Stocks Continue Strength in Q2

Stocks continued to rally in the second quarter of 2021, with the S&P 500 returning +8.2% and ending the quarter at an all-time high (which was subsequently surpassed to begin Q3). The S&P 500 has now posted five consecutive quarterly gains since the market sell-off in Q1 2020. Numerous positive catalysts helped propel stocks higher, including ongoing accommodative central bank policies, massive fiscal (government) stimulus, success of the vaccine roll-out, economic reopening momentum, and a very strong corporate profit backdrop. At the same time, still elevated cash levels underpinned robust equity inflows.

Despite broad strength, there was some disparity in performance across sectors and themes. In a reversal of the trend witnessed in the first quarter, Growth stocks outperformed Value stocks in the second quarter, with Growth returning +11.6% while Value returned +5.6%. This divergence in performance underscores the importance of a disciplined approach to portfolio rebalancing; we had been broadly trimming exposures to Value stocks at the beginning of the second quarter based on relative strength at the time. Real estate was the best performing asset class over the quarter and has produced some of the strongest returns so far this year after underperforming in 2020. This too has worked in our favor after broadly adding to real estate positions through the back half of 2020 and early 2021 on relative weakness.

Bonds Stabilize

After experiencing weakness in the first quarter of the year on the back of rising inflation concerns, core bonds stabilized in the second quarter, with the broad bond market (as measured by the Bloomberg Barclays Aggregate Bond Index) returning +1.8%. High quality municipal bonds returned +1.5% during the same time period. Yields fell over the course of the quarter, helping strengthen bond prices, with the benchmark US Treasury 10 year yield falling from 1.74% to 1.45%, though it is still up from 0.92%, where it began the year. Satellite fixed income outperformed core bonds during the second quarter, with high yield bonds returning +2.5% and emerging markets bonds rallying +4.0%. We continue to favor dedicated allocations to satellite fixed income, actively managed bond funds, and private debt, all of which have performed well year-to-date while also aiming to reduce interest rate risk.

Inflation May Be Peaking

All eyes were focused on inflation for much of the second quarter. Many businesses have cited upward pricing pressures from supply chain disruptions, higher raw-materials costs, and shipping constraints. Headline consumer prices were up 5.0% year-over-year in May, the biggest increase since June 2008. With that said, the higher reading was influenced by weak base effects (cycling a very weak economy in May 2020) combined with short-term supply chain pressures. We consider the current elevated inflation dynamic to be largely a normalization from a multi-month shock to the global economy brought about by COVID and has been compounded by near-term supply chain disruptions, which will ultimately abate. The Fed, for its part, was consistent in communicating its view that price pressures will be transitory and the market appeared to increasingly adopt this outlook as the quarter progressed, as many commodity prices – most notably lumber prices – fell from the peaks experienced earlier in the quarter. Regarding monetary policy, the stronger economic backdrop combined with increased near-term pricing pressures led the Fed to update its “dot plot” forecasts, which now indicates two fed funds rate hikes in 2023, up from zero in March.

Taxes Still In Flux

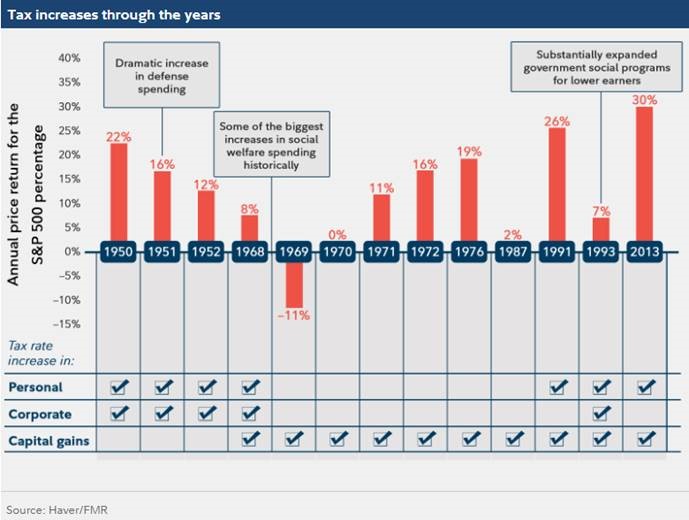

Taxes were also on the minds of many investors for much of the quarter. The Biden Administration has proposed raising taxes on high income earners (including individual and capital gains tax increases) and to increase corporate taxes to help fund stimulus packages. We anticipate Congress will ultimately pass a scaled back version of Biden’s initial proposals and many market strategists don't expect the corporate tax rate to go above 25%, which would represent only a ~3% impact to 2022 S&P 500 earnings. Many investment partners also believe there isn’t enough support to pass Biden’s originally proposed capital gains tax rate of 39.6% and it may decrease to a lower level (28% has been cited). While taxes will remain in flux for some time yet, most investment partners expect any tax increases are likely to take effect in January 2022. If history is a guide, any negative market impact may be short-lived. Markets tend to discount tax increases in advance and exhibit short-term weakness ahead of them taking effect, but exhibit strength thereafter as the economy and businesses subsequently benefit from associated fiscal stimulus. Looking at the past 13 instances of tax hikes going back to 1950, there was only one instance of a negative stock market return in the year higher taxes took effect (1969) and contrary to conventional wisdom, the S&P 500 has generated higher average returns under periods with increasing taxes.

Outlook

While the potential for tax increases may cause some uncertainty over the near-term, we believe any weakness is likely to be short-lived. Still accommodative government and central bank policies may continue to act as a positive tailwind for stock market returns, albeit potentially at a more moderate pace of growth than the first half of this year. The Fed’s balance sheet is expected to increase by another $1 Trillion between now and the end of 2022. This may provide a catalyst for stock market returns – similar to the dynamic that unfolded in the aftermath of the Great Financial Crisis of 2008. We believe inflation pressures are likely to peak this year and abate thereafter, as short-term supply chain disruptions are resolved, while structural economic issues are likely to contain inflation over the medium-term. We anticipate bond yields may move higher from current levels and have positioned our core fixed income allocations with less duration risk (interest rate sensitivity) than the broad bond market. We believe our fixed income allocations are well-positioned for the forthcoming period, and unique opportunities currently exist in certain areas of the fixed income market which may offer relative return upside. Overall, we continue to focus on long-term fundamentals and believe our portfolios are well positioned to continue to meet the long-term financial goals of our clients.

00410684 07/21