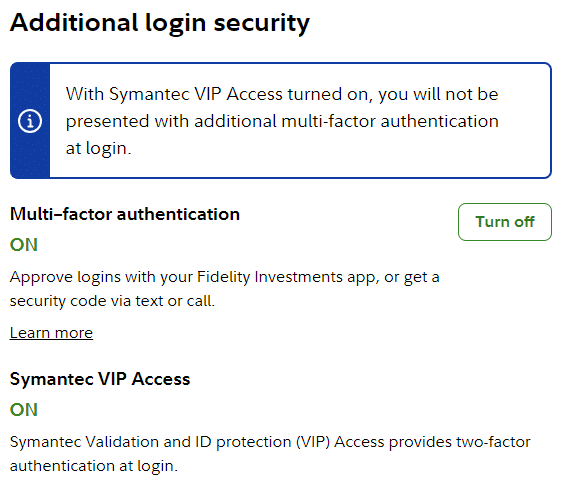

- Additional Login Security – Make sure “Multi-Factor” authentication is turned on. Here is a link on how to implement Symantec VIP.

- You will need to call Fidelity per the instructions above to activate the VIP credential for your login. If someone is able to get into your email account, log into your brokerage account, and you don’t have dual authentication, you can see the type of control they can have (assume the bad guys have your date of birth and social security number, both easy to purchase on the dark web). The same issues reside with your bank and other institutions as well. Lock those down as well using the techniques shared here!

- You will need to call Fidelity per the instructions above to activate the VIP credential for your login. If someone is able to get into your email account, log into your brokerage account, and you don’t have dual authentication, you can see the type of control they can have (assume the bad guys have your date of birth and social security number, both easy to purchase on the dark web). The same issues reside with your bank and other institutions as well. Lock those down as well using the techniques shared here!

- View the Security Checklist as well as other boxes to see if anything else pertains.

- Congrats, you just made yourself a very difficult target for cyber criminals!

We’re Committed To Your Security

Mission Wealth, along with our custodians Fidelity and Schwab, are committed to maintaining the integrity of our clients’ financial wellbeing. We understand that the digital aspect of financial security is increasingly critical. By staying informed and adopting robust cybersecurity practices, together we can navigate the complexities of the digital world, ensuring your wealth is not just managed wisely, but also protected robustly.

Other Resource Articles:

Navigating the 2024 Digital Terrain: Cybersecurity Tips to Protect Your Accounts

Cyber Scammers Continue to Target with Technology Advancements

How to Make Yourself a Difficult Target for Cyber Criminals

How to Reduce Your Cybersecurity Risk

As always, if you have any concerns about your financial security or need personalized advice, our team at Mission Wealth is here to help. Protecting your wealth is our top priority.

Contact us today for a free financial check-up or call (805) 882-2360.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Recent Insights Articles

Mission Wealth Rises on Forbes’ 2024 List of America’s Top RIA Firms

October 23, 2024

Oregon Estate Taxes – Planning for State Level Peculiarities

October 11, 2024