Investment Outlook

We believe we have already entered a structural shift with respect to monetary policy. Whereas the years post-Global Financial Crisis were marked by low interest rates and quantitative easing, the years ahead are likely to be marked by tighter policies: higher interest rates and quantitative tightening. Given this backdrop, we believe expectations should be reset for stock market returns more in line with historic averages of mid to high single-digit annualized returns. We are constructive on the outlook for bond returns. Bond yields are far more attractive today relative to 18 months ago, and many of our preferred bond holdings are yielding mid to high single digits. Should we enter a period where the Fed pauses and interest rate risk is skewed to the downside, this would be supportive of bond price stabilization and potential price appreciation. We also continue to favor alternative income-generating asset classes that may provide enhanced risk-adjusted return potential.

Market Update

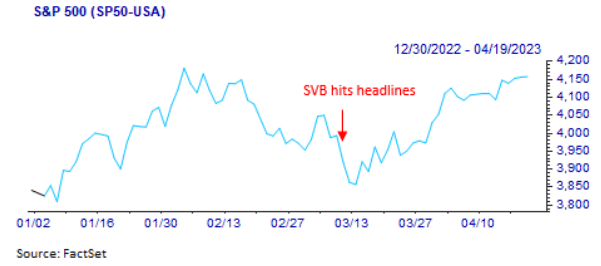

The stock market has moved higher post the Silicon Valley Bank (SVB) collapse and related regional banking concerns. It now appears these issues were a relative bump along the road, with the ultimate economic impact likely to be much less severe than many had originally feared. Stock market weakness has largely been contained to the financial industry, with broader strength experienced across most major sectors of the market.

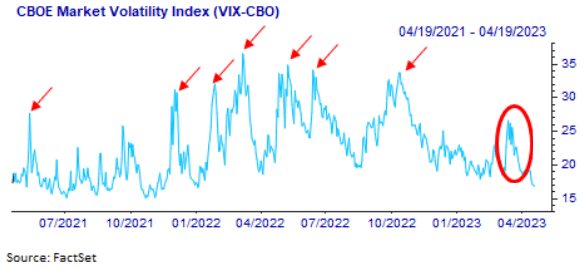

The market reaction to the situation – even at the height of the crisis and despite some very dire headlines circulating – was relatively subdued by historic (and recent) standards. To be sure, the VIX Index, a measure of market concern commonly referred to as the “fear index,” spiked in the immediate aftermath of SVB’s failure. However, the VIX didn’t spike anywhere near historic levels, and there were multiple instances in the past 24 months where the VIX spiked much higher, indicating the market didn’t believe SVB’s collapse would cause a systemic issue or far-reaching contagion effects.

Economic Impact not as Bad as Feared

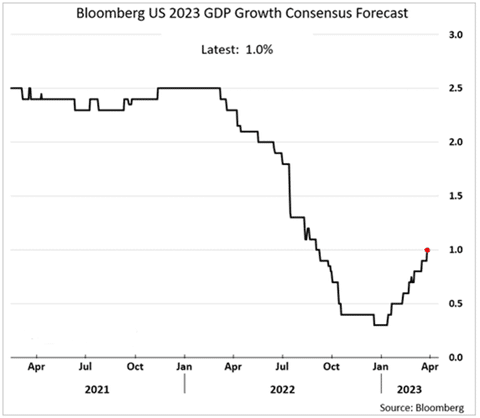

The market’s reaction has largely been borne out in industry data. After experiencing deposit outflows in the days immediately following SVB’s collapse, smaller regional banks have since seen deposits stabilize, and actually increase in the most recent weeks; by no means have we seen a wholesale run on small regional bank deposits. Not to say this is a rosy outcome for the regional banks – better than expected, yes, but many will need to scale back or freeze lending activity and potentially sell off high-quality loans to shore up balance sheets. On top of which, regulators – who are scratching their heads asking one another how SVB could occur in the first place – are likely to impose greater restrictions on the regional banking sector moving forward. Overall, the ultimate economic impact does appear to be relatively contained and not nearly as severe as some had feared. Indeed, the average economists’ forecast for 2023 real GDP growth has increased in the aftermath of SVB, driven by improved Q1 data, continued robust consumer spending underpinned by a still strong labor market, and expectations that the Fed will not raise rates as aggressively as previously anticipated.

Fed Implications

Despite a less severe than feared economic impact, it does do some of the Fed’s job for them. Lending activity is set to slow and that will weigh on economic activity, meaning the Fed is unlikely to raise rates quite as aggressively. As recently as the beginning of March and prior to SVB hitting headlines, the market had anticipated 1.00% or more of total Fed rate increases through the balance of the year. After raising rates 0.25% in March, the market now anticipates the Fed will only raise rates another 0.25% in May and then pause.

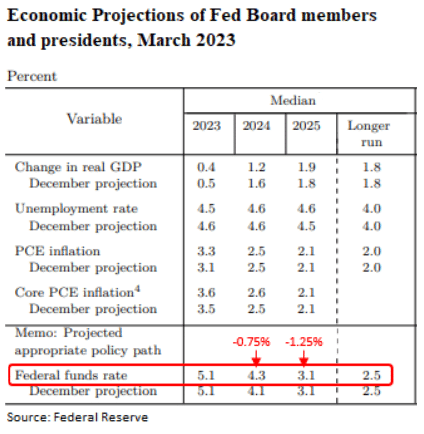

The Fed’s own estimates are consistent with this view. The most recent economic projections, commonly referred to as the “dot plot” forecasts, indicate one more 0.25% rate increase before pausing through the end of the year.

Likely Entering a “Wait and See” Period

Interestingly, the Fed’s projections indicate they will start cutting interest rates in 2024, with rate cuts through 2025. On the other hand, the market is pricing in the possibility of rate cuts in the back half of this year. We anticipate the market may be ahead of itself on this front, and believe the Fed may enter a “wait and see” period with respect to monetary policy.

Monetary policy has a lagged effect: the impact of an interest rate increase can take over 9 months to be fully reflected in economic activity. As a result, and assuming the Fed decides to pause rate increases after their May meeting, we anticipate the Fed may err on the side of caution thereafter. Given their clearly communicated laser focus on inflation, the Fed would need to see a material deterioration in economic fundamentals such that inflation drops to their long-term target of 2% before they even consider cutting interest rates. We just don’t see this occurring over the near term, given the information at hand.

Nonetheless, and on a go-forward basis, we may be approaching an inflection point where the risks for interest rates may switch from the upside towards the downside. The Fed’s own outlook supports this view.

Mission Wealth’s Investment team is monitoring developments closely and we believe our portfolios are well-positioned to continue to meet the long-term financial goals of our clients.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Recent Insights Articles

IRS Issues Final SECURE Act Regulations: Affects RMDs, Inherited IRAs, and More

July 24, 2024

Mission Wealth Named to FA Magazine’s 2024 RIA Ranking and FA’s Top 50 Fastest Growing RIAs

July 22, 2024