In late 2017, Congress passed the Tax Cuts and Jobs Act (the "Act"), the most sweeping tax legislation since 1986. The Act, which was signed into law by President Donald Trump on Dec. 22, makes significant changes to estate tax laws and some changes to 529 Plans.

We were provided with the following estate tax update by attorney Kenneth Devore of Kenneth E. Devore & Associates and thought it would be a good resource for our clients. This is a brief summary of what will change regarding estate tax laws and 529 Plans this year:

-

- Doubling of the Estate, Gift, and GST Exemptions. Effective January 1, 2018, the exemption against estate tax and gift tax is doubled from its current level of $5.6 million to $11.2 million. This means that married couples, with effective planning, can transfer at least $22.4 million without estate and gift tax. On January 1, 2018, the generation-skipping transfer tax ("GST") exemption also increases to $11.2 million ($22.4 million per couple). The increased estate, gift, and GST exemptions continue to be indexed for inflation.

- Increased Exemptions Expire on December 31, 2025. These increased exemption amounts apply only to gifts made, persons dying, and GST transfers occurring during the 2018 to 2025 tax years. Without further legislation, on January 1, 2026, the exemptions revert to current law ($5 million plus inflation since 2011). Depending on inflation between now and then, the exemption in 2026 would likely be somewhere around $6.5 million per person to $13 million per couple.

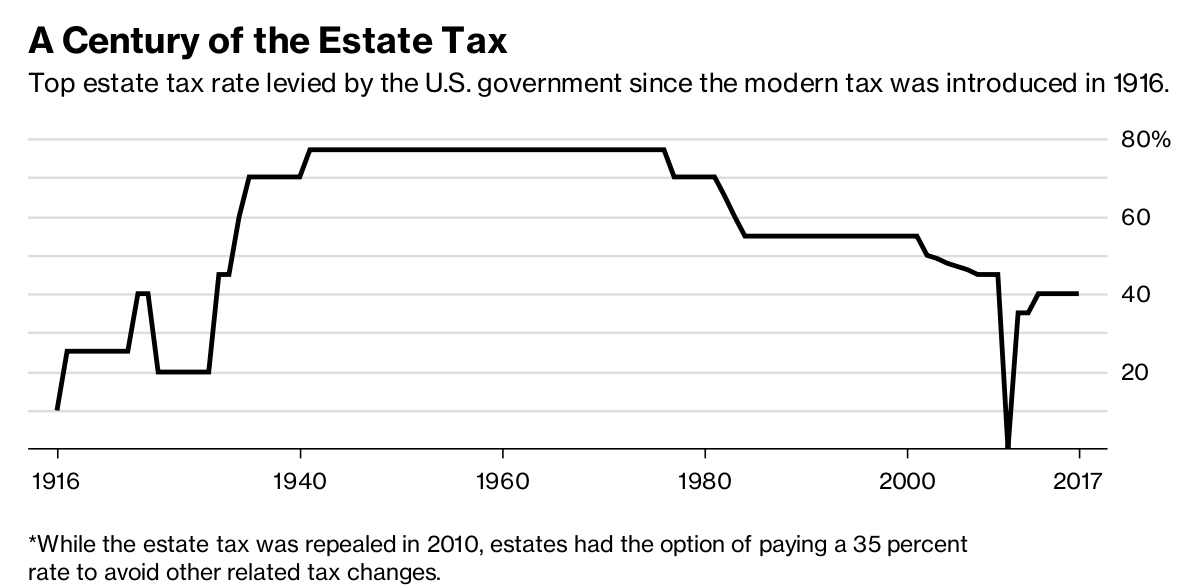

Source: Bloomberg

- 529 Plans. 529 Plans permit tax-free growth of funds in those plans, provided the funds are used for college or graduate school expenses. The use of these funds have been expanded. Effective January 1, 2018, up to $10,000 per student per year can be used for tuition at public, private or religious elementary or secondary schools. Further, certain expenses related to homeschooling can be paid from such plans.

The following items have not been impacted by the Act:

- Tax Rate Remains 40%. The tax rate on gifts, estates, or GST transfers above the exemption amount remain a flat 40%.

- Annual Gift Tax Exclusion Increased to $15,000. Effective January 1, 2018, an individual shall be able to give $15,000 per year to anyone without reducing their lifetime gift tax exemption.

- Portability Retained. The Act keeps the concept of "portability", which allows a spouse to give his or her remaining estate and gift tax exemption to the surviving spouse by timely filing an estate tax return.

- Stepped-up Cost Basis Retained. The Act makes no change to the rules governing a "stepped-up" cost basis. Therefore, when a person dies, his or her assets, with some exceptions, shall still receive a new cost basis so that the assets can be sold post-death with no capital gains tax.

- Valuation Discount Planning Still Available. For those estates that are still taxable, discount planning is readily available as the 2704 proposed regulations were withdrawn and nothing in the Act affects such planning.

- Income Tax Planning Opportunity. Existing bypass trusts and other irrevocable trusts are typically designed to avoid estate tax at the death of the beneficiary, but not to receive a stepped-up cost basis. With the increased exemptions, for many clients, excluding assets from estate tax is no longer necessary. For bypass trusts and other irrevocable trusts, avoiding capital gain at the death of the beneficiary by securing a stepped-up cost basis can offer substantial tax savings to the beneficiary's heirs. Available strategies to obtain this stepped-up cost basis should be considered.

Kenneth E. Devore & Associates specialize in estate, probate and elder law, and the firm is located in Westlake Village, CA.

READ MORE: GOP Releases Details About Finalized Tax Reform Bill

1001998 1/18