Economic Update

- This weekend’s announcement that an agreement on the debt ceiling has been reached in principle was a welcome development.

- There is no desire for a debt default on either side of the aisle, as the economic ramifications would be far-reaching.

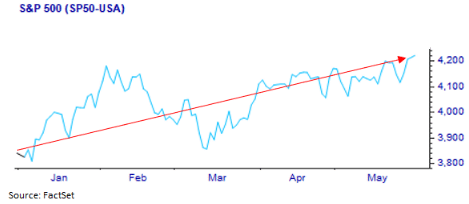

- The S&P 500 is now up over +10% so far this year, despite regional banking concerns and the recent overhang of the debt ceiling stand-off.

- Some have scrutinized the U.S. dollar’s status as the global reserve currency. Simply put, the depth, breadth, and liquidity of the U.S. financial markets are second to none. The U.S. financial system is unrivaled and is unlikely to be challenged anytime soon.

Debt Ceiling: Welcome Developments but Unnecessary Noise

This weekend’s announcement that President Biden and House Speaker McCarthy had reached an agreement on the debt ceiling was a welcome development. The “Fiscal Responsibility Act” suspends the debt limit until 2025 and removes a lot of uncertainty regarding the looming debt limit deadline. It appears set to be passed through both the House and Senate this week, before moving to the White House to be signed into law ahead of the so-called “X date” of June 5th (the date by which Treasury Secretary Yellen indicated the U.S. Treasury would not be able to make all its payments unless the debt ceiling is raised). The market reaction was relatively muted, with the S&P 500 finishing marginally higher on Tuesday, though it is now up over +10% for the year, despite regional banking concerns and the recent overhang of the debt ceiling stand-off.

While an agreement ultimately appears to have been reached, we are somewhat cynical on the topic. Both sides of the aisle played a game of political chicken up until the last minute, which is consistent with history, as we’ve seen this play out in the past. Unfortunately, all the political posturing causes a lot of unnecessary uncertainty and headline noise. Moreover, the solution at hand kicks the proverbial can down the road a couple of years, at which point it risks causing another round of headline noise and unnecessary investor anxiety.

No Desire for Default

There is no desire for a debt default on either side of the aisle. The economic ramifications would be far-reaching, and no politician wants to be seen as responsible. From a business standpoint, assume a company has entered a contract to buy a good or service denominated in U.S. dollars (all major commodities are typically quoted in U.S. dollars). Now assume that company has parked the cash intended to make that purchase in a U.S. T-Bill maturing days before it is set to make the payment. You can see where this is going… now multiply that scenario by the thousands of businesses that may be faced with the choice of finding an alternative if they can no longer trust the U.S. government to make good on its obligations on time. Almost all risk management departments at financial firms have spent time and money hedging themselves against the minuscule (but not zero) chance that a default occurs. All that time and energy represents a significant use of resources, but one that could have been avoided.

U.S. Dollar: Global Reserve Currency Status at Risk?

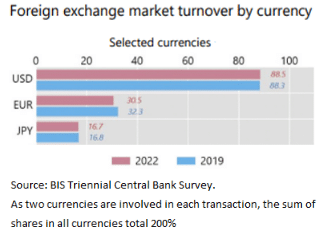

A related topic and one that has garnered attention recently is the status of the U.S. dollar as the global reserve currency. If a default occurred, that reserve currency status would certainly come into question. But assuming Washington can prevent a default, the reality is there is no viable alternative to the U.S. dollar as a global reserve currency over the near term. Simply put, the depth, breadth, and liquidity of the U.S. financial markets are second to none. The nearest currency alternative by volume is the euro, and you can see that’s a distant second.

The issue with the euro is both the political dynamic and the fragmented markets of the underlying member countries of the Eurozone. If you think the political environment in the U.S. is disparate, spare a thought for our European counterparts. 20 countries use the euro as the official currency (the “euro area,” not to be confused with the European Union, which includes an additional seven countries). Each country has a different political system, its own set of rules, interests, and unique biases. All of which makes it very difficult to come to an agreement on material regulatory changes. Moreover, the financial markets are not centralized in the same way the U.S. market is: if you want a government bond in the U.S., you buy a Treasury; if you want a government bond in the euro area, you need to decide whether you want a German, French, Spanish, Greek, etc. On top of this, each country’s bonds have varying spreads and different liquidity characteristics, none of which come close to the liquidity of the U.S. Treasury market.

Japan’s yen is the third largest global currency by trade volume. Japan is faced with challenging demographic shifts that have led to relative stagnation. Not shown on the above chart is the Chinese renminbi, which represented 7.0% of the global currency market turnover in 2022 (less than half the turnover of the Japanese yen). For all the talk of the Chinese renminbi usurping the U.S. Dollar as the global reserve currency, the Chinese financial markets are still in relative infancy when compared to developed markets and certainly, the U.S. China’s markets just don’t offer adequate breadth or depth. Moreover, China would have to allow its currency to float freely, allowing for the free flow of capital in and out of its borders before it could even be considered a realistic alternative. However, that goes against its heavily manipulated approach and is unlikely to happen for decades, if at all.

In short, the depth, breadth, liquidity, and reliability of the U.S. financial system are unrivaled and are unlikely to be challenged anytime soon. We trust that Washington will expedite the passage of the debt ceiling agreement into law, removing any possibility of a potential default, at least for a couple more years.

Mission Wealth’s Investment team is monitoring developments closely and we believe our portfolios are well-positioned to continue to meet the long-term financial goals of our clients.

Financial Guidance For Your Life Journey

Talk with a financial planner about your next steps.Guidance For Your Full Financial Journey

Through our comprehensive platform and expertise, Mission Wealth can guide you through all of life's events, including retirement, investment planning, family planning, and more. You will face many financial decisions. Let us guide you through your options and create a plan.

Mission Wealth’s vision is to provide caring advice that empowers families to achieve their life dreams. Our founders were pioneers in the industry when they embraced the client-first principles of objective advice, comprehensive financial planning, coordination with other professional advisors, and proactive service. We are fiduciaries, and our holistic planning process provides clarity and confidence. For more information on Mission Wealth, please visit missionwealth.com.

To meet with a Mission Wealth financial advisor, contact us today at (805) 882-2360.

Recent Insights Articles

IRS Issues Final SECURE Act Regulations: Affects RMDs, Inherited IRAs, and More

July 24, 2024

Mission Wealth Named to FA Magazine’s 2024 RIA Ranking and FA’s Top 50 Fastest Growing RIAs

July 22, 2024