Market Update

2022: A Highly Unusual and Uncertain Year

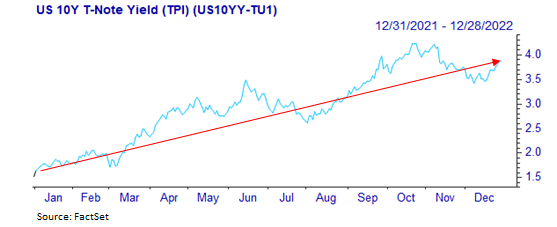

Uncertainty dominated markets in 2022. Concerns surrounding inflation, the Fed raising interest rates, and the war in Ukraine all underpinned an increase in volatility throughout the course of the year. It was also an unusual year regarding stock and bond returns, as both moved lower in tandem.

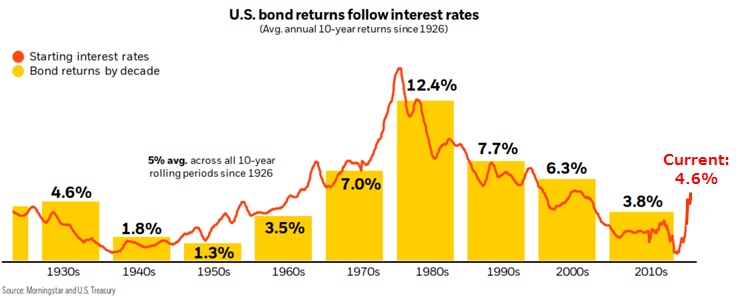

Historically, stocks and bonds move in opposite directions: when stocks sell off, bonds tend to hold their value or rally. This was not the case in 2022, as the Fed’s tightening policies drove bond yields higher (bond prices lower) and concurrently weighed on the stock market. Once there is more clarity surrounding monetary policy, we anticipate bond prices may stabilize and once again act as the anchor for well-diversified portfolios, zigging when the stock market zags. Indeed, we are much more constructive on the outlook for bond returns, given current bond yields.

Mission Wealth Actions

Ahead of 2022, we positioned portfolios in anticipation of a structural shift in monetary policy, and elevated, sticky inflation. We allocated our core fixed income positions with less duration (or interest rate sensitivity) than the broad bond market, which proved beneficial as we experienced a backdrop of tighter monetary policies driven by Fed interest rate increases. Given the inverted nature of the yield curve (longer-dated Treasury yields are lower than shorter-dated yields), we are emphasizing the shorter end of the yield curve which currently offers more attractive yield potential relative to longer-dated maturities.

Speaking of yield, we actively increased exposures to alternative, income-generating asset classes and floating rate securities, all of which have performed relatively well despite the broad public market weakness. Whereas rising interest rates weighed on public markets, many of these strategies benefited from the rising interest rate environment, given the floating rate nature of several of these strategies. Moreover, with heightened and sticky inflation, our real-estate backed income-oriented strategies performed particularly well and we continue to favor the asset class, which has historically been one of the best inflation hedges.

Enhanced Rebalancing Opportunities

Tax Loss Harvesting – the Silver Lining of a Down Market

Outlook – Structural Shift Underway

Stocks

Bonds

With this backdrop, we believe alternative, income-oriented strategies may perform particularly well over the next decade. These strategies aim to generate high single-digit returns with consistent income and little correlation to the broad stock market.

Overall, we believe our portfolios are well positioned for the forthcoming period, offering diversification across multiple asset classes, generating income for today and growth for tomorrow.

Thank you for your continued support as we look forward to a brighter 2023. As always, should you have any questions, please do not hesitate to contact your Client Advisor.

ALL INFORMATION HEREIN HAS BEEN PREPARED SOLELY FOR INFORMATIONAL PURPOSES. ADVISORY SERVICES ARE ONLY OFFERED TO CLIENTS OR PROSPECTIVE CLIENTS WHERE MISSION WEALTH AND ITS REPRESENTATIVES ARE PROPERLY LICENSED OR EXEMPT FROM LICENSURE. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. INVESTING INVOLVES RISK AND POSSIBLE LOSS OF PRINCIPAL CAPITAL. NO ADVICE MAY BE RENDERED BY MISSION WEALTH UNLESS A CLIENT SERVICE AGREEMENT IS IN PLACE.

MISSION WEALTH IS A REGISTERED INVESTMENT ADVISER. THIS DOCUMENT IS SOLELY FOR INFORMATIONAL PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

00490401 12/22